views

According to the Heart and Circulatory Disease Statistics 2019 from the British Heart Foundation (UK), there has been a significant increase in the number of cardiac surgical procedures such as angioplasty and aortic valve replacement in the UK over the last decade, and this trend is expected to continue in the coming years.

Post-surgical adhesion formation leads to different complications in different surgeries, such as severe abdominal pain in the case of abdominal surgeries, infertility in women after gynecological surgeries, and physical impairment of patients after neurological surgeries. Considering the severe effects of post-surgery adhesion formation in patients, the importance of products such as adhesion barriers is increasing in the market.

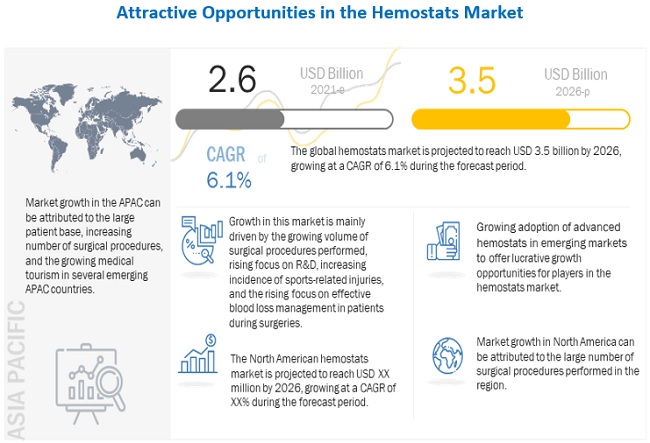

Over the years, there has been a significant rise in the number of surgical procedures performed across the globe. According to WHO estimations (2019), approximately 235 million major surgical procedures are undertaken worldwide every year. This is attributed to the growing prevalence of obesity and other lifestyle diseases, the rising geriatric population, the increasing prevalence of orthopedic conditions, and the increasing incidence of spinal and sports-related injuries.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=9571619

Currently, the lack of skilled surgeons, both in developed and developing economies, is one of the major factors limiting the adoption of these products. For instance, the Association of American Medical Colleges (AAMC) projects a shortage of about 122,000 physicians by 2032 in the US. Of these, a shortage of 12,000 medical specialists and 23,400 surgeons and 39,100 other specialists such as neurologists and radiologists is expected to occur by 2032.

The technology landscape and application areas of hemostats products are changing rapidly, owing to technological advancements in this field. This necessitates physicians and other healthcare providers to acquire the necessary skills to apply advanced hemostats products such as hemostats, bone graft substitutes, surgical sealants, and adhesives effectively.

By type, the Hemostats is segmented into thrombin-based hemostats, oxidized regenerated cellulose-based hemostats, combination hemostats, gelatin-based hemostats, and collagen-based hemostats. The thrombin-based hemostats segment accounted for the largest share in the hemostats market in 2020. The large share of this segment can primarily be attributed to the advantages associated with the use of thrombin-based hemostat.

The growing geriatric population, increasing incidence of sports injuries, and the growing prevalence of lifestyle disorders (such as arthritis, osteoporosis, and obesity) are some of the major factors responsible for the growing number of orthopedic surgeries performed globally. However, the reconstructive surgery segment is expected to grow at the highest CAGR during the forecast period. Growth in the number of facial cosmetic surgeries and breast reconstruction procedures are the major factors driving the growth of this segment.

Some of the major players operating in this market are C.R. Bard (US), Baxter (US), Teleflex Incorporated (US), Ethicon (Subsidiary of Johnson & Johnson) ( US), Medtronic plc (Ireland), B. Braun Melsungen AG (Germany), Pfizer (US), etc. In 2020, Ethicon (Subsidiary of Johnson & Johnson) ( US) held the leading position in the market. The company has a strong geographic presence across the US, Asia, Europe, Middle East and Africa, & the Americas. Moreover, the company’s strong brand recognition and comprehensive product portfolio in the Hemostats market is its key strength. Baxter (US) held the second position in the in 2020.