views

Great variety of exchange between countless cryptocurrencies, reduce the possibility of being hacked, make movements anonymously, different possibilities for the finances of the future.

Great variety of exchange between countless cryptocurrencies, reduce the possibility of being hacked, make movements anonymously, different possibilities for the finances of the future.

great variety

If you are interested in finding a token that is booming just in the early days of its launch, exchanges are the perfect place to get it.

DEXes offer a virtually unlimited range of tokens, from the most well-known to the most bizarre and totally random.

That's because anyone can mint an Ethereum-based token and create a liquidity pool for a crypto or token.

For this reason, in a decentralized exchange development you will find a greater variety of projects ; both “verified” and “unverified” projects.

IMPORTANT : Remember that the buyer must be very careful when buying newly launched tokens or cryptos.

Reduce the risks of piracy

Because all funds in a DEX Exchange Development trade are stored in the merchants' own wallets, theoretically, those moves are less susceptible to potential hacking.

(This is quite relative, as DEXs also reduce what is known as “counterparty risk” which is the probability that one of the parties involved, potentially including the central authority in a non-DeFi transaction, defaults on the transaction.) .

Anonymity

No personal information is required to use the most popular exchanges / DEX.

Use in the economy of the future

There are many economic movements that in the future could be taken to the blockchain and sooner or later could be handled through exchanges.

For example: Loans between peers.

Fast transactions and anonymity make it possible for DEXs to become increasingly popular in developing economies, where a robust banking infrastructure may not be required over time.

Anyone with a smartphone and an internet connection can trade through a DEX.

What are the potential disadvantages of DEXs?

The -mostly- complicated user interfaces, the possible vulnerability of smart contracts and the ease of including any cryptocurrency (even those of fake projects).

Complicated user interfaces

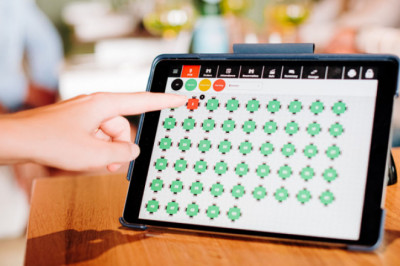

Navigating decentralized exchanges requires some specialized knowledge and the interfaces are not always easy to use.

Be prepared for a lot of research and don't expect the DEX itself to offer much help for intuitive use.Usually, you will have to search outside the site to be able to perform any action or find a clear explanation of how to execute a move.For this reason, a lot of caution is required when using a DEX, since it is very easy to make an irreparable error at the time of its execution or to be scammed while following a tutorial (in which you end up sending the assets to a private address ).Another common known problem is the so-called “impermanent loss” that can result from pairing a more volatile cryptocurrency with a less volatile one.Smart contract vulnerabilityAny DeFi protocol is only as secure as the smart contracts that power it and the code can have exploitable bugs (despite lengthy testing) that can lead to token loss.While a smart contract may work as intended under normal circumstances, developers cannot anticipate all rare events, human factors, and other potential attacks.

Cryptocurrencies with more risk

With the wide range of unexamined tokens available on most DEXes, there are also a greater number of scams and schemes to watch out for.A token that is on a hot streak could suddenly be “knocked down” when its creator mints a bunch of new tokens, overwhelming the entire liquidity pool and sinking the value of the coin.Before buying a new cryptocurrency or experimenting with a new protocol, it is important to learn as much as you can about the project itself.Read whitepapers, visit developer Twitter feeds, Discord channels, and look for audits of any particular project you're interested in (among some auditors, you have companies like Certik, Consensys, Chain Security, or Trail of Bits).

How to interact with a DEX?

You can connect to a DEX like Uniswap clone using a crypto wallet like Metamask (for your web browser) or Coinbase Wallet (for mobile devices).While you can interact with DEXs directly from the browser built into Coinbase Wallet, an easier way is to open the website in your computer's web browser (in the case of Uniswap, the address is app.uniswap.org) and click Click “Connect” to a wallet.A QR code should appear that you can scan with your phone's camera (tap the top right corner of the Coinbase Wallet app to access the camera) once scanned, your wallet will connect to the DEX.You are also going to need a supply of Ethereum to start trading most DEXes that you can get from an exchange like Binance or Coinbase.The reason you need some ETH is to pay the fees (known as gas) that are required for any transaction that occurs on the Ethereum blockchain. These are separate from the fees charged by the DEX itself.

How do DEX fees work?

Exchange fees vary. Uniswap charges a 0.3% fee which is split between liquidity providers and a protocol fee may be added in the future.But it is important to note that the fees an exchange charges can be dwarfed by the gas fees to use the Ethereum network.