573

views

views

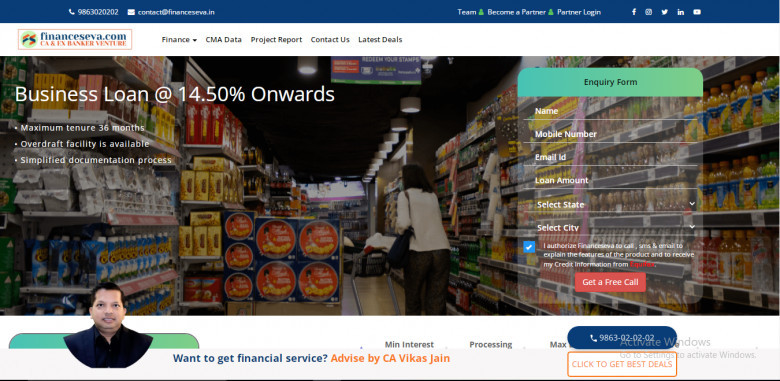

Financeseva offers unsecured business loan in Delhi for low interest rates.Check your eligibility criteria for a business loan in Delhi here.

Documents Required for Business Loans

Documents Required for Business Loan

A Business Loan is also called commercial loan. It is an unsecured loan if an applicant wants to start a documents required for business loan or enlarge an existing business, they can opt for a business loan. It is provided by the Banks, financial institutions, or NBFCs to meet the needs for firms' financial requirements. The borrower can get loan amount up to Rs. 2 crores on business loan at a lower interest rate of 14.00% onwards of a maximum tenure of repayment of principal amount of 7 years.

Documents required for partnership firm:

- 2 Passport-sized photographs of both partners.

- Copy of clear PAN Card proprietor

- Address proof of proprietor – Voter ID Card and Passport

- ITR with computation of income, balance sheet, tax audit, profit & loss A/C, all scheduled and annexure of firms 3 years.

- For Office address proof – recent telephone bill and electricity bill.

- Copy of GST registration and firm registration certificates

- Copy of GST return for last 1 year.

- Provisional financial year.

- Updated last 1 year bank statements (overdraft account, current account, cash credit account)

- Updated statement of saving account of 6 months (proprietor)

- Repayment schedule and sanction letter if running any existing loan

- Complete property documents with chain sanction map.