views

Demand for NFTs (Non fungible tokens) has continued to increase this year as the total NFT market volume for 2021 attained $23 billion. This is a prominent jump compared to the previous year when NFTs worth a little less than $100 million were traded.

The data that a blockchain analytics firm compiled detailed the number of blockchain addresses that engaged with NFTs regularly increased from 5,000 at the starting of this year to nearly 140,000 at the end of the year. The firm tracks over 30 blockchain supporting dApps (decentralized applications).

NFT Market Volume: Expensive JPEGs

Non fungible tokens are primarily digital artworks that are kept on the blockchains. These virtual images are auctioned and can be bought with digital currencies and they can be held on decentralized exchanges. The ease of transfers and the authenticity of ownership has shifted the fame of these artworks among both the investors and artists. As per the NFT volume tracker, there has been an exponential growth of this sector in 2021.

Even though these NFTs existed for just a few years now, their demand mostly expanded in the last couple of years. Many famous support persons, artists, and celebrities are presently launching their NFTs, creating more demand in this sector and thus increasing the total NFT market volume.

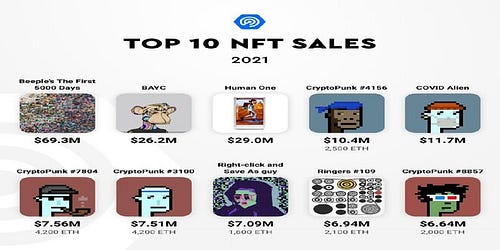

Non fungible tokens have also made their route in the mainstream art world as the best auction houses are now into selling digital arts. In the beginning of this year, an NFT of Christie was sold at $69 million in digital currencies, which is still the most expensive NFT as of now. Along with that, projects like Bored Ape Yacht Club and CryptoPunks are designing exclusive digital clubs with the holders of their collectibles. These JPEgGs are being sold at tens of millions of dollars. The fashion brands have started to sell digital wearables. So it can be said with the assertion that 2021 was indeed the year for NFTs and the total NFT market volume that has been generated is worthy.

The blockchain analyst firm said,

“With all of these elements in play, and hundreds of exciting projects launching by the day, the demand for NFTs spiked to unprecedented levels. The pieces from specific collections are viewed as value storage units and sparked another exciting trend: fractionalization of NFTs.”

Venture capital investors presently value OpenSea, the leading marketplace of this industry, over one $10 billion that was reported, formulating all-new unicorns in this category. And that is just the peak of the iceberg.

Factors Responsible For The Increase In NFT Market Volume

The incredible NFT market size growth this year is because of various factors that cannot be ignored. So let us have a look at the various factors that fuel the growth of this NFT market size 2021.

- Celebrities

Eminem, Naomi Osaka, Paris Hilton, Tom Brady, Paul Pogba… Name a celebrity who has not joined the NFT bandwagon in the past 12 months. From purchasing these items to launching their own committed platforms, the famous and rich have largely guided the way in bringing digital collections into the mainstream.

- Brands

Space has also been cultivated collectively. Luxury Fashion House as D&G, Gucci, and Burberry presented their first digital wearables; Visa bought one of the 10,000 24×24 pixel pictures of the Cryptopunks NFT collection, attaching its blue-chip position, and Nike purchased collectibles startup and a virtual sneaker, to name a few.

- Auction House

Many, including Sotheby’s and Christie’s, embraced digital art and started to accept digital currencies for payment. In March, virtual artist Mike Winkelman, who is better known as Beeple, entered the club of the most valuable living artists in the world when his iconic artwork “Every day’s — The First 5000 Days” was sold for $69 million.

- Game

While decentralized finance applications stayed a hot topic in the initial half of the year, games based on blockchain, or so-called GameFi, quickly amassed more users than any of its similar categories. Earn-to-play games, many of which avail NFTs, now portray 51% of the usage of the industry, while DeFi accounts for 37 percent, as per reports.

- Venture Capital

Publicity, mainly GameFi. nearby, Greed venture capital Investors who invested a predicted amount of $4 billion in this category.

- Meta

Finally, in the wake of rebranding Facebook to Meta, the price of metaverse Related projectsincreased. Blockchain virtual spaces like Decentraland and The Sandbox created over $500 million in trading volume and attained an NFT market volume of $3.6 billion.

The Bottom Line

NFTs have altered the way of our thinking on ownership and opened the latest financial opportunities for all creators, institutional and retail investors, VCs, but the hype is settling. The large adaptation of NFTs and digital currencies as a whole have navigated to this increased NFT market volume for 2021 and NFT market projections 2025 are going to be much higher.