views

After you have settled you will have access to our on-line portal which is a convenient and secure way to pay Sharia Bank Loans bills, access your account balance and transaction history and make transfers and redraws. If you are refinancing, the valuation on the property is ordered immediately after you are granted a Conditional Approval. We are rigorous about ensuring the Shariah integrity of our products through Shariah audits and on-going testing. Invest ethically and get Shariah compliant returns as you move one step closer to your goals. Money is a big deal for everyone so we’re here as your money partners, Halal Finance finding the best way to make it happen.

"We've recognised that the Islamic finance industry has grown at a rate of about 15 per cent since the 1990s," NAB's director of Islamic finance, Islamic Home Finance Australia Imran Lum, tells Islamic Finance Sydney ABC News. "A lot of people that we know that are Muslims have gone with conventional ways." One area Islamic Bank Home Loan the sector is tapping into – with some logistical wrangling – is consumer home loans, like those taken out by Melike and Ibrahim. Before the couple met, Melike had also previously taken out a traditional home loan with Commonwealth Bank.

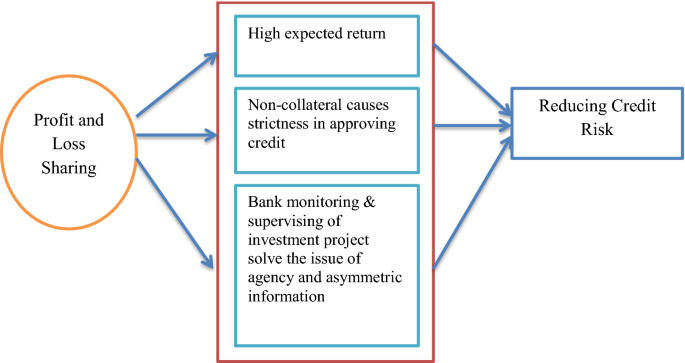

It is thus incumbent upon Muslims to find a way of lending, borrowing, and investing without interest. Islam is not the only religious tradition to have raised serious concerns about the ethics of interest, but Muslims have continued to debate the issue with vigour. Australia's finance sector