views

CAPM Model

CAPM Model

CAPM stands for CAPM Model, it is a model that describes the relationship between the expected return and risk of investing in a security. It shows that the expected return on a security is equal to the risk-free return plus a risk premium, which is based on the beta of that security.

It is an idealized portrayal of how financial markets price securities and thereby determine expected returns on capital investments. The model provides a methodology for quantifying risk and translating that risk into estimates of expected return on equity.

A principal advantage of CAPM is the objective nature of the estimated costs of equity that the model can yield. CAPM cannot be used individually because it necessarily simplifies the world of financial markets. But financial managers can use it to supplement other techniques and their own judgment in their attempts to develop realistic and useful cost of equity calculations.

CAPM Formula and Calculation

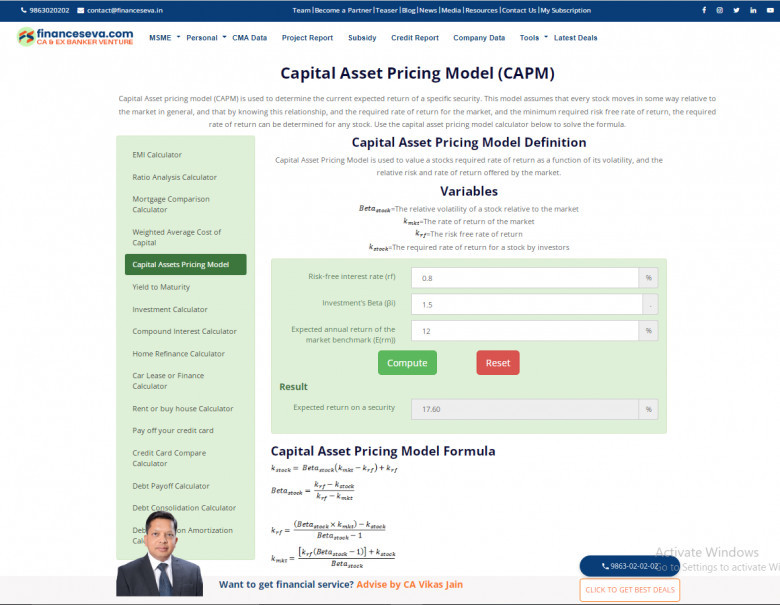

CAPM is calculated according to the following formula:

Where:

Ra = Expected return on security Rrf = Risk-free rate Ba = Beta of the security Rm = Expected return of the market

Note: “Risk Premium” = (Rm – Rrf )

The CAPM model interest rate formula is used for calculation of the expected returns of an asset. It is based on the idea of systematic risk or otherwise known as non-diversifiable risk. that investors need to be compensated for in the form of a risk premium.

A risk premium is a rate of return greater than the risk-free rate. When investing, investors desire a higher risk premium when taking on more risky investments.