views

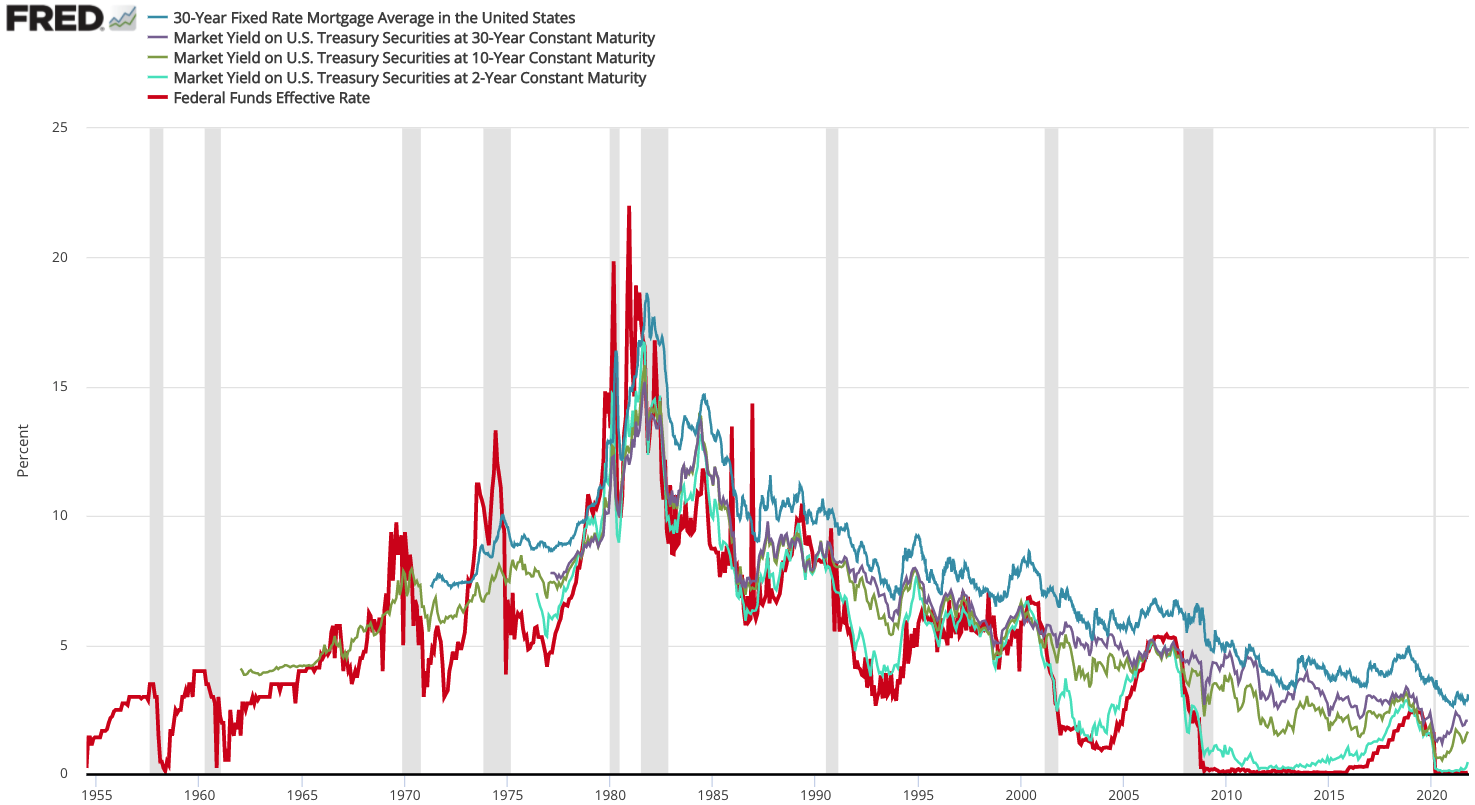

Since 2019, the average down payment for novice customers is approximately 7%, as well as is greater (16%) for repeat purchasers. See if you qualify for a zero-down VA loan here.When contrasted to any other low deposit home mortgage, VA home mortgage are the most economical-- in upfront as well as regular monthly expenses. Lenders can provide a credit scores toward shutting costs if you choose a higher-than-market rates of interest. For example, if rates are around 4.0%, you can take a price of 4.25% and also obtain thousands of dollars toward your closing expenses directly from the lending institution.

However, there is an up front home loan cost equivalent to a percent of the borrowed amount. FHA loans enable you to purchase with as low as 3.5% down, yet you after that pay home mortgage insurance for either 11 years or the life of the car loan. This would certainly allow you to get approved for a standard car loan with fewer charges and no exclusive home loan insurance called for. Placing 20% down also reduces the possibility you'll end up owing more than your home is worth, so it can be much easier to get accepted for a finance.

- When you're house-poor, you have plenty of money on paper however little cash money offered for day-to-day living costs and also emergencies.

- The adhering to are just a few instances of several of the most prominent kinds of mortgage offered to customers.

- Jumbo describes a mortgage that's also big