views

Food Service Equipment Market Overview

Food Service Equipment Market size is estimated to reach $43.7 billion by 2027, growing at a CAGR of 5.1% during the forecast period 2022-2027. Foodservice equipment is utilized for the establishment and repository of food products for commercial purposes. This equipment is inclusive of cooking equipment, catering equipment, storage & handling equipment, ware washing equipment, food & beverage preparation equipment, and serving equipment. The equipment discovered in a restaurant kitchen is very distinct from the ones observed at residential homes. For a restaurant kitchen, restaurant-grade stoves, fryers, mixers, blenders, steamers, and slicers and dishwashers, coffee makers, beverage dispensers, and more need to be procured. Commercial kitchen equipment requires to generate food for a large count of consumers. It must be strong, durable, and effortless to operate. The equipment must take up less electricity, enhance the productivity of food production operations, and needs to be eco-friendly. Services that cater /offer food services are termed Catering Services. Catering may also be considered as a service that offers a pleasant change from home-cooked food. People like to enjoy a meal/snack/beverage that has been prepared and served in different and pleasant surroundings. Plates, glasses, and cutlery for guests constitute part of the catering business. Foodservice handling equipment for food services includes an assortment of products for utilization anywhere from large supermarket stock management to cafe service trolleys to office water cooler sack trucks and everything in between like sandwich trolley and water bottle sack truck for 6 bottles. The altered food intake patterns, surging demand for takeaways, and the extensive hospitality sector employing kitchen equipment are set to drive the Food Service Equipment Market. The proliferating series of technologically progressive and innovative products to have penetrated the market is set to propel the growth of the Food Service Equipment Market during the forecast period 2022-2027. This represents the Food Service Equipment Industry Outlook.

Report Coverage

The report: “Food Service Equipment Market Forecast (2022-2027)”, by Industry ARC, covers an in-depth analysis of the following segments of the Food Service Equipment Market.

By Product Type: Cooking Equipment, Storage And Handling Equipment, Ware Washing Equipment, Serving Equipment.

By End Use: Full-Service Restaurants & Hotels, Quick Service Restaurants & Pubs, Catering.

By Geography: North America (the U.S, Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, Russia and Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand, and Rest of Asia-Pacific), South America (Brazil, Argentina, Chile, Colombia, Rest of South America), and Rest Of The World (Middle East, Africa).

Key Takeaways

- Geographically, North America Food Service Equipment Market accounted for the highest revenue share in 2021 and it is poised to dominate the market over the period 2022-2027 owing to the early acceptance of progressive kitchen equipment and the increase in demand for processed food in the North-American region.

- Food Service Equipment Market growth is being driven by the proliferating growth of the hospitality sector utilizing catering equipment and a surge in the application of temperature-controlled storage equipment for perishable and processed food items in commercial kitchens. However, the soaring costs on training and equipment cost, high-priced service staff, soaring capital, and great running cost are some of the major factors hampering the growth of the Food Service Equipment Market.

- Food Service Equipment Market Detailed Analysis on the Strength, Weakness, and Opportunities of the prominent players operating in the market will be provided in the Food Service Equipment Market report.

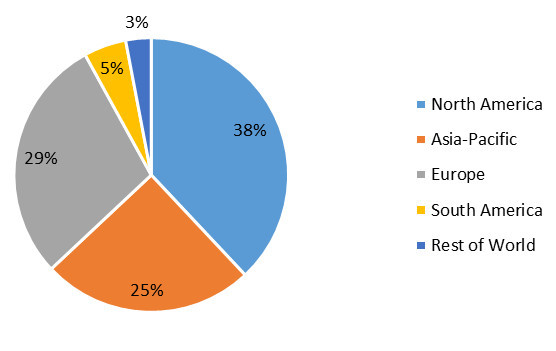

Food Service Equipment Market: Market Share (%) by Region, 2021

For More Details on This Report - Request for Sample

Food Service Equipment Market Segment Analysis – By Product Type:

The Food Service Equipment Market based on product type can be further segmented into Cooking Equipment, Storage And Handling Equipment, Ware Washing Equipment, and Serving Equipment. The Cooking Equipment Segment held the largest market share in 2021. This growth is owing to the extensive application of kitchen equipment like grills, fryers, and ovens and the introduction of novel innovative kitchen appliances targeted for application in commercial kitchens. Contemporary trends like embedding sensors in kitchen equipment like fryers, ovens, and cooktops for real-time supervision of meal preparations are further propelling the growth of the Cooking Equipment segment.

Furthermore, the Storage And Handling Equipment segment is estimated to grow with the fastest CAGR of 5.7% during the forecast period 2022-2027 owing to the proliferating application of refrigeration equipment to store frozen foods in conjunction with the soaring recognition of take-away and ready-to-eat items and the inclusion of bidirectional internet of things (IoT) connectivity in commercial refrigerators to remotely supervise food inventory and temperature along with the associated application of kitchen equipment.

Food Service Equipment Market Segment Analysis – By End Use:

The Food Service Equipment Market based on end-use can be further segmented into Full-Service Restaurants & Hotels, Quick Service Restaurants & Pubs, and Catering. The Full-Service Restaurants And Hotels Segment held the largest market share in 2021. This growth is owing to the onset of digital dining trends. This has forced foodservice operators to deploy contemporary equipment including kitchen equipment to make the preparation technique faster and minimize delivery uptime. The consequent shift in the dine-out culture for formal events and informal gatherings in the course of travel and tourism activities is further propelling the growth of this segment.

Furthermore, the Quick Service Restaurants & Pubs segment is estimated to grow with the fastest CAGR of 5.8% during the forecast period 2022-2027 owing to the proliferating working population and worldwide integration of outstanding restaurant chains with progressive kitchen equipment through the development of franchisee joints.

Food Service Equipment Market Segment Analysis – By Geography:

The Food Service Equipment Market based on geography can be further segmented into North America, Europe, Asia-Pacific, South America, and the Rest of the World. North America (Food Service Equipment Market) held the largest share with 38% of the overall market in 2021. The growth of this region is owing to the existence of well-established brands like McDonald’s, Burger King Corporation, KFC corporation, and Starbucks Coffee Company employing advanced kitchen equipment in the region. The soaring government initiatives leveraging the tourism sector in conjunction with immigration in the nation and the existence of key players like Alto-Shaam, Inc., in the region are further propelling the growth of the Food Service Equipment Market in the North American region.

Furthermore, the Asia-Pacific region is estimated to be the region with the fastest CAGR rate over the forecast period 2022-2027. This growth is owing to factors like accelerated westernization and the growth of the tourism sector, specifically in countries like Singapore, Indonesia, Malaysia, and Australia in the Asia-pacific region. The inclusion of numerous cuisines in restaurant menus owing to the surging count of consumers experimenting with novel foods and developing a taste for diverse cuisines in conjunction with the soaring intake of processed foods employing progressive kitchen equipment is further fuelling the progress of the Food Service Equipment Market in the Asia-Pacific region.

Food Service Equipment Market Drivers

Soaring Restaurant Innovations Are Projected To Drive The Growth Of Food Service Equipment Market:

Restaurants are typically furnished with kitchen equipment like restaurant-grade stoves and fryers. Digital point-of-sale (POS) systems may be incorporated wherein a cloud-based model serves as an operational platform for the crew of the restaurant. The waitstaff takes orders, the kitchen instantaneously accepts them, and cashiers process purchaser payments. The advantages include reporting features providing detailed scrutiny that assists owners and managers to make data-backed decisions to enhance operations like which items are selling best or poorly, removing guesswork. Customer-facing tabletop tablets/kiosks permit diners to scan the menu, transmit orders directly to the kitchen, and pay the bill without the requirement of a live server. Other improvements may be inclusive of bill-splitting apps and video games. The advantages include rapid orders translating to happier diners, larger tips, quicker turnaround, and, the resultant soaring sales. Waitstaff can focus more on tables, and guests are entitled to order more drinks or dishes at their leisure. The extensive restaurant innovations are therefore fuelling the growth of the Food Service Equipment Market during the forecast period 2022-2027.

Surging Digital Innovations In Catering Industry Are Expected To Boost The Demand Of Food Service Equipment:

With the advent of firms like JustEat and DoorDash, the catering industry has been witness to purchasers opting to order their meals online and have them delivered. There is a novel wave of mobile apps from large restaurant chains. They do more than simply indicate where the closest restaurant is. Numerous apps can presently book a table, display the menu, and even permit payment for food at the table without requiring any human assistance, thereby enabling many businesses to attract novel customers and maintain existing customers. Kitchen equipment includes numerous innovations presently apart from smart fridges and internet-connected appliances. They are planned to assist in boosting the effectiveness of food preparation and to also guarantee that food is maintained at the correct temperature. The Friulinox HiChef has greatly differentiated the commercial kitchen owing to its ability to perform numerous functions that would otherwise require to be performed separately. It has five operations namely blast chilling, blast freezing, thawing, leavening retarder, and slow cooking. It enables the kitchen to become more effective and assists in food security management. Rather than maintaining paper records of fridge temperatures and cleaning schedules, a series of software and mobile applications can be utilized to keep track of food safety records. The proliferating digital innovations in the catering industry are therefore driving the growth of the Food Service Equipment Market during the forecast period 2022-2027.

Food Service Equipment Market Challenges

Issues In Food Safety Present Challenges To The Growth Of The Food Service Equipment Market:

One of the most critical issues in the foodservice industry is food safety. This is vitally concerning since any mistreatment, infection, or recorded food-borne sickness is ensured to be a principal Public Relations (PR) nightmare. The vital accountability of the food industry to consumers in public health and security. Contemporary consumer food trends that popularize rapidly (thanks in part to the Internet and social media) have evolved into a breeding ground for food safety-associated issues, and food security professionals should be prepared to respond. Consultants must always be on guard for food trends to efficiently lead food entrepreneurs in carrying out safety strategies and safeguarding their brand. Those responsible for regulation must vigilantly track food crazes and trends and alterations in consumer behavior to be able to anticipate the requirement to review and update the food code to guarantee public health and security. Issues in Food Safety are thus hampering the growth of the Food Service Equipment Market.

Food Service Equipment Industry Outlook

Novel product launches, mergers and acquisitions, collaborations, and R&D activities are key strategies adopted by players in this market. Food Service Equipment top 10 companies include:

- Alto-Shaam, Inc.

- Cambro Manufacturing Co. Inc.

- Castle Stove

- Duke Manufacturing Co. Inc.

- Dover Corporation

- Electrolux Professional

- Illinois Tool Works Inc.

- Ali Group

- Middleby Corporation

- Welbilt, Inc.

Acquisitions/Product Launches:

- In November 2021, Alto-Shaam has introduced a gas-powered alternative to its award-winning Vector F Series Multi-Cook Ovens. Competent in cooking an extensive assortment of food to an extraordinarily high standard, the full-size Vector F models are particularly planned for foodservice operations where a high volume of constantly high-quality food is needed. Characterized by three or four self-reliant ovens in one, operators can curb the temperature, fan speed, and cook time in every individual oven chamber, and concurrently cook an assortment of menu items with nil flavor transfer.

- In June 2020, further backing a minimization in travel and better social distancing, Alto-Shaam, introduced ChefLinc™, a cloud-based, remote oven management system. ChefLinc offers foodservice operators’ entire control of their equipment, menus, and business from wherever they are—boosting effectiveness and constancy across numerous locations. Operators will not be required anymore to program recipes by hand into ovens or to transmit recipes through USB or to journey to and arrive at stores to update ovens.

- In September 2020, Alto-Shaam introduced the latest version of its Vector® F Series of Multi-Cook Ovens with a novel design, progressive user-friendly interface, and the capability to stack with a Combitherm® oven to offer the most value from a single, vertical cooking footprint. Accomplished in cooking a very extensive assortment of food to a phenomenally high standard, the novel Vector F model is particularly planned for foodservice operations where high-volume and constantly high-quality food is needed. Characterized by three or four self-reliant ovens in one, operators can curb the temperature, fan speed, and cook time in every individual oven chamber, and concurrently cook an assortment of menu items with no flavor transfer.

Related Reports

Commercial Kitchen Equipment/Appliances MarketReport Code: ESR 92328

Kitchen Appliances Market

Report Code: CPR 46532

For more Food and Beverage Market reports, please click here