views

Cocoa & Chocolate Market size is estimated to reach $62.4 billion by 2027, growing at a CAGR of 4.4% during the forecast period 2022-2027. Cocoa seeds can be described as fermented Theobroma cacao seeds commonly used around the world for their extracts. Unlike other crops, the cocoa crop is not period or time-bound and can be grown throughout the year. Hot and humid weather is the most suited for the cocoa crop; therefore, several African countries such as Ivory Coast, Ghana, Cameron, and Nigeria are the biggest producers of Cocoa beans worldwide. Cocoa is generally sold in liquid, paste, and cocoa powder forms in the market. Moreover, cocoa has several remedial benefits, such as preventing infectious intestinal disease and lowering the risk of bronchitis, asthma, and lung congestion. Cocoa beans are an inextricable ingredient in chocolate making. Both cocoa and chocolate are used as flavoring agents in the production of confectioneries and flavored beverages. Moreover, the growing confectionery industry, soaring demand for innovative flavors, growing popularity of chocolate among millennials, bettering retail industry in developing countries, urbanization, and improving disposable incomes are the factors set to drive the growth of the Cocoa & Chocolate Market for the period 2022-2027.

Report Coverage

The report: “Cocoa & Chocolate Market Forecast (2022-2027)”, by Industry ARC, covers an in-depth analysis of the following segments of the Cocoa & Chocolate Market.

Key Takeaways

- Geographically, the North America Cocoa & Chocolate Market accounted for the highest revenue share in 2021. The growth is owing to. Furthermore, Asia-Pacific is poised to dominate the market over the period 2022-2027.

- Changing tastes & preferences of people, expanding cuisine culture, ameliorating retail infrastructure in developing nations, health benefits associated with moderate consumption of chocolate, soaring disposable income levels, proliferating population, the rising popularity of confectioneries among millennials, and quick urbanization are the factors said to be preeminent driver driving the growth of Cocoa & Chocolate Market. Augmenting unemployment, soaring inflation, and environmental catastrophes are said to reduce market growth.

- Detailed analysis of the Strength, Weaknesses, and Opportunities of the prominent players operating in the market will be provided in the Cocoa & Chocolate Market report.

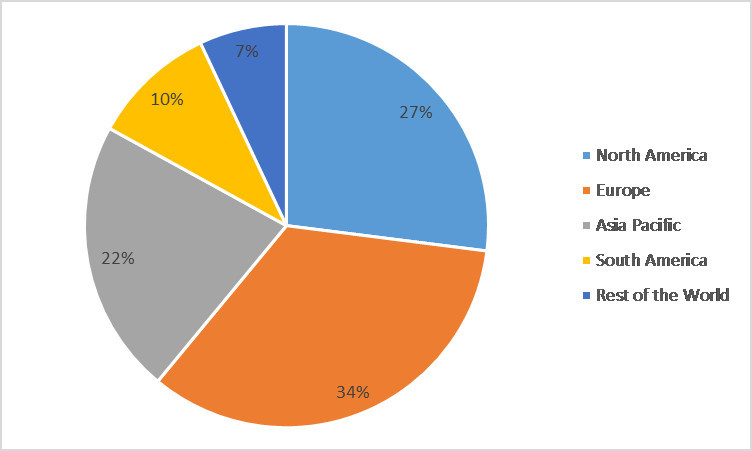

Cocoa & Chocolate Market Share, By Region (%) in 2021

For more details on this report - Request for Sample

Cocoa & Chocolate Market Segment Analysis-By Nature

The Cocoa & Chocolate Market based on nature can be further segmented into organic and conventional. The conventional segment held the largest share in 2021. Conventional farming prevails around the world because of several advantages associated with it. Owing to less labor requirement and large-scale production in less land area, conventional farming help farmers in reducing their expenses and maximizing revenue; as a result, it always remains the first choice for them. In addition to that, unlike organic products, conventional products are available across the board regardless of geographical location. Therefore, they always remain in demand. However, the organic segment is estimated to be the fastest-growing segment with a CAGR of 5.4% over the forecast period 2022-2027. The primary reason behind this is the downsides of conventional farming such as harmful effects on the environment, health problems, high risk of plant diseases, and many others. Therefore, with growing attentiveness among consumers regarding their health and environment, the overall demand for organic products is soaring drastically.

Cocoa & Chocolate Market Segment Analysis-By Distribution Channel

The Cocoa & Chocolate Market based on distribution channels can be further segmented into offline and e-commerce. The offline segment held the largest share in 2021. The growth is owing to round the corner presence, easy return, bulk buying, bargaining, quality check before making the purchase, instant buying, and last but least a reason to go outside which can refresh the mood. In addition to that, the growing existence of modern outlets like supermarkets attracts the attention of people with appealing discount offers and the conveniences of buying everything in one place. Nevertheless, online is estimated to be the fastest-growing segment with a CAGR of 5.8% over the forecast period 2022-2027. The growth is owing soaring popularity of WFH, top thriving technological advancements like Google maps and e-banking services, rising smartphone users, internet penetration, eventful lifestyles of people, and a tech-friendly population.

Cocoa & Chocolate Market Segment Analysis-By Geography

The Cocoa & Chocolate Market based on Geography can be further segmented into North America, Europe, Asia-Pacific, South America, and the Rest of the World. Europe held the largest share with 34% of the overall market in 2021. According to a report, Switzerland is by far the biggest chocolate consumer with a per capita consumption of nearly 9 kg followed by Germany and Austria with 7.9 kg and 8.1 kg per capita consumption. Moreover, Ireland, France, Norway, and many other European countries have a sizable annual chocolate consumption. The sky-rocketing trend of chocolate consumption in these nations can be justified by the high disposable incomes of residents, quality lifestyles, well-established retail network, and presence of leading market players. However, Asia-Pacific is expected to be the fastest-growing segment over the forecast period 2022-2027. This high sugar cane production in India, China, and Thailand is aiding the market. In addition to that, improving living standards of people, rising disposable incomes as economies are flourishing, a growing number of manufacturers, and bettering infrastructure bracing the ease of doing business.

Cocoa & Chocolate Market Drivers

The spiraling disposable incomes and improving lifestyles of people in developing countries are anticipated to boost market demand.

Spiraling disposable incomes and improving lifestyles are one of the key factors driving the market growth. The majority of countries in Europe such as Norway, San Marino, Netherlands, Denmark, Austria, Iceland, Germany, and Others had GDP over capita income above $55,000. These figures are enough to represent the quality of lifestyles on the European continent. Nevertheless, with the rising economic affluence of major developing countries like India, China, and Indonesia, the overall living standards of people are improving and they are making more demand for premium products like milk chocolates. For instance, from $10,511 in 2020, China’s GDP per capita income soared and reached $12,551 in 2021. Also, last year by uplifting nearly 100 million people from poverty, the country declared itself free from extreme poverty.

Extensive usage in confectioneries, innovative payment technologies, and rapid urbanization are expected to boost market demand.

The trend of conferring chocolate during festive seasons and occasions like Christmas, Diwali, Eid, Valentine's Day, and others have broadened in recent years; as a result, the overall demand for confectionery has witnessed a massive ascension. The existence of electronic fund transfers has revolutionized the retail industry worldwide enhancing product demand. Moreover, as they support hassle-free and swift payment, EFT platforms act as a potent trigger in affecting consumers' buying behavior. According to the National Payment Corporation of India, in March 2022, the Unified Payment Interface (UPI) accounted for nearly 5.04 billion payments in India; moreover, in FY22, the platform processed transactions worth $1 trillion. The growing number of internet users in the country is likely to expand the figures. Moreover, the rapid urbanization of people from the countryside to urban centers worldwide is another factor promoting the growth of the aforesaid market.

Cocoa & Chocolate Market Challenges

Broadening inflation, unemployment, and environmental catastrophes are projected to hamper the market growth.

The disrupted supplies because of pandemic restrictions have impacted the market negatively. Furthermore, a sweeping increase in unemployment levels and inflation rates are affecting the purchasing power of consumers worldwide and eventually challenging the growth of the cocoa & chocolate market. For instance, India’s urban unemployment increased from 8.28 percent to 9.2 percent in April 2022. Moreover, according to a UN report, with a hike of 18 million, global unemployment is likely to reach the 205 million mark in 2022. On another hand, in March 2022, India witnessed 17 months' highest CPI inflation rate of 6.95 percent and the U.S. is facing 42 years of highest inflation. All these factors are anticipated to impede market growth in the near future.

Cocoa & Chocolate Industry Outlook:

Product launches, mergers and acquisitions, joint ventures, and geographical expansions are key strategies adopted by players in the aforementioned Market. Cocoa & Chocolate market's top 10 companies include-

- Cargill Inc.

- Touton S.A.

- Cocoa Processing co Ltd.

- Olam International

- Barry Callebaut AG

- Fuji Oil Company

- Nestle S.A.

- ECOM Agroindustrial Co.

- Niche Cocoa

- Archer Daniels Midland

Recent Developments

- On December 22, 2021, Illinois, United States-based company Archer-Daniels-Midland (a firm known for its food processing) announced the successful acquisition of Panama-based Flavor Infusion International SA (a firm that provides flavor and specialty solutions). The financials of the transaction were not disclosed by the firm; nevertheless, the transaction has expanded the company's presence in Latin America and the Caribbean.

- On October 21, 2021, Minnesota, United States-based renowned food corporation “Cargill” announced that the company has gone into a joint venture with Continental Grain Company in order to acquire Mississippi, United States-based “Sanderson farms” gets a nod from Sanderson’s stockholders. The total value of the acquisition stands around $4.5 billion ($203 per share).

- On June 25, 2021, Pennsylvania, Unites States-based renowned chocolate manufacturing company “The Hershey Company” announced that the company has successfully acquired the confectionery business from Boulder, the United States-based company Lily’s Sweet LLC (a company that offers a variety of chocolates). The total value of this transaction stands at around $425 million.

Relevant Links: