The

U.K. Pet Food Market has generated a revenue of $5,366.1 million in 2016. The UK Pet Food Market is analysed to take centre stage owing to its ability to gradually change the target audience's reliance on the dairy industry. While responding to the vibrant demands of the target audience, UK Pet food provides the same nutrients as dairy products used by people and maintains a good and stable degree of environmental sustainability. However, to assist the Pet Food Market in overcoming the current global uncertainty, the United Kingdom government is increasing its investment in research and development, which will assist market players in overcoming the disrupted demand and supply schedule and opting to initiate new trends. This does assist in presenting the target audience with a range of market services and goods to pick from, all of which are innovative and creative. Furthermore, the major market players pursued higher levels of innovation and creativity, which aided in expanding their operations and providing prospects to grow in the worldwide market.

U.K. Pet Food Market Report Coverage

The report: “U.K. Pet Food Market (2016 -2020)", by IndustryARC covers an in-depth analysis of the following segments of the U.K. Pet Food Industry.

By Pet Food – Dogs and Cats, Others (Ornamental Fish, Pet Bird Feed, Small Mammals and Others).

Key Takeaways

- The growth in the middle-class section, rapidly growing urbanization, growing numbers of elderly, and people getting married and having children later than before are factors transforming the U.K. into a pet-owning and loving society.

-

A detailed analysis of strengths, weaknesses, opportunities, and threats will be provided in the U.K. Pet Food Market Report.

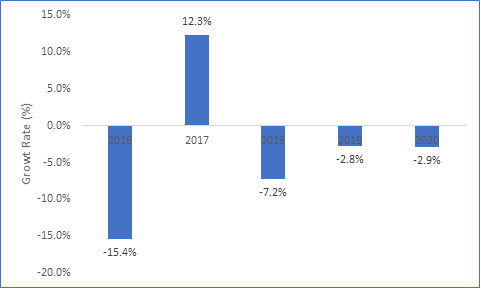

U.K. Dog & Cat Pet Food Market Growth rate (%) for the year 2016-2020

U.K. Pet Food Market Segmentation Analysis - By Animal Type

The U.K. Pet Food market based on product type can be further segmented into Dogs and Cats, and Others. In 2016, the dogs & Cats category had the most market share. Reptiles have long been the most popular pets around the U.K., and they account for a big portion of the country’s pet food industry revenue. Some of the primary drivers driving the reptile pet food market in the country are pet humanization, the growing trend of e-commerce, and the growth in demand for homemade pet food for reptiles. Increased consumer knowledge of their health has resulted in a greater focus on improving reptile weight and maintaining their overall health. Customers choose from a variety of foods and place a high value on product brands. Manufacturers are continuously working to break into the luxury food goods segment and increase their overall profit margin.

Download sample report @ https://www.industryarc.com/pdfdownload.php?id=700001

However, in the U.K. market, the ornamental fish segment has held the fastest-growing position, during the period 2016-2020. The habit of having multiple ornamental fishes amongst the citizens of the U.K. is gaining traction, which is driving up product demand. In comparison to dogs and cats, ornamental fishes require less training and can spend more time alone. Furthermore, the cost of owning a fish in the U.K. is quite modest when compared to that of owning a dog and cat. Moreover, when compared to dogs, cats, and reptiles, the short lifespan and low rate of food consumption are anticipated to be the main reasons for low product demand in the U.K. market.

U.K. Pet Food Market Drivers

The Industry Is Growing Increasing The Adoption Of Dogs And Cats As Pets

The rise of the middle class, increased urbanization, an aging population, and people marrying and having children later than before are all elements that are converting the U.K. into a pet-owning and loving nation. Because of changes in people's lifestyles, pet humanization is on the rise in the U.K. Social networking and the embrace of the western lifestyle have affected the rise in pet ownership among younger generations in particular. According to the Pet Food Manufacturers Association (PFMA), the adoption of dogs and cats in the U.K.'s growing pet population, coupled with the rising pet-owning trend, is poised to drive the U.K. pet food market during the study period.

The Lucrative Ecology In The U.K. Is Being Altered By The Great Success Of Domestic Players, Which Is Fuelling Market Expansion

The pet food market in the U.K. has grown in tandem with the rise in pet ownership, owing to an increase in pet owners' spending on a variety of pet food products. The boost in pet ownership, combined with an increase in pet food spending, is anticipated to fuel pet food demand across the region. Market participants in the U.K. currently control nearly half of the pet food market by value, and their share is expanding. Increased innovation and public awareness are to boost expansion. Local expertise is more important than ever to appeal to clients in the country, as the unforeseen pandemic crisis has proved. This is changing, however, as a result of market participants' remarkable performance and expanding prominence.

U.K. Pet Food Market Challenges

Stomach Disorders Through Pet Food Consumption Are To Impede The Market Expansion

One of the biggest challenges that the U.K. pet food market is going to experience from 2016 to 2020 is people's apprehension of developing comparable stomach disorders if they use pet food products. In addition, a lack of understanding about the benefits of pet products and their ability to meet the body's nutritional content demand is an underappreciated element that could pose growth obstacles for market trends during the projection period, which ends in. Hence, there is an inclination towards homemade pet food by the people in the region which is to help economies, health considerations with a sentiment of eating healthy.

U.K. Pet Food Industry Outlook

Product launches, mergers and acquisitions, joint ventures, and geographical expansions are key strategies adopted by players in the U.K. Pet Food Market. The top 10- U.K. Pet Food Market companies’ are-

- Mars Incorporated

- Nestle Purina Pet Food

- Hill’s Pet Nutrition Inc.

- The J.M. Smucker Company

- Pets Choice Ltd.

- Harringtons Pet Food

- Total Alimentos SA

- Blue Buffalo Pet Products, Inc.

- WellPet LLC

- World Feeds Ltd.

Recent Developments

In December 2020, World Feeds Ltd. Has made an agreement with an Ireland-based firm, Pacific Trading Aquaculture Ltd. With distributors of the region focusing on the feed and potential hatchery applications in the future.

Relevant Titles

Report Code: FBR 84784

Report Code: CPR 0082

For more Food and Beverage Market reports, please click here