views

Luxury Wines And Spirits Market

Luxury Wines and Spirits Market size is estimated to reach $123.4 billion by 2027, growing at a CAGR of 5.1% during the forecast period 2022-2027. Wines and Spirits fall under the category of alcoholic beverages. The only difference in both terms is alcohol content. Wine generally exhibits below 15% whereas spirits have over 30% alcohol. Distilled spirits or liquors are another communal description of spirits as they are obtained through decontamination from wines and fruit. Some common spirits include tequila, whiskey, cognac, rum, and others. Talking about wine it’s fabricated through fermentation where juices are converted into ethanol with the help of an enzyme. Most wines are made from fruit and flowers such as grapes, apples, dandelion, and others. Besides that, in many countries, grains such as rice, and cereals are also taken into account to preparing such alcoholic beverages. Growing western influence among the younger generation in developing nations is one of many factors set to drive the growth of the Luxury Wines and Spirits Industry for the period 2022-2027.

Report Coverage

The report: “Luxury Wines and Spirits Market Forecast (2022-2027)”, by Industry ARC, covers an in-depth analysis of the following segments of the Luxury Wines and Spirits Market.

By Type: Wine, Spirits (Vodka, Tequila, Rum, Whisky, Brandy, and others).

By Distribution Channel: Wholesale, Retail outlets (wine and beer shops, cafeterias, clubs, hotels, army canteens, and Others.), Online Platforms.

By Geography: North America (U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain, Russia, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia & New Zealand, and Rest of Asia-Pacific), South America (Brazil, Argentina, Chile, Colombia and Rest of South America) and Rest of World (the Middle East and Africa).

Key Takeaways

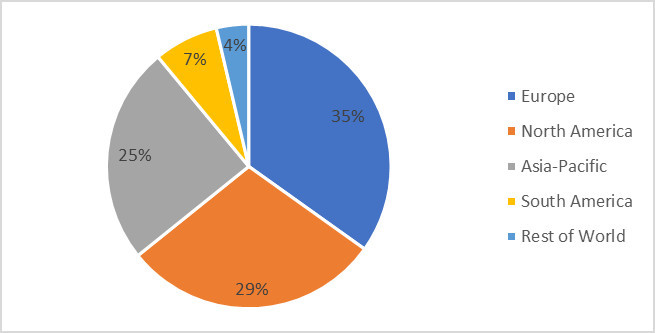

- Geographically, Europe’s Luxury Wines and Spirits Market accounted for the highest revenue share in 2021. However, Asia-Pacific is poised to dominate the market over the period 2022-2027.

- The state-of-the-art fermentation technologies, swift modernization, and accruing disposable income is said to be preeminent driver driving the growth of the Luxury Wines and Spirits Market. Whereas, several health complications accompanied by alcohol intake are said to reduce the market growth.

- Detailed analysis on the Strength, Weaknesses, and Opportunities of the prominent players operating in the market will be provided in the Luxury Wines and Spirits Market report.

Luxury Wines and Spirits Market- Geography (%) for 2021.

For More Details on This Report - Request for Sample

Luxury Wines and Spirits Market Segment Analysis-By Type

The Luxury Wines and Spirits Market based on the type can be further segmented into Wine, Spirits (Vodka, Tequila, Rum, Whisky, Brandy, and others). The spirit segment held the largest share in 2021. The growth is owing to numerous factors. One of the major factors is price. If compared to wine prices of spirit drinks are way below. Furthermore, people prefer more alcohol intake in order to escape the stresses and worries of the present life. Moreover, trends of consuming alcoholic beverages at festivals, marriage ceremonies, and other occasions call for a celebration. Similarly, the spirits segment is estimated to be the fastest-growing with a CAGR of 6.7% over the forecast period 2022-2027. This growth is owing to the elevation in the trend of alcohol consumption among teenagers. As per US CDC analysis, over 85% of the people have reported consuming alcohol at some point in their life, further around 8% are regular alcohol in takers. Far-reaching availability even in pastoral areas.

Luxury Wines and Spirits Market Segment Analysis-By Distribution Channel

The Luxury Wines and Spirits Market based on distribution channels can be further segmented into Wholesale, Retail outlets (wine and beer shops, cafeterias, clubs, hotels, army canteens, and others), Online Platforms. The retail segment held the largest share in 2021. The growth is owing to the wide-scale presence in both cities and the countryside. Proliferating the number of clubs and discos in urban areas. According to a recent report, there are more than 43000 liquor stores in the US. The number has witnessed a significant expansion of 1.3% as compared to 2020. Moreover, the alcoholic beverage market has locked a revenue of $249,0888 million in 2021. Furthermore, retail is estimated to be the fastest-growing segment with a CAGR of 6.9% over the forecast period 2022-2027. This growth is owing to factors such as the availability of diversity in options, and convenient shopping options extended by retail outlets.

Luxury Wines and Spirits Market Segment Analysis-By Geography

The Luxury Wines and Spirits Market based on Geography can be further segmented into North America, Europe, Asia-Pacific, South America, and the Rest of the World. Europe held the largest share with 35% of the overall market in 2021. The growth in this segment is owing to the factors such as the presence of nations that consume the highest alcohol. For instance, Moldova has the highest alcohol consumption rate with 15.2 liters per year followed by Lithuania with 14.4 liters. Additionally, in other European nations such as Germany, Ireland, Bulgaria, Luxemburg’s consumption rate is over 12 liters. Besides, ascribing to affluent economies European public enjoys high standards of living. Luxembourg's GDP per capita (nominal) has reached $125,923. Similarly, other nations like Norway, Switzerland, and Denmark have GDP per capita of more than $60,000. However, the Asia-Pacific is expected to offer lucrative growth opportunities over the forecast period 2022-2027. This growth is owing to the emerging trend of alcohol consumption among adults as well as teenagers. Thriving economies of Asian nations like India, China, and Indonesia. expanding the disposable income of people.

Luxury Wines and Spirits Market Drivers

Speedy modernization augmenting the number of wine shops, pubs, and discos is Anticipated to Boost Product Demand

With swift modernization number of wine shops and clubs is on the rise to tap the proliferating demand for alcoholic beverages. With a 1.3% expansion, the number of wine shops in the U.S. has reached over 43,000 in 2021. Moreover, the exuberant nightlife of countries like the U.S., U.K., and Spain is a sight to hold. A report claimed that there are more than 60,000 bars and nightclubs in the U.S. as of 2021. The number is expected to rise further in foreseeable future.

Accruing purchasing power of people especially in the developing economies is Expected to Boost Product Demand

As economies of major developing countries like India, China, and South Africa are augmenting the number of people living hand in a month or people living paycheck to paycheck in these nations is diminishing. In short, purchasing power in hands of people is proliferating. Recently, China became the richest country in the world after beating the US. China’s total wealth has accumulated to $514 trillion. Moreover, the per capita income of countries like India, and Bangladesh is soaring. Bangladesh’s per capita income in the financial year 2020-21 witnessed a 10% hike and reached an all-time high of $2,227. The number was around $2,064 in 2019-20. Moreover, India’s per capita income is anticipated to reach $1850 by the year 2023.

Luxury Wines and Spirits Market Challenges

Numerous health complications and strict regulations of government are Anticipated to Hamper Market Growth

There are countless health hitches linked with alcohol intake which are anticipated to strangle the growth of the aforementioned market. Over usage of alcoholic beverages can result in deterioration of liver tissue. Once liver tissue is damaged it affects the functioning of the liver, and after a certain period of time patient can face liver failure. Within the U.S., around 2,000 cases of ALFs are reported. Moreover, increasing cases of domestic violence have set many rallies and campaigns against the use of alcohol on the motion. Therefore, governments around the globe have no other option than to impose a ban. All these factors can hamper the growth in the aforementioned market.

Luxury Wines and Spirits Industry Outlook:

Product launches, mergers and acquisitions, joint ventures, and geographical expansions are key strategies adopted by players in the Luxury Wines and Spirits Market. Luxury Wines and Spirits Market Key companies are-

- Bacardi & company

- Diageo PLC

- Thai Beverage PLC

- Brown-Forman

- Bayadera Group

- Campari-Milano

- Pernod Richard

- Hitejinro Co.

- The Edrington Group

- Suntory Holdings Limited

Recent Developments

- On January 12, 2022, Jameson launched new whiskey, with the offering imbued with citrus launching on St. Patrick Day. The resulting product draws on the flavors found in an Old-Fashioned cocktail and has tasting notes of nuts and vanilla. The product launched in 2021 in the U.K., where it found a foothold, and Jameson plans to roll out the product across America this month with a suggested MSRP of $24.99. The launch of this product stateside marks a new era for the whiskey developer, as the brand continues to explore flavored spirits.

- On January 12, 2022, Block- Bar has launched NFT gifting with 300 Bottles of Rare Penfolds Wine. BlockBar, the world’s first direct-to-consumer NFT platform for wine and spirits, just expanded its marketplace by launching a gifting capability. The offering allows the BlockBar community to gift a highly coveted collectible wine or luxury spirit–BlockBar cites the market for investing in high-end collectible spirits has increased by 582 percent in the last decade–that bridges the digital and physical worlds.

- On April 14, 2021, England-based multinational firm Diageo which manufactures alcoholic beverages successfully acquired “Loyal 9 Cocktails”, a US-based company that manufactures ready-to-drink spirits. The step is anticipated to be a complete banger as demand for ready-to-drink cocktails is soaring in the US. The ready-to-drink cocktails sales witnessed a 79% increase and reached $664 million in 2020.

- On November 18, 2020, TAILS a very famous bottled cocktail manufacturer organization that was established in London in 2010 is acquired by Bacardi. The company (Bacardi) bought 100% of the stake, and this step will enlarge Bacardi’s reach across the European continent because TAILS was mounting across western Europe.

Relevant Links:

Alcohol Ingredients Market-Forecast (2022 – 2027)

Report Code: FBR 63780

Denatured Alcohol Market – Forecast (2022 - 2027)

Report Code: CMR 0993

Craft Spirits Market - Forecast(2022 - 2027)

Report Code: FBR 28605

For more Food and Beverage Market reports, please click here