views

Investment Calculator in India

Investment Calculator in India

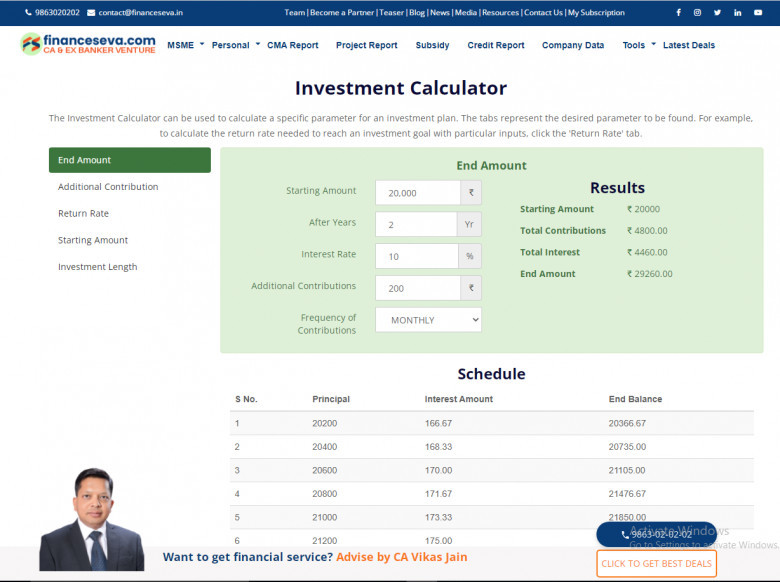

An investment calculator in India is immensely helpful to figure out how to reach your goals. Whether you have just started with investment or you are already a seasoned investor. It can show you how your initial investment, frequency of contributions, and risk tolerance can all affect how your money grows.

How to use investment calculator

Use the button for selecting the SIP (Systematic Investment Plan) and lumpsum investment

Use the slider for selecting investment calculator in India amount

Select the tenure in years or months using slider

Use the slider for selecting expected rate of Interest

Recalculate your SIP by changing the input sliders

You can understand the workings of an investment calculator with this formula.

FV = P [1+i) ^n-1] * (1+i)/iFV = Future value or the amount you get at maturity. P = Amount you invest through SIP i = Compounded rate of return n = Investment duration in months r = Expected rate of return

This is an example where you invest Rs 2,000 per month for a term of 24 months (about 2 years). You expect a 12% annual rate of return (r). You have i = r/100/12 or 0.01. FV = 2000 * [(1+0.01) ^24 - 1] * (1+0.01)/0.01 You get Rs 54,486 at maturity.