views

The report presents a comprehensive study of the current and future potential of automated sampling systems. Due to increasing demand for biologics and strict regulatory standards, the biopharmaceutical industry has turned to automated sampling methods that provide reliable systems for the direct transfer of bioprocess samples from bioreactors to analyzers while maintaining process sterility and integrity.

In addition, it provides a detailed discussion of the likely opportunities for actors working in this field over the next decade. Amongst other elements, the report includes:

- A detailed assessment of the current market landscape of automatic sampling systems and their manufacturers.

- A competitiveness analysis of automatic sampling systems manufacturers.

- Elaborate profiles of prominent players engaged in the manufacturing of automatic sampling systems (shortlisted based on company size).

- A detailed market landscape of automatic sample collection / preparation systems and their manufacturers.

- Detailed profiles of the players offering automatic sample collection / preparation systems (shortlisted based on the number of systems manufactured).

- An insightful analysis of the patents filed / granted for automatic sampling systems, since 2016.

- An analysis of various developments / recent trends related to automatic sampling systems.

- A discussion on affiliated trends, key drivers, and challenges, under a SWOT framework.

- A qualitative analysis, highlighting the five competitive forces prevalent in the automatic sampling domain.

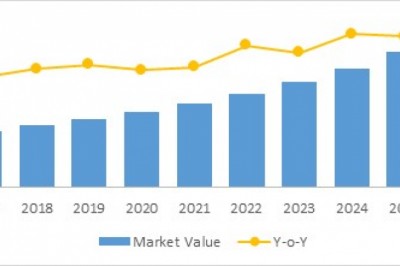

According to Roots Analysis, the automated sampling systems market is expected to grow over 15% by 2035.

Given the advanced features and potential for cost savings, automated sampling systems have been widely adopted by various stakeholders in the biopharmaceutical industry to monitor real-time data and reduce bias associated with manual sampling.

Automated sampling systems have a variety of applications, including bioprocess/analyte monitoring, data management, and advanced process control/feedback control, in the biotechnology and pharmaceutical industries. As a result, several bioprocess instrument designers have engaged in the development of easy-to-use, controlled, and automated systems to increase bioprocess productivity and flexibility.

Key Market Insights

Now, more than 55 automatic sampling systems are available in the market

The majority (71%) of automated sampling systems can be monitored online, followed by offline (22%) and online (7%) monitoring. It is worth noting that about 25% of automated sampling systems offer multiplexer modules to collect sterile samples, followed by systems with routing modules (23%) that can transmit the sample to multiple analyzers.

Around 45 companies are presently engaged in the manufacturing of automatic sampling systems, globally

The autosampler industry is dominated by medium-sized companies (51–200 employees), which account for more than 40% of all autosampler manufacturers. In addition, around 15% of companies were founded after 2010. Furthermore, the majority (54%) of the players in this field are in Europe, followed by North America (32%).

Close to 20 automatic sample collection/preparation systems are presently available

Most automated sample collection/preparation systems (84%) are stand-alone systems. Integrated systems follow, accounting for 16% in this area. In addition, most of these systems (almost 40%) are used in the pharmaceutical industry, followed by the biotech industry (35%).

Over 400 patents related to automatic sampling in the biopharmaceutical industry have been filed/granted, since 2016

Almost 50% of patent applications were filed after 2016 due to increased R&D efforts by various industries and non-industry players in this field. It’s worth noting that 56% of patents related to automated sampling systems were filed/granted only in the US.

Partnership activity in this field has increased at a CAGR of nearly 30%, between 2017 and 2021

Around 45% of deals were signed in 2020 and 2021. Most cases captured in the report (~40%) were product distribution deals. In addition, many deals were signed with players from North America (nearly 70%).

Over 25 global events related to automatic sampling systems were organized in the past couple of years

The majority (~80%) of events related to automated sampling systems have been organized virtually to comply with guidelines in the current COVID-19 pandemic. It should be noted that the agendas of the organized post-2020 events include discussions on the potential, advances and challenges associated with these systems at different bioprocessing plants.

North America is anticipated to capture over 50% of the global market share for automatic sampling systems, by 2035

The market is mainly determined by the sale of automatic sampling systems with online monitoring (59%). In addition, systems used in upstream bioprocessing methods are expected to hold a larger share (60%) of the overall market (in terms of revenue based on sales) by 2035.

Key Questions Answered

- Who are the key players engaged in the development of automatic sampling systems?

- What is the relative competitiveness of different automatic sampling system manufacturers?

- Who are the leading manufacturers involved in the automatic sample collection/preparation systems market?

- How has the intellectual property landscape of automatic sampling systems evolved over the years?

- What are the key agenda items being discussed in the various global events/conferences related to automatic sampling systems?

- Which partnership models are most adopted by stakeholders engaged in the automatic sampling industry?

- How is the current and future market opportunity, likely to be distributed across key market segments?

The financial opportunity within the automatic sampling systems market has been analyzed across the following segments:

Type of Monitoring Method

· On-line

· Off-line

· At-line

Bioprocessing Method

· Upstream

· Downstream

Working Volume

· Less than 10 mL

· 10–50 mL

· 51–100 mL

· More than 100 mL

Scalability

· Lab

· Pilot

· Commercial

Key Geographical Regions

· North America

· Europe

· Asia-Pacific and Rest of the World

The research also includes detailed profiles of the key players (listed below) engaged in the manufacturing of automatic sampling systems; each profile features an overview of the company, its financial information (if available), details on product portfolio, recent developments, and an informed outlook.

- Agilent Technologies

- Captiva

- Mettler Toledo

- Pall Corporation

- Shimadzu