views

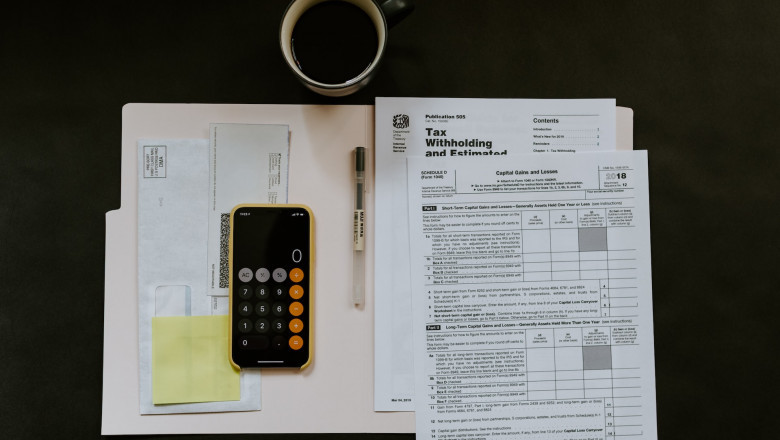

Everybody is needed to submit a tax give back. Sometimes for an individual or being a business. Have more specifics of CPA Conroe Tx

Tax preparation is the procedure of planning revenue tax earnings. It is often performed by someone besides the taxpayer, and it can generally be for reimbursement. Tax preparation services will help when preparing of taxes, often by using proper tax preparing software.

It may also be carried out by certified specialists like legal counsel, accredited general public accountant or agents.

There are now stipulations and restrictions regarding whom can prepare and just how tax profits are ready. You can find licensing specifications for fee-based preparation of some status tax earnings.

Recommended alterations could eventually need that all paid national tax give back preparers become registered. The brand new rules will require that preparers who definitely are paid, will be asked to pass a federal tax regulation examination and undergo continuing education requirements. Some of these demands may already be met by available tax professional services.

Qualified Open public Accountants, lawyers or enrolled agents could be exempt,as they could be already required to take continuing education courses to be able to maintain exercising licenses. They are essential to possess a specialist tax detection variety (PTIN). The rules will help you to make the decision of selecting this solutions much simpler as competency tests are now expected to come to be officially authorized as a tax profit preparer.

You can find wonderful advantages to making use of tax preparing providers as tax documents may be overly sophisticated and perplexing. The actual tax rule is a huge file, which hardly any, but pros can completely fully grasp.

When choosing tax preparing professional services, there are some things that you need to search for.

• Ensure the preparer is available, even with the profit is filed, in the event there are inquiries. A lot of professional services look limited to tax time of year and fades away after income taxes have been registered.

• Make sure you give all records and statements to prepare your come back. Most trustworthy tax preparing solutions will require all documents and information to find out your eligibility for credits and reductions.

• You can examine the historical past of tax preparing solutions. Check if there any disciplinary activities together with the Greater Business Bureau and view to the status of your license using the proper regulatory boards.

• A tax preparer that is paid out, is already expected to signal the come back and include their PTIN, but you since the tax payer remains to be held accountable for the accuracy of the information that may be contained in the give back.

• Avoid any tax preparers that have you signal a empty tax type. This is not only deceitful, additionally, it can be illegal.

• Evaluate the give back and inquire any questions about troubles that you do not recognize before you sign it. If you are uncomfortable about something, be sure that all is discussed before you place your personal.

• Prior to signing your tax come back, review it and request questions. Be sure to comprehend every thing and they are at ease with the accuracy from the come back prior to signing it.

• The charges ought to be normal instead of based on any portion of your profit, because this will show an opportunity for inflating figures.

Tax preparation services could add convenience with educated pros who are required to continue to be present with taxation regulations. They could help save both money and time, whilst delivering skilled services.