views

Dairy Blends Market

Dairy Blends Market size is forecasted to reach $5.3 billion by 2027 and is expected to grow at a CAGR of 8.7% during the forecast period 2022-2027. Dairy blends are dairy mixtures made from a combination of condensed milk fat in the form of cream, vegetable oils, salt, and water. It can also be made from butter blends or butterfat, a saturated fat-free alternative. A major advantage of dairy blends is that they can be converted into products in several forms for ease of consumption. Customers' growing health consciousness, as well as the nutritional benefits of these products, has prompted them to choose dairy blends over traditional dairy ingredients. Dairy blends in powder form are also inexpensive, and many consumers in the lower class utilize them as a liquid milk substitute, which in turn is driving the Dairy Blends Market for the period 2022-2027. The demand for dairy blends is further increasing owing to the availability of numerous flavors. Market players are trying to experiment with various combinations of flavors to cater to the increasing demand for innovation. Moreover, dairy blends can be used in various forms in different industries. For instance, powdered dairy blends can be used as sweeteners and stabilizers in a variety of yogurts and ice creams which in turn is driving the Dairy Blends Market for the forecast period 2022-2027.

Dairy Blends Market Report Coverage

The report: “Dairy Blends Market Forecast (2022-2027)”, by Industry ARC, covers an in-depth analysis of the following segments of the Dairy Blends Market.

By Product Type: Dairy Mixture, Ingredients, Carriers, Others.

By Distribution Channel: Wholesalers, Retailers (Departmental Stores, Supermarkets, and Others), Online Store

By Packaging: Pouch, Packet, HDPE bottle, and Others

By Product Form: Powder, Liquid, Solid/Substitutes

By Application: Ice cream, Butter, Cheese, Yoghurt, Beverages and Others

By Geography: North America (the U.S, Canada, and Mexico), South America (Brazil, Argentina, Colombia, Chile and Rest of South America), Europe (U.K, Germany, France, Italy, Spain, Netherlands, Russia and Rest of Europe), Asia-Pacific (China, Japan, India, Australia & New Zealand, South Korea and Rest of Asia-Pacific), and Rest of the World (Middle East, Africa).

Key Takeaways

- Geographically, The Asia Pacific Dairy Blends Market accounted for the highest revenue share in 2021. This is owing to the increase in the number of middle-class consumers in the region, which has led to an increased demand for products such as ice cream and butter blends.

- The market growth is further being driven because of the high demand across diverse sectors, especially the Bakery sector. Powdered dairy blends are especially sought after for their bakery applications. However, several Dairy Blends are underutilized in functional food production. This in turn is hampering the growth of the Dairy Blends Market.

- Dairy Blends Market Detailed Analysis of the Strength, Weaknesses, and Opportunities of the prominent players operating in the market will be provided in the Dairy Blends Market report.

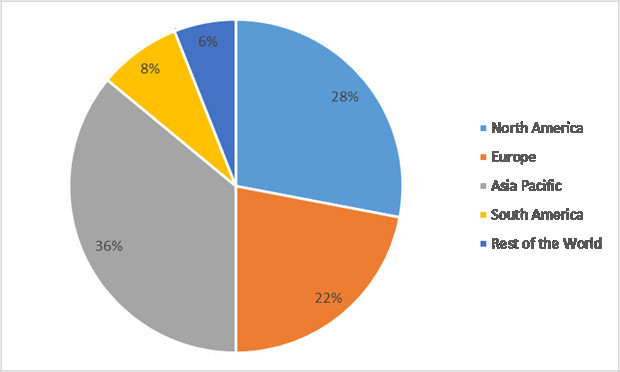

Dairy Blends Market Share, By Geography (%) in 2021

For More Details on This Report - Request for Sample

Dairy Blends Market Segment Analysis – By Product Type

The Dairy Blends Market based on Type can be segmented into Dairy mixtures, Ingredients, Carriers, and Others. The Ingredients segment had the largest share in the Dairy Blends Market in 2021 growing at a CAGR of 9.9% during the forecast period 2022-2027. This is owing to its multiple applications in the preparation of consumer favorite products such as ice cream and cheese. Modern-day dairy ingredients are naturally extracted and not based on whey derivatives like in the old times. Therefore, dairy ingredients in this day and age contain several valuable nutrients which are found in milk. This has driven the demand for ingredient-based dairy blends as they are being used on several dairy-derived products, dietary supplements, and even snacks, beverages, and infant formulas. However, Dairy Mixtures will be the fastest-growing segment during the forecast period 2022-2027 owing to their increasing popularity as a food source for infants who lack access to their mother’s milk. Dairy mixtures can also be frozen for longer periods and are hence popular across restaurants for the production of frozen drinks.

Dairy Blends Market Segment Analysis – By Application

The Dairy Blends Market based on the application can be segmented into Ice Cream, Butter, Cheese, Yoghurt, and Beverages. The Ice cream segment is the fastest-growing segment and is expected to grow at a CAGR of 9.6% during the forecast period of 2022-2027. This is owing to the increase in the total number of middle-class households, a rise in urban lifestyle, and an improved post-pandemic economy. The ice cream industry took a hit during Covid-19 but has since recovered as demand has improved dramatically since the fourth quarter of 2021. Due to this increase in demand, the requirement for raw materials, especially Dairy Blend products has significantly increased. The onset of covid 19 has also led to an increased demand for fat-free dairy blends in the F&B sector, especially amongst the ice cream manufacturers. As to the International Dairy Foods Association, the demand for ice cream, in general, is rising every year and recorded a 24% increase in sales in 2019. This has positively influenced the ice cream segment of The Dairy Blends Market.

Dairy Blends Market Segment Analysis – By Geography

The Dairy Blends Market based on Geography can be segmented into North America, South America, Europe, Asia Pacific, and the Rest of the World. The Asia Pacific dominated the geography segment of the Dairy Blends Market in 2021 with a share of more than 36%. The growth is owing to an increase in middle-class consumers in the region with an increased disposable income. Asia Pacific region is the fastest-growing market for products such as Ice cream and butter which in turn is further driving the growth of the Dairy Blends Market in this region. The presence of top dairy processors such as Saputo in the region, and their popular Butter blend and milk powder-based products will further fuel the market in the Dairy Blend Market Size in the Asia Pacific Region. However, North America is the fastest-growing segment owing to the increased consumption of dairy products. As per the USDA Economic Research Service, per capita consumption of cheese, butter, and yogurt in the region reached a record high in 2019 and has continued to grow.

Dairy Blends Market Drivers

Custom Blends that can be used in several applications are set to drive the market

Dairy Blend products are used extensively by several manufacturers across several industries. This has led Key players such as NZMP and Castle Dairy to invest in resources and R&D, to provide custom blends for manufacturers involved in the bakery, ice cream, chocolates, and processed cheese sectors. According to the Ministry of Foreign affairs, The world’s average chocolate consumption amounts to an estimated 0.9 kilograms per capita per year. European countries show significantly higher averages. The largest chocolate consumers in the world are the Germans with a per capita consumption of 11 kilograms per year. Switzerland is ranked as the second-largest with 9.7 kilograms per capita, followed by Estonia with 8.8 kilograms. The average per capita chocolate consumption in Europe is estimated at 5.0 kilograms. The European chocolate market was valued at €46 billion in 2020. It is expected to grow at an average annual rate of around 2.2% between 2021 and 2026. Some manufacturers are also providing custom stabilizer blends with functionality-specific ingredients, as well as custom hydrocolloids and emulsifiers. Private label products are also provided by the players along with contract blending services. This convenient partnership between the parties is driving the growth of the Dairy Blends Market for the Forecast Period of 2022-2027.

Growing demand for cheese products and subsequent increased production will drive the market

As per the USDA, Cheese output and production have been on the rise since August 2020. Several manufacturers reported jumps of over 8% from previous years. Raw ingredients required such as powdered dairy blends witnessed an increased production of almost 7% from 2020. Production of other blends such as buttermilk has also gone up by almost 10%. The study also predicts consistent a rise in demand beyond the Covid period which will further drive the market for Dairy blends.

Dairy Blends Market Challenges

Inefficient usage of Buttermilk may hamper the market's growth

The dairy industry's principal by-products are whey and buttermilk. Despite their promise as raw materials for the creation of new products, they are rarely or never properly utilized. This leads to buttermilk having very high concentrations of phospholipids as compared to whole milk products. Globally, consumers have become health aware of the food consumption and buttermilk is one of the most manufactured forms of Dairy blend. One cup (237 mL) of whole milk contains 660 kilojoules (157 kilocalories) and 8.9 grams of fat. One cup of whole buttermilk contains 640 kJ (152 kcal) and 8.1 grams of total fat. The inefficient use of buttermilk negatively affects the demand for buttermilk products which include buttermilk beverages, and, this in turn is hampering the growth of the Dairy Blends Market for the Forecast Period of 2022-2027.

Dairy Blends Industry Outlook

Acquisition, Business Expansion, and Product Launch are the key strategies adopted by players in the Global Dairy Blends Market. In 2021, the Global Dairy Blends Market share is consolidated by the top ten players present in the market. Global Dairy Blends top 10 companies include: -

- Dana Foods Inc.

- Kerry Foods

- Fairfield Dairy

- Fonterra Co-operative Group

- BPI A/S

- Saputo Inc

- Castle Dairy

- All American Foods

- ACE International

- Cargill, Incorporated

Recent Developments

- On November 10th, 2021, Fonterra Co-Operative Group Limited acquired Connecterra’s Ida. The Ida (Intelligent Dairy Assistant) platform from Connecterra integrates data from proprietary collar-mounted sensors with data from internet-connected farm systems, farm equipment, and third-party sources to create an intelligent dairy assistant.

- On June 18th, 2021 Cargill announced that along with Continental Grain Company, will purchase Sanderson farms for $203 per share in cash, reflecting a total equity value of $4.53 billion. This will allow the company to improve its customer service in both retail and foodservice, as well as promote organic growth in an industry fueled by affordability and important consumer trends.

- On August 7th, 2020, Cargill invested $15 million in a new plant in India that would produce bovine additives that are said to boost milk production. The plant, which has a 35,000-ton annual capacity, aims to meet the country's increased milk production needs.