views

Investing in stocks is considered as an option for obtaining additional income or profit. Stocks are purchased at a lower price and sold when there is assurance of high returns. However, traders may incur huge financial loss if market trends are not analyzed properly. Specifically, beginners find this intimidating and find the whole process to be risky. Even experienced investors lose money due to a bad decision. Therefore, it is very important to know how the market works and the fluctuations in stock prices.

Unlike saving instruments like fixed deposits, investing in stocks ensures high rate of return. Also, periodic investments in stocks inculcate financial discipline and help to channelize money effectively. It is obvious that investors wish to purchase stocks of companies that have a good track record. So, adequate research and learning about key factors of investing are beneficial before buying a stock. The basic requirements before investing in stocks are to know the fundamentals about the stocks and verify whether the stock fits your portfolio or not.

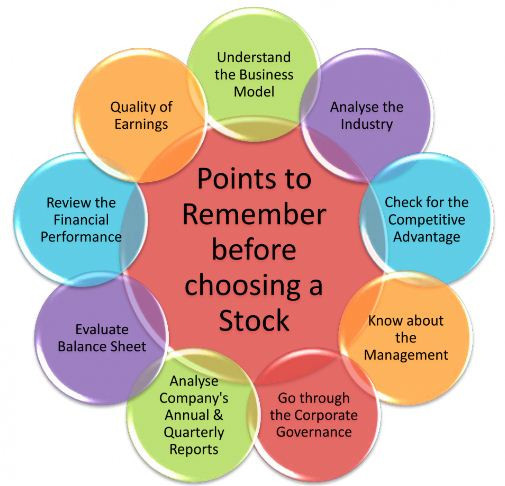

Therefore, before hastily investing your hard-earned money in stocks, it is important to take an informed decision based on the following factors:

1. Identification of investment goals

Investing in stock is not dropping your money into random investment vehicles. There should be a focused approach in this regard. So, the foundation of your financial journey is identifying the timeline of investment. It plays a crucial role in taking a decision on the type of stock you are going to invest in. The time horizon of investment is classified into three broad categories:

· Short-term: The time frame of the investment and the holding period of the stock are under a year.

· Medium-term: The investment and holding period of the stocks span from one year to 10 years. Investing in quality emerging market stocks reduces the risk of medium-term investment.

· Long-term: If you are planning to hold the stocks for more than ten years, then they are long-term investments. This type of investment gives adequate time to recover if there is loss and can generate considerable returns.

2. Investing strategy that fits your portfolio

Identifying the investment strategy is considered as an important prerequisite before purchasing stocks. The key strategies used by successful investors are:

· Value Investing: In this strategy, high gains are anticipated by investing in stocks that are undervalued compared to their peers.

· Growth Investing: In this, upward trends of the stocks are closely monitored. Stocks that show market-beating growth in terms of revenue are considered as an opportunity to generate huge profits.

· Income Investing: Investing in quality stocks is less risky. So, investors tend to purchase stocks that pay significant dividends. The income from reinvesting these dividends increases the earning potential.

3. Analysis of business model of the company

In simpler terms, an investor is required to know how companies make money, the growth trajectory, the nature of business and location of company (off-shore, on-shore). For this, one needs to get familiar with market terminologies, economy, business strategies and fundamentals about the stocks. Check whether the company hasa good business model by examining the following:

· Size of the company

· The company is aligned with the marketing goals

· The company is tolerant to risks and recovers from loss using its own resources

· The sturdiness of the company

· The quantum and frequency of company’s revenue

Image source:https://www.mymoneysage.in/blog/9-points-to-consider-before-investing-in-stocks/:

4. Industry Analysis

Investors should have preliminary knowledge about the industry within which a particular company is operating. Identifying the factors that influence the growth potential of the industry is vital for strategizing investment plans. It includes working of an industry based on potential new entrants and the status of the competition the industry has to deal with. Every industry has a related industry such as how pharmaceuticals and medical devices sectors are related tothe health industry.

Industry analysis is done by evaluating the following:

· Understand the past and present trends of the industry

· Observe the performance of the sectors of a particular industry to invest accordingly

· Analyze the forces driving the industry by learning the most recent industry report

· Success factors of the industry

5. Past performance of the stock

Consistent growth of a stock is an indicator of how well the investment can pay dividends and generate profit in the future. It enables investors to take an informed decision by identifying the intrinsic worth of a security prior to investing in it. Stock analysis gives investors an edge to arrive at equity buying and selling decisions. So, first analyze the stocks and then evaluate the value of a security.

6. Important metrics that show stock performance

· Price-to-Earnings ratio: According to investopedia, P/E ratios are used to measure a company’s current share price relative to its per-share earnings. It is done by comparing the current market price of the stocks to the cumulative earnings it has accrued in the last four quarters.

· Price-to-Sales ratio: According to moneycrashers.com, P/S ratio compares the price of the stock to the annual sales, or revenuegenerated by the company.

· Price-to-Book-Value Ratio: According to moneycrashers.com, the P/B ratio compares the price of the stock to the net value of assets owned by the company, divided by the number of outstanding shares.

7. Balance sheet of the company

A company’s balance sheet has details about the value of assets it owns, the amount of debt and shareholder’s equity. The analysis helps to understand the financial strength of the company and gives valuable insight into the company’s cash flow statement. Overwhelming debts can lead the company to bankruptcy, which means loss for the investor.

8. Volatility of the stocks

The price of the stocks varies considerably due to market fluctuations. Higher price volatility means higher risk and investors need to closely watch the price fluctuations in order to insulate themselves from market risks. According to traderscockpit.com, it is determined by computing the annualized standard deviation from daily change in price of the stock. Online stock brokers constantly monitor these parameters and give a comprehensive index based on these data.

9. Feasibility of investment with regard to diversification of the portfolio

Diversification of assets in a portfolio minimizes the risk associated with badly performing assets. It involves the distribution of investments across different stocks and securities. The level of diversification should be considered before buying stocks to maintain stability of the portfolio.

10. Real net return

The sole purpose of investing in stocks is to earn high returns. Therefore, evaluating the fees of buying and selling of stocks helps to track the real net return of the stocks. This determines the net gains from the investment. Higher expenses for asset management and holding of the stocks will not yield high returns.

When the economy is on the path of growth, the price of stocks has a steady upward trend. Investors perceive this as a potential for higher returns. However, frantic purchase of stocks without educating yourselves about the fundamentals of the stock could result in huge loss. A well-thought-out decision based on quantitative and qualitative aspects of stocks could help earn a steady income.