views

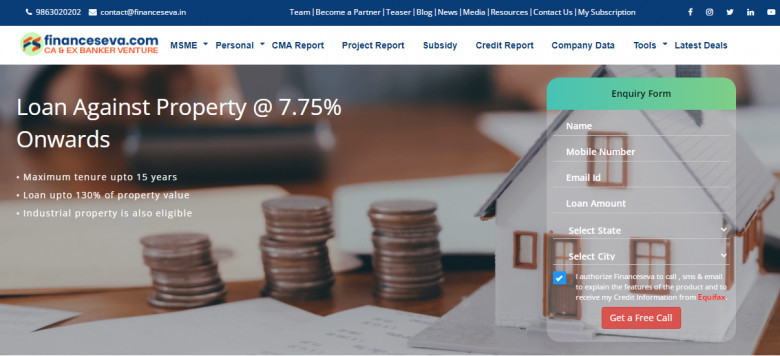

Loan Against Property Land

Loan Against Property Land

loan against property (LAP) can be avail by anyone for your personal or business needs. Both residential and commercial properties can be mortgaged for availing a loan against property land. Banks and financial institutes provide loans at attractive interest rates. A loan against property is a simple solution to your financial needs. Lenders provide loans to anyone who owns any piece of land and uses collateral as security for loans. To get a smooth & hassle-free loan against property to both salaried and self-employed individuals, you can apply online for the loan. Nowadays, most lenders are providing their services online. The interest rate of loan against land property is 11.10%, it may vary from lender to lender. Generally, loan against property Eligibility Criteria depends on numerous factors like age of the individual, monthly salary or business income, total work experience & CIBIL (Credit Information Bureau India Limited) Score, etc. The required criteria are mostly common; some lenders may ask for some other condition for eligibility.

Features of the loan against property

- Loan against land property or commercial properties for: Business Needs; Marriage, medical expenses, and other personal needs.

- You can transfer your outstanding loan availed from another Bank / Financial Institution

- You may pay your payments for the loan over a maximum term of 15 years.

- Smaller EMIs (Equated Monthly Installment)

- Attractive interest rates

- Easy and hassle-free documentation

- Simple repayments through monthly instalments