views

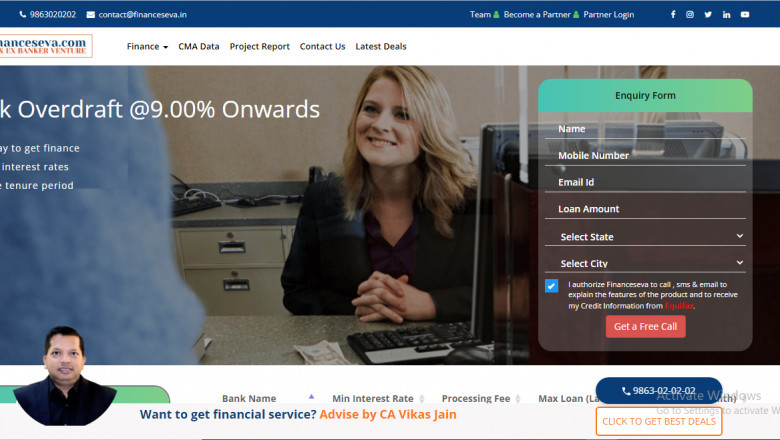

Current Bank Overdraft

Are you facing a shortage of funds in your current account, an overdraft facility allows you to withdraw from even a zero balance.

Overdraft facility are widely offered by several banks and financial institutions to their customers. This allows the borrowers to avail funds to meet their specific short-term needs. Even though it can prove beneficial during unplanned financial situations.

Apply Online Click Here:- Bank Overdraft

The interest rate on bank overdraft shall be charged only on utilized amounts. You are permitted to withdraw an amount up to a certain agreed limit by banks. The duration can be extended based on customer obtained value, repayment tenure and credit history.

Current Bank Overdraft Rates

If overdraft facility is availed against banks own term deposits, the interest rate will be 2% on term deposits rate while on other hand overdraft facility availed against the surrender value of LIC policies, KYP and Indian post-NSCs will cost base rate plus 2%. However, there is other charge applicable on processing fees.

Key features-

- Designed to facilitate frequent transactions

- No restriction on the numbers of transactions in a day by applicant

- Interest rate charged only on utilized loan amount

- Business can fulfill their financial needs with short-term overdraft facilities

Banks takes the responsibility to decide repayment structure and tenure of applicant from their end, it has the full authority to control over the overdraft facility and its usage.