views

Peak Oil and Thermoplastics Demand to be Imminent Post COVID-19

The widespread impact of the coronavirus (COVID-19) pandemic has radically altered global oil sector. Analysts of the Transparency Market Research (TMR) opine that peak oil demand has either passed or is imminent in the upcoming months. This has created hope for economy revival with context to companies in the Americas & Europe thermoplastic composite market for oil & gas industry. As such, volatile demand and supply in the oil & gas industry is anticipated to accordingly manipulate the business of thermoplastic products.

The COVID-19 outbreak has now laid emphasis on the contribution of companies in the Americas & Europe thermoplastic composite market for oil & gas industry toward the environment and low-carbon emissions. This trend is expected to support the business of thermoplastic products since these materials can be easily reused and recycled.

Can Thermoplastics Replace Steel in Oil & Gas Industry?

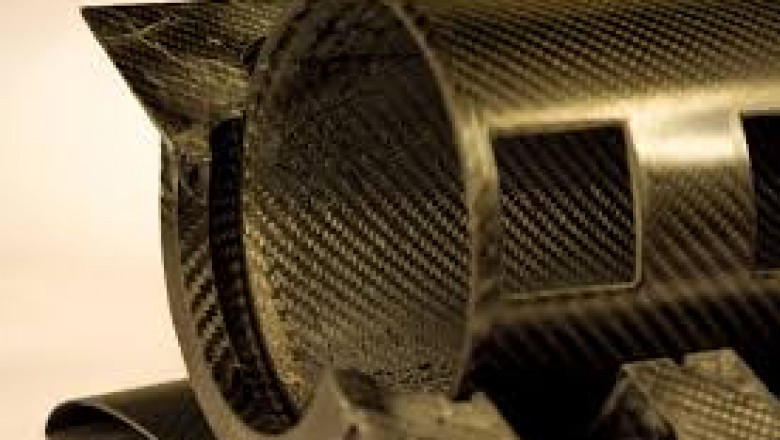

The Americas & Europe thermoplastic composite market for oil & gas industry is projected to reach a valuation of US$ 2 Bn by the end of 2030. Composites are in demand for various operations that involve the replacement of metal in subsea piping. However, the transition toward thermoplastic composites for oil & gas companies is relatively slow. Moreover, oil & gas companies are sowing reluctance for thermoplastic adoption due to the absence of global design and qualification standard. In order to overcome these challenges, oil & gas organizations are introducing strategic initiatives to push sales for thermoplastic composites.

Saudi Aramco— a multinational petroleum and natural gas company, has announced to sign a charter with TWI Ltd. and the National Structural Integrity Research Center to create the Non-Metallic Innovation Center (NIC), which promotes the widespread adoption of thermoplastic products. Manufacturers in the Americas & Europe thermoplastic composite market for oil & gas industry are taking cues from such companies to tap into incremental opportunities in deep-sea applications.

Request A Sample- https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=80033

Viability and Cost-efficiency of Thermoplastic Products Boost Market Growth

Thermoplastic composite pipes are in high demand for the Americas & Europe thermoplastic composite market for oil & gas industry. Manufacturers are increasing their R&D efforts to adapt and adopt technologies from the aerospace industry to manufacture innovative thermoplastic composite pipes. Thermoplastic products are being highly publicized for their cost-efficiency attributes when compared to steel for hydrocarbon operations and production. This trend is predicted to benefit companies in the Americas & Europe thermoplastic composite market for oil & gas industry, as the past decade has seen rapid advancements in the application and qualification of thermoplastic composite pipes.

Commercialization of thermoplastic products is contributing toward market growth, where the market is slated to grow at a favorable CAGR of ~7% during the forecast period.

Optimal Material Solutions Help Thermoplastic Composite Manufacturers Gain Market Recognition

Manufacturers in the Americas & Europe thermoplastic composite market for oil & gas industry are aggressively increasing production output for pipes. America’s multinational oil and gas corporation ExxonMobil has approved the application of Airborne Oil & Gas company’s thermoplastic composite pipes for a range of static and dynamic deep-water applications. In order to gain recognition, thermoplastic manufacturers are running through qualification tests and record to bolster the uptake of thermoplastic products. They are increasing the availability of intrinsically non-corroding and spoolable lightweight thermoplastic pipes.

Thermoplastic composite manufacturers are driving innovations in pipes with the help of glass fibers and polyethylene materials. These materials are gaining popularity as a fitting alternative to rigid steel pipes. Optimal material solutions are being highly preferred by companies in the oil & gas industry. Thermoplastic composite manufacturers are increasing their research in fiber and polymer materials to meet demanding applications as per pressure, service, needs, and temperature.

Purchase A Report-https://www.transparencymarketresearch.com/checkout.php?rep_id=80033<ype=S

Steel Pipes versus Thermoplastic Pipes: Which is better for Natural Gas Distribution?

Reinforced thermoplastic pipes are playing a pivotal role in natural gas distribution. High strength reinforcements for their design facilitate spoolable high-pressure pipeline systems. Companies in the Americas & Europe thermoplastic composite market for oil & gas industry are unlocking growth opportunities in upstream oil & gas applications such as gas gathering, water injection, water disposal, and the likes. As such, companies are expanding their business for gas distribution applications throughout Canada.

Until now, steel pipes have been the gold standard for gas pipelines, owing to their cost, strength, and usability. However, issues of corrosion resistance are arising, which have led to the popularity of thermoplastic pipes. Hence, companies in the Americas & Europe thermoplastic composite market for oil & gas industry are capitalizing on this opportunity to expand their business in natural gas distribution.

Advanced Engineered Polymer Solutions in Components Support Extreme Corrosive Environments

Advanced engineered polymer solutions are helping manufacturers in the Americas & Europe thermoplastic composite market for oil & gas industry gain a competitive edge over other market players. For instance, the Mitsubishi Chemical Advanced Materials company based in Switzerland is increasing its focus in high-performance thermoplastic materials that comply with extreme environments in the oil & gas industry. Apart from pipes, companies in the Americas & Europe thermoplastic composite market for oil & gas industry are increasing their output capabilities in tubing, pressure armors, tanks, and umbilical, among others.

Manufacturers are utilizing materials that support cutting-edge applications in pumps and compressors. They are adhering to ISO (International Organization for Standardization) standards to meet versatile oil & gas applications. Manufacturers are producing labyrinth seals, biodegradables, and polymer sealing components that resist extreme corrosive environments.