views

The automotive sheet metal components market is required to develop at a sound CAGR as organizations find approaches to decrease costs while looking after quality. While numerous organizations have effectively reported designs to cut assembling and administration staff, the inventory network will remain generally unblemished on the grounds that the stockpile of these materials is secured as a rule by an unpredictable exhibit of providers. The progressions in the business, significantly because of Covid-19, be that as it may, are beginning to influence the expense of automotive sheet metal components.

Competitive Analysis

Expanding dispatch of mixture and electric vehicles is required to move development of the automotive sheet metal components market. For example, in January 2020, Great Wall Motor, a China-based vehicle maker, declared to dispatch its electric vehicle Ora R1 in India in 2020.

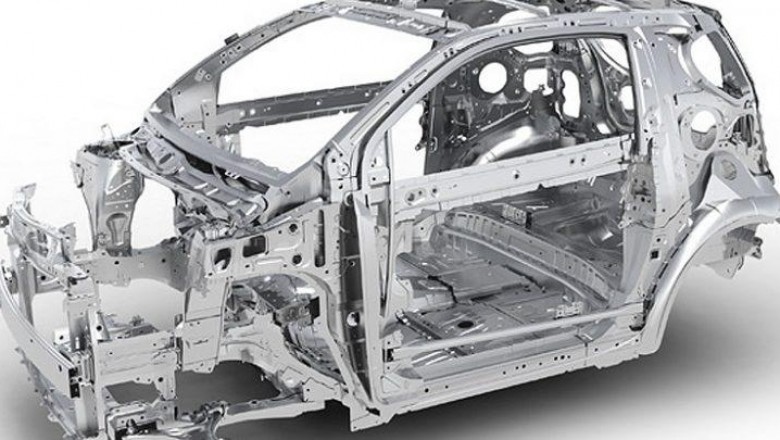

Expanding interest for light-weight vehicles is relied upon to offer worthwhile development openings for major parts in the automotive sheet metal components market.

Among districts, Europe is required to observe slow development in the automotive sheet metal components market, attributable to critical decrease in the automotive area. For example, as per the Society of Motor Manufacturers and Traders, the new vehicle enrollments in the U.K. diminished by 44% in March 2020 looked at that in March 2019. Additionally, North America is likewise expected to observe huge decrease in the automotive sheet metal components market, as deals of cruisers and vehicles witness descending pattern. For example, Yamaha Motor Co. has projected that the organization's bike deals will drop 4.7% to 60,000 units in North America in 2020. During the financial year finished December 31, 2019, cruiser deals dropped 6.3% to 63,000 units year over year. Likewise, Harley-Davidson Inc. detailed that retail deals volumes dropped 4.3% in 2019 from 2018.

Competitive Analysis

Major players operating in automotive sheet metal components market include, Larsen Manufacturing, General Stamping & Metalworking Inc., Aleris Corporation, Mayville Engineering Company Inc., The Cramer Group, O’Neal Manufacturing Services, Omax Auto Limited, Novelis, Inc., Frank Dudley Ltd., Jobro Sheet Metal Technology AB, Amada Co. Ltd. And Paul Craemer GmbH.

March 2019: General Stamping & Metalworking Inc., partnered with City of South Bend’s On Demand Program that supports local employers in helping build skill sets of their employees. Through General Stamping & Metalworking Inc.’s partnership with the City of South Bend, Washington, U.S., 13 GSM employees received the opportunity to attend training aimed at expanding lean and manufacturing skill sets.

Read More @ https://digitalinsightscmi-blog.blogspot.com/2021/06/changes-in-automotive-industry-mostly.html