Parallel robots estimated to grow at a CAGR of 11.8% market. These Robots will be formed by connecting parallelograms to a common base and are also referred to as spider-like robots. These robots are mostly used in food industry, pharmaceuticals, and electronic industries. As they are able do delicate/precise movement. Similarly, these robots will use three servo motors and are very high in speed and perfectly suits for light duty tasks within the small working zones. These are the main reasons which tends to use for high-speed sorting and packaging in the food, pharmaceutical, and electronic industries. In addition, the delta robot market anticipated to driven by trend of miniaturization in manufacturing industry, moreover smaller sizes of object lead to increase challenges of various micro assembly task, expected to increase demand of delta robots. Moreover, technologically advanced machine vision 3D cameras are being integrated with delta robots to enhance their efficiency and accuracy. In addition, Delta robots with vision systems can perform lethargic, dull, and monotonous tasks at high speed and accuracy with minimum imperfections and scrap. This will improve the performance of delta robots and increase their adoption in end-user industries. Additionally, several companies are investing heavily for research and development activities in this robots. In 2019, Fanuc has launched new food-grade delta robot with advanced specifications. Similarly companies such as ABB, KUKA AG and so on are investing heavily for the development of advanced robot in the forecast period 2020-2025.

End User - Segment Analysis

Electrical & Electronics is the fastest growing segment in Industrial robotics market and estimated to grow at a CAGR of 9.4%. Electronics sector has also been slowing emerging as a major end user for the industrial robotics market with its higher adoptability due to growing digitalization. Since accuracy and precision are one of the important factors in an electronic production plant, thus due to ease of use, the electronics sector has been proactively adopting industrial robots, boosting its market growth. With growing shift towards automation of manufacturing processes, industries like electrical and electronics have been widely deploying the industrial robots to perform high precision tasks, thus improving the productivity standards. Usage of industrial robots helps the electrical and electronics companies to automate almost every manual tasks while adding value to their business growth. Thus, growing adoption has been causing a positive impact on the market growth of industrial robots. With growing development of electronics sector due to rising demands for electronic devices by the consumers has been also acting as a major driver towards higher requirements for industrial robots. As the industries are shifting towards smart technologies, industrial robots are gaining much popularity in the electronics sector due to their capabilities of performing tasks like integration and assembling of various small sized components within the electronic devices such as mobile phones , computers and many others more efficiently within less time intervals. Since the electronics manufacturers have to work under tight profit margins, industrial robots act as a cost effective solution for improving the automation standards in their industry. Industrial Robots are used in applications ranging from cutting metal housings to assembling miniature components on boards, to applying adhesives and polishing surfaces, thus performing quality inspections and packing of finished products, within lower costs. Moreover, in the electrical and electronics sector, industrial robots are utilized mainly in assembly, screw tightening , electronic parts insertion as well as inspection process as the robots are highly capable of sustaining harsh working environments. Such growing deployments helps the industry to continue with their production process with quality preservation even at times of lack of skilled labor. Additionally, with innovations in the field of industrial robotics, lightweight and smaller robots are facing high demands in this sector.

Geography- Segment Analysis

APAC dominated the Industrial Robotics market in 2019 with a share of 58%, followed by Europe and North America. High and early adoption of advanced technologies in countries such as India, China is set to boost the market growth. The strong financial position allows it to invest heavily in the adoption of latest tools and technologies for ensuring effective business operations. The Chinese government’s ‘Made in China 2025’ policy aims at improving the competitiveness of Chinese companies though automation. As part of the strategy to achieve this, the government’s Robotic Industry Development Plan gives a target robot density (the number of robots per 10,000 workers) of 150 by 2020. In addition according to CRIA forecasts sales of industrial robots will reach 625,000 by the end of 2020. On the other hand, the Chinese government invested $577 million for the development of intelligent robots. Moreover, the automotive industry is the major adopter of industrial robotics with a wide variety of applications and thus the growing automotive industry in this region will propel the market. Companies such as BAIC Motors, Changan Automobile Group, have been investing heavily for the adoption of robotics in the forecast period 2020-2025. In addition, the launch of ‘Make in India’ has increased the focus on Indian manufacturing sector, which is set to be among the fastest growing market in the APAC region as well as globally. The manufacturing sector’s growth output has increased and is projected to exhibit high growth through 2020. The government of India has committed to invest more than $13 billion for industrial robotic R&D. The government estimates the manufacturing sector value could reach $1 trillion by 2025. Major companies such as GE, Bosch and Panasonic are planning to invest in the country which would boost India’s economic growth.

Drivers – Industrial Robotics Market

Robotic Process Automation and Artificial Intelligence Automation Spending Driving the Growth of Industrial Robots

Robotics process automation landscape has been changed in the past couple of years and has evolved from an emerging factor for the industrial robotics industry. Robotic automation enables to achieve the innovation in a quick and impactful way which can drive quantifiable benefits to the industrial automation industry. Across the globe, automation companies are investing lots of capital to develop and innovate new technology in research and development. In 2019, ABB has committed to invest more than $150 million for construction of its new robotics manufacturing and research facility in China by 2021. Similarly companies such as Mitsubishi electric Corp, Ellison and so on are investing heavily for the development of industrial robots in the forecast period. Some of the key factor affecting robotic process automation includes process with higher automation potential, with higher head count reduction that offers a great cost saving to the manufactures. Robotic Process Automation (RPA) recurring cost includes licencing, hosting, and monitoring vary significantly by vendors and type of solution, the lower the recurring cost for RPA, the higher will be the cost saving. Various service providers are implementing RPA tools in various areas of end-user processes focusing on achieving consistency, risk reduction, and cost reduction factor.

Rising Labor Costs amidst the Aging Workforce to Boost the Industrial Robots Demand

The labor cost is highly significant in the total industrial operating cost, making generally 62%-65% of the total cost. In majority of the cases, manual jobs typically consist of two categories of staff: direct and indirect where industries cover an area of more than 2, 00,000 square feet. Direct staff is responsible for executing the process while indirect staff is for the back-end support for direct staff. The presence of both direct and indirect staff coupled along with department managers presents a crucial cost in operating a warehouse. Rise in the hourly wages from $19.6 in 2017 to $22.7 in 2020. Moreover, the average weekly hours have increased 42.11 in 2017 to 39.2 in 2020 that has relatively created stagnant warehouse productivity. As average hourly earnings will hike further amidst the rising global inflation with weekly hours to remain constant or decline in the coming years, the operating costs are bound to advance. Apart from this, the developing nations have seen a constant growth in the ageing workforce resulting in issues related to safety, quality control and productivity. Thus, the automation of industries has become a notable means to tackle the rising wages and workforce age. This has resulted in the industrial operators to rely upon the robotics to provide a convenient and efficient way of reducing the operational costs while simultaneously maintaining the productivity at optimum levels.

Challenges – Industrial Robotics Market

Limited Flexibility of Robots for Handling Skus Posing Challenge for Industrial Robotics

The dawn of electronic commerce enabled due to the increasing accessibility to mobile devices has resulted in consumers to shop online from a multitude of merchandisers. As the delivery to the consumer in working time of 3-5 days is crucial for retailers, it has resulted in multi-varied stock keeping units (SKUs) and caseloads. This scenario often becomes challenging in the Food & Beverage sector where companies need to address the consumer demand at a much faster pace. The robots utilized in the process industries are simply robots used in manufacturing operations that only require a limited flexibility in handling pallets. Although over the time, robots have developed to handle the SKUs with greater precision and accuracy but still require a great deal of evolution in handling mixed SKUs with the consistent speed and accuracy without damaging the product. Hence these kind of challenges hamper the market growth in the forecast period 2020-2025.

Market Landscape

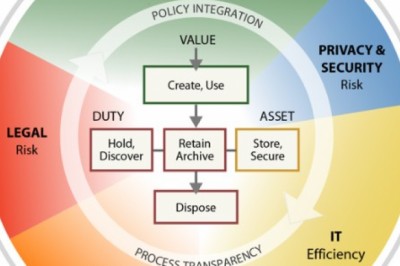

Product Launches, acquisitions and R&D activities are key strategies adopted by players in the Enterprise Asset Management market. Industrial Robotics top 10 companies include Fanuc, KUKA AG, ABB Group, Yaskawa Electric Corporation, EPSON, Kawasaki Heavy Industries, Ltd, Mitsubishi Electric Corporation, Omron Adept Technology, Staubli, Siasun Robot and Automation among others.

For more

Automation and Instrumentation Market reports, please

click here