views

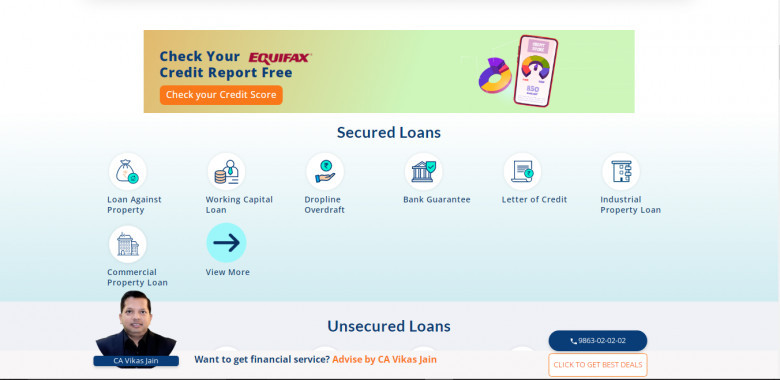

Apply Online Click Here:- Secured Loan

A secured loan is referred to business loan that require you to pledge MSME Collateral /security in order to obtain loan, these loans offer lower Secured Loan Interest Rates because of low-risk consistency.

A secured loan is referred to Business Loan that require you to pledge MSME Collateral/security in order to obtain loan, these loans offer lower interest rates because of low-risk consistency. If you are planning to set up or expand your existing business you can apply for a secured loan. One of the biggest advantages is lenders won't look on your credit history like how bad or good it is, Security stands equal to strong repayment capacity. In additional there are several benefits you will grant as listed below:-

•Maximum loan amount on property value

•Lowest interest rates as compared to unsecured loans

•Instantly improving credit history

•Top-up facility available for additional funds requirement

In other words we can say it's a secured way to finance, if you feel that you have the capacity to repay the loan anyhow at any condition. Then, no doubt this will be the best loan you can look for! Financeseva is a one stop financial point where borrowers will able to compare 80+ loan products with top banks & financial institutions. Hence, it will help you to save time & money from being anywhere. Moreover, there will be chance to get Rs.5000 cash back on disbursement if you approach them via online.