views

A church’s financial health is an indicator of its spiritual health. It also indicates whether or not a church has the resources necessary to minister effectively. If your church isn’t adequately funded, it may cause you to go into debt to make up for the revenue gap. As a pastor or church treasurer, you don’t have to be a finance whiz to understand the basics of financial management. A little research and an understanding of best practices will help you keep your church financing healthy and well-funded.

Keep reading to implement critical financial management strategies in your ministry.

1) Create a budget

It is crucial to grasp the fundamentals of budgeting and how the budget relates to your church’s unique circumstances if you hope to streamline your budget and conquer the financial issues facing your congregation. Reviewing the church’s financial accounts from the past several years is a great way to get up to speed on the organization’s income, spending, and assets. These records will provide an overarching perspective of financial matters, and they should aid in the identification of worrying patterns in donation levels, savings, expenditures, and other areas.

2) Control your expenses

Consider all of your existing outgoings, such as salaries, volunteer programmes, repairs, and electricity. Make sure you’re able to pay your bills and maintain a steady flow of funds to ensure their safety. To properly distribute your funds, you need to dissect your budget.

3) Monitor Chruch’s income

You can figure out your church’s yearly income by adding all the donations, gifts, and other things it gets. Assistance in terms of cash, cheques, and online payments accounts for the bulk of the budget. Records of fundraising efforts, stock and security purchases , and non-monetary contributions (e.g., goods and services) should be kept as well . With the rise of the internet and church accounting software, keeping track of your church’s income has become easier.

4) Regularly review finances

Having a second set of eyes, especially if they are trained to see problems in the church’s budget and finances, is always a good idea. Financial integrity may be established with the use of internal controls like this one, which can help eradicate any mistakes or missed opportunities for economic advancement that may have crept into your individual evaluation.

Conclusion

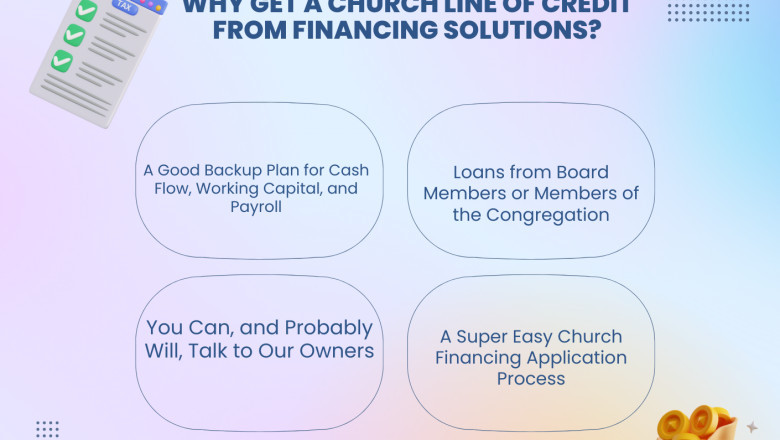

Churches have always had their financial ups and downs. Though the church may see a long-term boost in financial resources, there may not be enough to sustain it. Also, the income of a congregation may not be keeping pace with the operating expenses of a successful ministry. These factors can result in a steep drop in money raised. To keep your church afloat and prevent such a drop in income, you need to create a budget and implement controls to ensure you can meet the demands of running your church.Set a financial goal for your church, and track your efforts from beginning to end. get church finance line credit loan eassly. For more information about church finance so you can visit our website. https://financingsolutionsnow.com/

Originally published at https://www.mogulvalley.com on October 19, 2022.