views

Navigation Systems Market

Navigation systems witnessed a market value of $34.5 billion in 2021, growing at a CAGR of 3.2% throughout the forecast period 2022-2027. Navigation systems refer to systems that are opted for tracking position, orientations and route guidance. These systems are used in applications namely automotive, aircrafts, geospatial, marine, defense and others. The market is expected to witness strong growth in aviation industries owing to high demand for aircrafts with integrated navigation systems. The rise in demand for real time tracking, monitoring facilities and others will further fuel the navigation system market in coming years. Navigation systems are also gaining momentum in automotive vehicles owing to the enhanced driver assessment along with its application in autonomous vehicles. Navigation systems refer to systems that are used for tracking position, orientations and route guidance. They include Satellite Navigation Systems based on technology such as Global Positioning systems as well as inertial Guidance systems. The Growing aviation industry and increasing aircraft order and deliveries particularly in emerging countries will propel the robotic mapping capabilities of navigation systems. In 2022, despite the coronavirus outbreak, the global aircraft fleet is expected to have 25,578 aircraft in service worldwide, the highest since pre-Covid-19 levels. Also, advancement in Micro-electro mechanical systems (MEMS) and low-cost navigation systems will further boost the market. In smart phone, navigation systems are used to en-route and provide guidance to the users which will further snowball the navigation market in coming years.

Report Coverage

The report: “Navigation Systems Market – Forecast (2022-2027)”, by IndustryARC covers an in-depth analysis of the following segments of the Navigation Systems Market Report.

By Equipment - LORAN Navigation System, Omega Navigation System, Satellite Navigation System (Global Navigation Satellite System, Galileo Satellite Navigation System, Global Positioning System), Inertial Navigation System, Tactical Air Navigation System and Others

By Technology - Radio Frequency Identification Based (RFID), Cellular, Network, Bluetooth, Remote sensing services, Real Time Kinetic and Others

By Type – Radio Navigation, Electronic Navigation and Others

By Application – Healthcare, Aerospace (Business Jets, Airlines/Cargos, Helicopters), Automotive, Marine (Under water surveying, Mapping), Intelligent Transport Systems, Agriculture and Farming, Others

By Geography - North America (U.S, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Russia and Others), APAC (China, Japan India, SK, Australia and Others), South America (Brazil, Argentina and others) and RoW (Middle East and Africa).

Key Takeaways

- The rapid rise in world trade owing to the globalization and free trade relationships among developed economies especially in Europe has pressurized the transportation service providers to track their logistics location and real time monitoring which has been primarily escalating the usage of these navigation systems.

- In the recent years, logistics organizations are increasingly focusing on tracking the location of their personnel and vehicles including trucks, high value assets, logistics and so on to improve the productivity & to have better control over each and every step across the value chain of a product.

- There have been an increasing number of companies which are entering into the market and have been continuously developing the new technologies as per the requirements of the application which is projected to boost the impact of this driver on the market growth positively

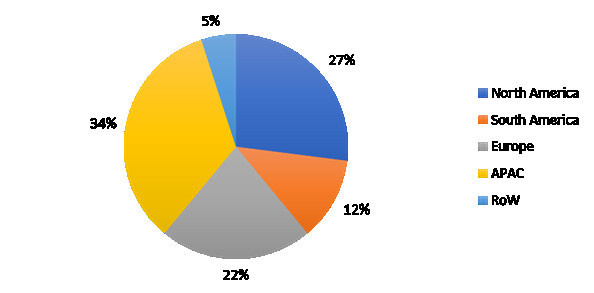

Navigation Systems Market, By Region, 2021 (%)

Navigation Systems Market Segment Analysis- By Equipment

Navigation Systems Market Segment Analysis- By End Use Industry

Navigation Systems Market Segment Analysis- By Geography

APAC is the dominant region for Navigation System market accounting for 43% of the total market share in terms of value in 2021. With the rise in demand for aircrafts and rise in the air traffic are demanding for the exact navigation systems. Advancements in the technology by companies to create business opportunities is also enhancing the growth of the navigation systems market. The rise in demand from various industries for real-time traffic data is influencing the growth of the market. Germany is one of the developing countries for automobile navigation systems. Rising production and demand of vehicles and the need for offering advanced functions in the vehicles by the manufacturers is enabling the rise of the navigation systems market. The presence of many automakers in this country and high adoption rate of advanced technologies by automakers is propelling the growth of the market

Navigation Systems Market Drivers

Development of Connected Vehicles

Connected cars is one of the emerging trend where navigation systems are gaining the popularity from the recent past. Google, Inc. and some other leading companies are partnering and collaborating with the automotive companies for the development of these connected vehicles which have been providing new opportunities for the market growth. The automotive infotainment market is experiencing an extraordinary acceleration in the rate of change of technologies and user expectations. Recent publications states that, close to 50% of the world’s vehicles are connected to the internet in 2020 and is projected to increase in the further decade. The automotive navigation systems market has reached full maturity. In the coming years, In-Vehicle Systems (IVS) and smartphone apps with pre-installed and self-updating maps are projected to replace these navigation systems. In the coming future, automotive manufacturers are anticipated to take advantage of IVS to provide value added services, such as connected and autonomous vehicles and other safety-critical applications to sustain in completive environment which is projected to boost the market growth over the forecast period.

Increasing Demand & Production of Aircraft

Aviation segment is one of the promising market in terms of growth aspects for the navigation systems market. Increasing demand for the aircrafts and fighter jets coupled with the increasing production of drones and other aircrafts have been creating the ample number of opportunities for these navigation systems from the recent past decade. Deliveries of new Airbus aircraft are set to grow 18% to a total of around 720 by end of 2022, surpassing the 2017 level but still far from its pre-COVID record high of 863 planes. Commercial aircrafts are projected to gain the momentum over the forecast owing to the increasing production of these aircrafts in U.S. & strengthening of China, India, Japan and some other emerging economies in the market. For the full year 2021, Boeing delivered 340 aircraft, compared to 157 and 380 in 2020 and 2019, respectively. There is a continuous rise in the military expenditure especially investments in the production of military aircrafts from both developed and developing economies across the globe. In the coming years, the emerging economies across the globe are projected to increase their investments in the aircrafts production which in turn turnout be the primary opportunities generating segment and market growth rate elevating segment.

Navigation Systems Market Challenges

Growth of smartphone mappings provides an alternative

From the past five years, smartphones are being used for the navigation applications. Increasing penetration of smartphones coupled with the increasing need of navigation especially in low end applications like automotive applications has affected the penetration of navigation systems in the end user industries like automotive, aviation and some other. However, emphasis for the accurate navigation systems coupled with the increasing number of smart devices has paved the way for the embedding of these sophisticated navigation systems in automotive and aircraft areas. The focus on navigation systems is also projected to increase in the coming years owing to the government regulations to improve the concept of connected vehicles and market is anticipated to flourish in the coming years. Google Maps is the most popular navigation app by a landslide, with 67% of total navigation users — second to Maps is Waze, with only 12% of total mobile phone navigation users thereby hindering market growth.

Navigation Systems Market Landscape

Acquisitions, Partnerships and R&D activities are key strategies adopted by players in the Navigation Systems market. Navigation Systems top 10 companies include

- Alpine

- Panasonic

- Denso

- Pioneer

- Harman

- Honeywell

- Thales

- Safran

- Northrop Grumman

- Garmin

Recent Developments

- In May 2022, EMCORE Announced the Closing of the Acquisition of the L3Harris Space and Navigation Business for $5 Million. In addition, the transaction creates partnership opportunities to expand EMCORE’s business with L3Harris, adding EMCORE as a preferred supplier to L3Harris divisions for future business opportunities

- In November 2021, Honeywell announced that it had launched two new resilient navigation systems: the Honeywell Compact Inertial Navigation System and Honeywell Radar Velocity System.

- In July 2021, Garmin launched NavIC enabled handheld devices GPSMAP 66sr and GPSMAP 65s in India.