views

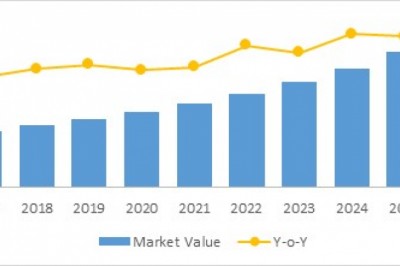

Economic growth across key Latin American economies is expected to improve in 2019 and over the forecast period, resulting in positive outlook across building and infrastructure construction sectors. GDP growth is expected to average around 2.7% in the region over the next four quarters, significantly higher than previous four quarters. This is expected to result in stable commodity prices, improved business confidence, and increased consumption.

Socio-economic factors as well as political turbulence in Latin America are considered to be the major reasons for construction industry witnessing deteriorating cash flow, hitting a plateau in recent years. Owing to the rising fuel prices, Latin American countries have been in state of unrest. This could also undermine the social stability in the region over the forecast period.

However, Latin America is likely to witness growth in its construction industry after sluggish period. The factors those are likely to contribute include increase in commodity prices, private capital infrastructure developments through Public Private Partnerships (PPPs) as well as State-run funds.

Known to be the largest construction market in the Latin American region, Brazil is expected to report an annual growth of 2.3% over the next five years. The government will invest nearly BRL 130 billion to resume 7,000 construction projects under the ‘Agora é Avançar’ scheme that aims to resume and complete previously stalled works.

Argentina is likely to boost growth in the region with 1.9% for the forecast period of 2018-2023. The Argentinean growth is driven by the passing of the law that allows public-private partnerships (PPPs) for infrastructure projects, which previously were undertaken by the state, thus protecting private investors and favouring financing.

Chile is witnessing accelerated growth, boosting the Latin American region’s economy. It has unveiled state-owned company ‘Fondo de Infaestructura’ to manage capital for infrastructure projects, with an aim to remove political influences and gain quick access to large projects.

Colombia is likely to report annual growth rate of 3.6% during the forecast period 2018-2023 for the Latin American region. It also has attracted investment of over US$ 18 billion for 32 road toll projects though PPP programmes.

Mexico aims to grow by 3.1% by 2020. One of the major concerns for Mexico is its high priority for secure trade negotiations to boost exports, which further will diversify and strengthen Latin American countries' trading partners.