views

What's in the future For Real Estate?

It is a time to think about the future. Real Estate is both exciting and uncertain. After the last recession as we enter a competitive environment, where will that leave the Real Estate industry? Get more information about Newport residences

What is real Estate?

"Real estate" also means "real estate" refers to properties, land, and any other improvements made to it, as well as the natural resources that lie within its boundaries. It also includes the air over it and the earth beneath it. It is also a physical asset that is able to be purchased, traded, or even leased.

There are many kinds of real estate, including: residential, commercial, industrial, agricultural, in addition to undeveloped land. Residential real estate comprises townhouses, houses for sale, apartments, condominiums and condos. Commercial realty includes office buildings, retail space Warehouses, hotels, and. Industrial real estate comprises factories and manufacturing plants. Agriculture real estate comprises farmland and ranchland. Undeveloped land is land that is not being designed for any particular use.

Real estate can be an investment that is worth it because it is a tangible asset that can appreciate in value over time. The value of real estate also is less volatile than other investments like stocks and bonds. Real estate can generate income through renting or leasing properties to tenants. It can also provide an apartment or work for the owner of a house.

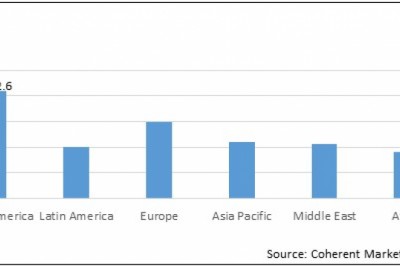

Real estate is likely to be influenced by trends in the demographics such as population growth or decline, rates of household formation and patterns of migration. Economic factors such as employment growth, interest rates or contraction in particular sectors in the market, and inflation will also play a impact on the future of the real estate market.

The Future of Real Estate

What does an ideal future for real estate like? It's the question frequently on the minds individuals working in the field especially as we face uncertain times.

There are numerous factors that will determine this future for the field of real estate, including technological advancements, demographic shifts and economic trends. Here's an overview of some of the most important:

1. Technology

Technology is already transforming the real estate market as it makes it easier and more efficient to locate and buy properties. For instance online tools such as Zillow and Redfin have made it easier buyers to find homes and access detailed details about them.

The future is where technology is likely to continue playing a function in making the procedure of purchasing and selling property much easier and faster. For instance, 3D printing could be employed to create scale models of property, which makes it easier for buyers to see them. Virtual reality could also be used to give prospective buyers a real-life experience of what the property in reality without needing to visit the property physically.

2. Demographic Changes

Demographic trends are another element that could impact on the development of the field of real property. For example, the baby boomers are now reaching retirement age, which could cause an increase in the demand for retirement homes. Also, millennials are in their prime years of home buying as such, and we could expect to see a rise in interest in starter homes and larger family-sized houses from this segment.

Economies and Real Estate

It's not difficult to see that the real estate industry has suffered going through some challenging times over the past several years. What does the future have in store for this crucial part of the economy?

There are a variety of variables that could impact your future prospects for investing in real estate including inflation, rates of interest, and demographics. It's hard to predict exactly what will happen, there are some trends that we can watch for.

A trend to be aware of is the rise in millennial homebuyers. The millennial generation is currently entering the home buying phase, and they're doing so with different priorities than previous generations. They're more likely to value their experience above all else, and they're willing to spend more money for a property that will fit their life style.

This could have a major impact for the real estate sector in the sense that millennials will likely drive the demand for various types of houses and communities. We may see a shift away from the traditional suburban sprawl towards more compact urban areas. And we could see a boom in "amenity-rich" development that gives residents access to playgrounds, pools as well as other facilities for recreation.

Of course, all of this is just speculation. Only thing we're sure of is that the industry of real estate is always evolving by adapting to changes in markets as well as demographics. Whatever the future brings the one thing we can be sure of is: there will always be a need for experienced real estate professionals to assist clients navigate these constantly changing waters.

It is a legal Aspect of Real Estate

There are several legal aspects to consider when selling or buying real estate. These include matters such as titles, zoning regulations, contracts insurance, mortgages and more.

Zoning laws vary between areas So it's vital to be aware of local regulations for zoning where you're planning to buy or sell property. Contracts for the sale or acquisition of real property must be written in order to be legally binding. Title insurance covers the losses resulting from defects in title and is generally required by lenders. Mortgages are legal contracts between lenders and buyers that allow the lender to close on the property if buyers default on their loan.

How can you invest in Real Estate

There isn't a universal answer to this issue, since the best method to make investments in real estate depends on your particular circumstances and objectives. However, there are a few general suggestions to aid you in getting started:

1. Make sure you do your research.Investing on real estate is a major purchase, so it's best to do your homework before investing. Learn about the various types of investment options available and also the risks and potential rewards of each.

2. Set up the budget. Determine how much you're willing to invest in an investment property, and stick to that budget. Be sure to include all charges that go with it, such as repairs, renovations, taxes, and insurance.

3. Consider using leverage. When you aren't able to have enough cash to buy an investment property on its own, you may be able to leverage (borrowing money) to fund the purchase. Be aware that this comes with an array of risk as well as rewards.

4. Be realistic about your expectations. It's important to remember the fact that investing in real estate is a lengthy process. Don't hope to make profits in a short time; instead you should focus on building equity over time.

5. Get an experienced professional. If you're not sure how to begin, or don't feel at ease enough to tackle the task on your own, consider partnering an experienced realtor or an investor that can help you navigate the procedure successfully.