views

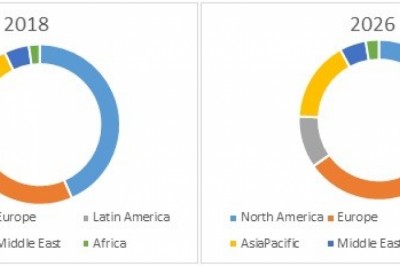

The increasing use of mobile devices such as smartphones, laptops and so on has propelled the need for live video streaming and OTT services from applications such as Amazon Prime, Netflix and so on. In conjunction with this, in recent times the COVID-19 lockdown is also highly enhancing several applications growth such as media and entertainment, online gaming and education which are further driving the growth of the CDN market during the forecast period 2021-2026.

Report Coverage

Key Takeaways

- China dominated the market by a market share of more than 36% in 2020, growing dominance of popular social media and OTT platforms like Facebook, Twitter, Instagram, encent Video, iQiyi, and Youku and many others has been rising in this region.

- Cloud security solutions is growing at a highest CAGR of 24.2% in the forecast period. As this solutions help in protecting data from thefts and loss, along with reducing attacks that can hamper network performance.

- Content delivery network in Media & Services segment is growing at a CAGR of 21.27% in the forecast period. Owing to increase in live streamed content, rising adoption of cloud-based video streaming solutions, and upsurge in demand for online videos in developing economies are set to drive the growth of the Media and Entertainment market.

- Content Delivery network top 10 companies include iScaler Ltd., ChinacacheÂ, Akamai Technologies Inc., Wangsu Science & Technology Co Ltd, Amazon Web Services Inc., CenturyLink Technology Singapore Pte. Ltd., MaxCDN, Limelight Networks Inc., Fastly Inc., Alphabet Inc. (Google Inc.),Hibernia Networks, Verizon Communication Inc., CDNetworks Co Ltd, Tata Communications Ltd., Internap Japan Co. Ltd., Cloud flare Inc. among others.

APAC Content Delivery Network Market Segment Analysis -By Solution

Cloud security solutions is growing at a highest CAGR of 24.2% in the forecast period. As this solutions help in protecting data from thefts and loss, along with reducing attacks that can hamper network performance. Similarly, with rising online threats, users are demanding for a secured online experience as more of personal data as well as business related information have moved online. In addition Cloud security solution provides a more secured network by absorbing less sophisticated attacks as well simplifying the bandwidth. This also helps in blocking threats as well as limiting abusive bots and crawlers, thus decreasing the hack and spam attacks.

Moreover, with the help of cloud security, websites and data centers are able to reduce the downtime risks, DDOS attacks thus improving the standards for data security. These solutions also help in transforming enterprise networks towards accelerating applications and lowering costs. In addition, this cloud security helps in protecting the devices from such harmful sites and also protects data files with optimum efficiency. Hence these benefits are analysed to drive the market in the forecast period 2021-2026.

APAC Content Delivery Network Market Segment Analysis -By Industry Vertical

Content Delivery Network in Media & Services segment is growing at a CAGR of 21.27% in the forecast period. Media and Entertainment segment is anticipated to reach increase in live streamed content, rising adoption of cloud-based video streaming solutions, and upsurge in demand for online videos in developing economies are set to drive the growth of the Media and Entertainment market. The voluminous increase in the amount of data generated by media and entertainment firms has created a need for reliable Content Delivery Network (CDN) solutions. The media and entertainment segment is utilizing full capabilities of CDN solutions to offer secure and best quality viewing experience to its users.

Content delivery network solutions help in lowering the delay and optimize the overall content delivery process. Hence, viewers get a high-quality viewing experience, and this in turn increases the revenue for the media and entertainment enterprises. As the demand for OTT platforms across the globe is rising, several companies are adopting Content delivery network solutions in order to optimize the performance. Adding to this, outbreak of Corona virus has significantly driving the market for media and entertainment services such as Television programs, OTT platform programs and so on. Due to this out break, Zee5 India, says the platform has witnessed an 80% increase in subscriptions and over 50% growth in time spent recently. Similarly Services like Amazon Prime and Netflix have seen an 82.63% increase in time spent due to outbreak of these viruses.

With the wide spread of this virus, Media and Entertainment companies including OTT platforms in the world have been taking several tactical steps to optimize the performance by adopting these services. Similarly, several delivery companies are helping media and entertainment services in providing video and audio content in faster and reliable method. For instance, Content delivery network PicoNets is helping OTT platforms optimise performance during this pandemic situation. Hence these benefits are analysed to drive the market in the forecast period 2021-2026.

APAC Content Delivery Network Market Segment Analysis - By Geography

China dominated the market by a market share of more than 36% in 2020, growing dominance of popular social media and OTT platforms like Facebook, Twitter, Instagram, Tencent Video, iQiyi, and Youku and many others has been rising in this region. Similarly, Initiatives such as partnerships and collaborations aim to favor the content delivery. Akamai China CDN, in collaboration with China Net Center, is designed to simplify the ability to deliver fast, reliable, and safe digital experiences to consumers in Mainland China.

In addition, Partnerships with local ISPs, China CDN brings customers closer to digital content in major metropolitan areas as well as in inland regions. The built-in cache optimization maximizes the amount of content offloaded from a server that leads to major improvements in performance. BaishanCloud is a major cloud data services provider in China and around the world. It is one of the fastest growing companies in CDN space, becoming the only service provider based in China to be recognized by Gartner as possessing 'world' network capabilities. Hence these benefits are analysed to drive the market in the forecast period 2021-2026.

APAC Content Delivery Network Market Drivers

Rising demand for online games

The rise of coronavirus pandemic has resulted in lockdowns in many countries which has caused a spectacular boom to the digital gaming industry, as it records numbers of online server for distraction, entertainment and friendship, and further connecting to the real-world. Moreover, people of all ages are turning towards gaming, and according to an Appannie report, since 17th March, 2020, there has been a high growth in the downloading of mobile games leading to upsurge the demand for online gaming.

Additionally, the outbreak of covid-19 has made online gaming the most popular option during the quarantine period for people, and has become a popular option for stay at home entertainment. Thus, the ongoing demand for the online gaming has also enhanced the content delivery network market, as companies offering online games rely on CDN to avoid lags in speed and performance. Also, as online gaming continues to become more demanding due to sophisticated graphics and capabilities there will be an increased drive for content delivery network (CDN).

Rising Live Video Streaming

APAC Content Delivery Network Market Challenges

Traffic Barrier while using Mobile Devices

APAC Content Delivery Network Market Landscape

Acquisitions/Technology Launches

- In April 2020, Verizon announced definitive agreement to acquire Blue jeans Network, due the growing demand of cloud based video services.

- In 2019, Anevia had announced launch of a cloud naive content delivery network solution to enable easy deployment of CDN by delivering high quality services, even in peak traffic