views

Weighted average cost of capital

Apply Online Click Here:- Weighted average cost of capital

What is WACC Weighted Average Cost of Capital?

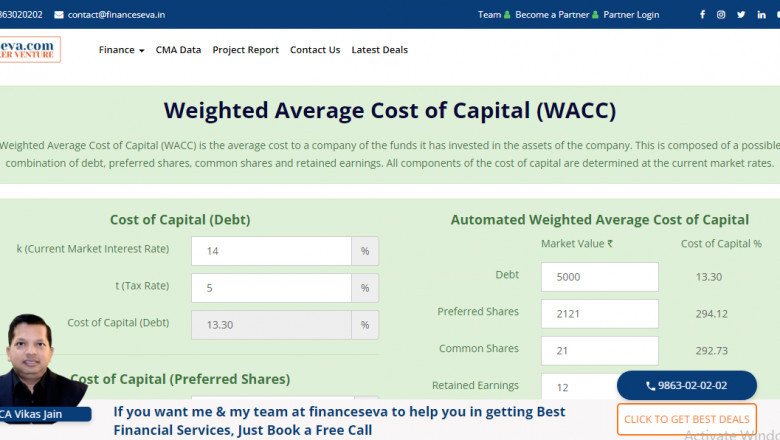

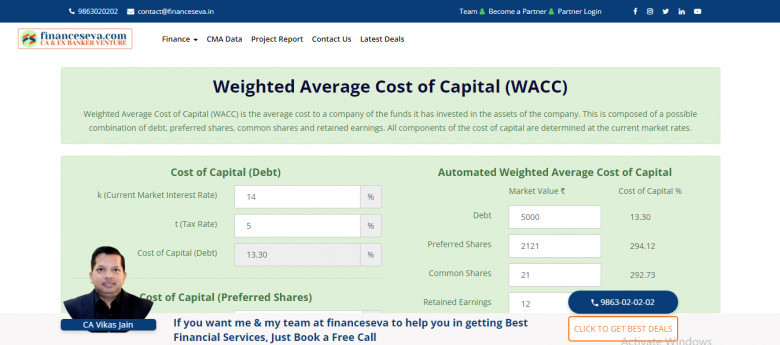

WACC Weighted Average Cost of Capital Definition: Weighted Average Cost of Capital (WACC) is the average cost to a company of the funds it has invested in the assets of the company. This is composed of a possible combination of debt, preferred shares, common shares and retained earnings. All components of the cost of capital are determined at the current market rates.

WACC Weighted Average Cost of Capital Description: When a firm needs to raise capital to buy assets, the capital can be raised from several sources. Investors will by equity shares in the company, investors will buy the company’s bonds, and the company can keep the profits earned through its operations. Any combination of these sources can be used to pay for capital projects. There is a cost to acquire any of these funds, equity investors expect a return on their invested money, and bond holders expect an interest payment to be paid regularly.

If an individual were to borrow money they would be expected to pay interest on that money. If the individual then invested these funds it makes sense that the investment return should exceed the interest cost of the borrowed funds.

This is the same concept that applies to the WACC Weighted Average Cost of Capital of a firm. A firm is expected to make decisions regarding the use capital to benefit shareholders. If the company cannot make a capital investment that will increase returns for shareholders, then it would be expected that the money would be best delivered directly to the shareholders as a dividend.

WACC Weighted Average Cost of Capital then becomes the hurdle rate for capital projects. A capital project is made when a firm purchases assets, with the intention of generating revenue that will exceed the cost of capital. Cash flow methods will be used to determine whether the project will benefit shareholders. The annual cash flows are estimated, and then the discounted at the WACC Weighted Average Cost of Capital rate. If the net present value is positive, then the project will return enough profit to compensate for the cost of capital, as well as a surplus return.

Since WACC Weighted Average Cost of Capital is the required rate of return used to make important decisions regarding a firm’s investments, it is important to estimate the firms cost of capital accurately. We use the WACC Weighted Average Cost of Capital to approve or reject potential projects. If the cost of capital is estimated wrong, then we may be approve projects that will reduce benefits to shareholders, or reject projects that could benefit shareholders.

The WACC Weighted Average Cost of Capital is dependent on the capital structure of a company. The capital structure refers to the amount of each funding source of a company. A firm with a high level of debt relative to its outstanding equity will have a higher weighting of the cost of debt. In this case, if the cost of debt is lower than the cost of equity, the WACC Weighted Average Cost of Capital will be lower as a result.

This is an important concept to understand. Since the cost of capital of a firm is weighted by the amount of each component, adjustments made to the size of each component can change the WACC Weighted Average Cost of Capital. This in turn can change the way that a firm behaves. If the WACC Weighted Average Cost of Capital is lowered, then projects that were previously rejected may now be approved.

It is important to understand this since each new project that a firm engages in will often be funded from a single source. If a firm has a capital structure of 30% debt, and 70% equity, it is unlikely that new projects will be funded from capital raised in the same proportions. As well, the profit from previous projects that is reinvested in new capital projects by the company can also change to weighing of the capital structure. If a firm continually uses retained earnings to fund new capital projects, then the weighting of the equity will increase as the size of retained earnings grows relative to the size of debt. Since the cost of equity is often greater than the cost of debt, this will tend to increase the total WACC Weighted Average Cost of Capital over time. This could limit the future growth of a company if the firm is unable to source new capital projects that will clear the higher WACC Weighted Average Cost of Capital rate.

How to calculate WACC Weighted Average Cost of Capital?

Now that we understand what WACC Weighted Average Cost of Capital is, we now need to understand how to calculate WACC Weighted Average Cost of Capital. To do this, we calculate the cost of each component of WACC Weighted Average Cost of Capital, and then weight each cost relative to its place in the capital structure.

There are two main steps to be taken in order to calculate WACC Weighted Average Cost of Capital. First, we must calculate the cost of each component. Capital can be acquired from four possible sources. Debt is borrowed from banks, insurance companies, governments and through the issuance of bonds to investors. The cost of debt is determined by the interest rate paid to the supplier of these funds.

Preferred shares are similar to debt in that the owners of the preferred shares are paid a regular fixed payment, like an interest payment. Unlike debt, the preferred shares are never repaid, the shares remain outstanding indefinitely, and the dividend payments are made for as long as the shares remain outstanding.

Common equity is acquired by a firm when they sell shares to the public. The holders of the shares expect to be compensated for the use of their capital, as well as the risk they take by investing directly in the company as an owner.

Retained earnings are acquired by a company from the profits it generates through its operations. The retained earnings are assumed to be the equity of the shareholders, that have been reinvested in the company rather than paid out through dividends.