views

U.S. Paints and Coatings Market: Industry Analysis and Forecast (2021-2027

Thanks to the development in the Resin, Technology, and Application segment, the U.S. Paints and Coatings Market is expected to reach by $32.50 Billion by 2027. The report analyzes market dynamics by country and end-user industries.

U.S. Paints and Coatings Market Overview:

The U.S. Paints and Coatings market was valued at US $25.03 Bn. in 2019, and it is expected to reach at US $32.50 Bn. by 2027 with a CAGR of 3.8% during the forecast period.

Paints and Coatings have two basic tasks, both of which are significant in terms of economics: decoration and protection. About 55% of all coatings produced are used to paint and protect new construction as well as to maintain existing structures, such as residential properties and flats, public buildings, and plants and factories.

Another 35% of coatings are employed to decorate and/or preserve industrial products. Without coatings, product lifespans might be significantly reduced, and many products would be unmarketable. The majority of the remaining coatings, known as "special purpose," are used for a variety of purposes, including traffic paints, car refinishing, high-performance coatings for industrial plants and equipment, and marine architecture and vessel protection.

COVID–19 Influence on U.S. Paints and Coatings Market:

The spread of the coronavirus pandemic had a significant impact on the country's building and construction sector, resulting in a reduction in infrastructural development activities in 2020, as major companies have either held their capital investment and ongoing and planned construction projects or have cancelled them, such as Google's planned Mission Bay Project. As a result, demand for paints and coatings for architectural and decorative purposes has decreased.

U.S. Paints and Coatings Market Dynamics:

The rise in construction activities and rising demand for paints and coatings from consumer goods, automobiles, and industrial maintenance applications in the country are driving the market's growth. Rising construction investment, as well as many governmental regulations aimed at enhancing the housing sector's recovery, are expected to have a beneficial impact on future construction developments.

Over the forecast period, reconstruction works, in combination with infrastructure expansion in the country as a result of growing industrialization, are expected to drive and create huge market potential in the United States respectively. For example, In February 2018, the US government-issued the US $200 billion to reconstruct the country's aging infrastructure and raise an expected US $1500 billion in the state, local, and private sector investments. In addition, as part of the COVID-19 pandemic response, in March 2020, the US government announced a US $2000 billion investment in infrastructure development, including hospital facilities and highways.

Environmental restrictions are growing more stringent in all regions to control emissions of volatile organic compounds (VOCs) and hazardous air pollutants (HAPs). Raw material costs account for 50–60% of overall paints and coatings production costs, therefore energy conservation, growing solvent, and raw material costs are also factors expected to hinder the market growth over the forecast period.

The shifting focus and rising investments of key players in the United States on developing eco-friendly paints and coatings products through various research and development activities. This is the factor expected to provide lucrative growth opportunities to the market during the forecast period.

With the increased focus on complying with state and local rules for wastewater discharge, the paints and coatings industry has been confronting numerous environmental issues. During the cleaning and pre-treatment phases, powder coating operations generate a significant number of metals, oil & grease, and suspended particulates in their wastewater stream. Thus, reducing the contamination through effluent and complying with strict regulations about wastewater discharge are the factors challenging the growth of the market.

U.S. Paints and Coatings Market Segment Analysis:

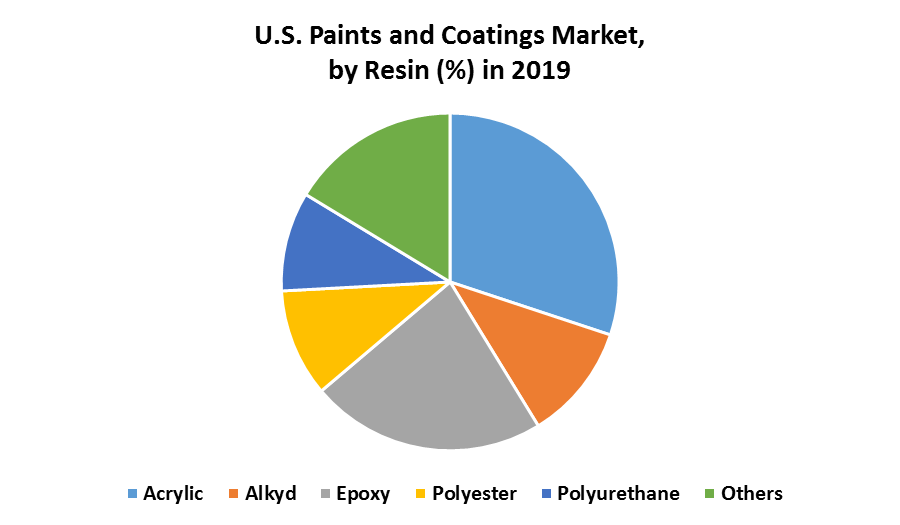

Based on Resin, the U.S. Paints and Coatings market is segmented into six types as follows, Acrylic, Alkyd, Epoxy, Polyester, Polyurethane, and Others (Silicone, Amino, Polyurea, Polyolefin, Nitrocellulose, Plastisol, Polyamide, Vinyl).

In 2019, the acrylic sector dominated the market, accounting for more than 42% of the market share. Its significant demand can be linked to infrastructure, automotive, paints and varnishes, and paints and metal coating applications. They have good physical and chemical qualities, including fire resistance, UV light resistance, corrosion resistance, vapor permeability, strong weathering resistance, and gloss durability, making them ideal for a variety of applications.

U.S. Paints and Coatings Market

To know about the Research Methodology :- Request Free Sample Report

2019 is considered as a base year to forecast the market from 2021 to 2027. 2020’s market size is estimated on real numbers and outputs of the key players across the United States. The past five years trends are considered while forecasting the market through 2027. 2020 is a year of exception and analyzed especially with the impact of lockdown by region.

Based on Technology, the U.S. Paints and Coatings market is segmented into four types as follows, Water-based, Solvent-based, Powder-based, and Others (UV and EB).

In 2019, the Water-based segment dominated the market, accounting for more than 46% of the market share. Over the forecast period, rising end-use industry adoption of eco-friendly paints and coatings, as well as stringent environmental regulations in the country, are expected to drive demand for waterborne paints and coatings. Where solvent-based coatings are expected to react with the surface, water-based paints and coatings are typically used. They make excellent primers along with their high heat and corrosion resistance. Furthermore, owing to their low VOC content and low hazardous air pollutant emissions, they are flame-resistant and have low toxicity.

The demand for Powder-based paints and coatings are expected to increase during the forecast period since they are more durable and environmentally friendly than their equivalents. Due to the lack of solvents, they have a very low VOC content and hence comply with environmental laws more efficiently and economically.

Based on Application, the U.S. Paints and Coatings market is segmented into eight types as follows, Architectural & Decorative Industry, Marine Industry, Packaging Industry, Aerospace Industry, Rail Industry, Automotive Industry, Industrial Use, and Wood Industry.

In 2019, the Architectural and Decorative segment dominated the market, accounting for more than 57% of the market share. Over the forecast period, rising infrastructure spending in the United States is expected to support the construction industry’s growth. South California Civic Center campus, the O'Hare Airport Construction Project, the LaGuardia Airport Construction Project and the Second Avenue Subway Construction Project are all upcoming construction projects. During the forecast period, this is expected to drive the demand for U.S. Paints and Coatings in architectural and decorative applications.

In recent years, the United States has seen a tremendous increase in automobile manufacturing. For instance, in January 2018, Toyota Motor Corporation and Mazda Motor Corporation announced that their production plant in Alabama, United States, would be expanded. Thus, the use of U.S. Paints and Coatings is expected to increase as a result of this expansion.

Recent Advancements:

• In June 2019, Moisture Vapor Barrier Interior Latex Primer/Sealer, a new quick-drying coating from Sherwin-Williams, was designed to help minimize moisture through ceilings and walls. The new coating gave a low-cost solution to the problems that surround manufactured housing buildings.

• Hemmelrath Lackfabrik GmbH, a producer of automobile coatings, was acquired by PPG. The purchase was meant to assist PPG's strategic expansion objectives by adding new products to the company's current portfolio.

Demand for Paints and Coatings in the U.S.:

U.S. Paints and Coatings Market 1

The objective of the report is to present a comprehensive analysis of the U.S. Paints and Coatings market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants.

PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers.

The report also helps in understanding the U.S. Paints and Coatings market dynamics, structure by analyzing the market segments and project the U.S. Paints and Coatings market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the U.S. Paints and Coatings market make the report investor’s guide.

U.S. Paints and Coatings Market Scope: Inquire before buying

U.S. Paints and Coatings Market 2

U.S. Paints and Coatings Market Key Players

• Masco Corporation

• Benjamin Moore & Co.

• PPG Industries, Inc.

• Axalta Coating Systems, LLC

• The Sherwin-Williams Company

• RPM International Inc.

• Rust Oleum

• 3M Company

• The Chemours Company

• Others

Frequently Asked Questions:

1. What is the forecast period considered for the U.S. Paints and Coatings market report?

Ans. The forecast period for the U.S. Paints and Coatings market is 2021-2027.

2. Which key factors are hindering the growth of the U.S. Paints and Coatings market?

Ans. Strict environmental restrictions to control VOCs emission is the key factor expected to hinder the growth of the U.S. Paints and Coatings market during the forecast period.

3. What is the compound annual growth rate (CAGR) of the U.S. Paints and Coatings market for the next 6 years?

Ans. The U.S. Paints and Coatings market is expected to grow at a CAGR of 3.8% during the forecast period (2021-2027).

4. What are the key factors driving the growth of the U.S. Paints and Coatings market?

Ans. The rising construction and infrastructure activities in the United States is the key factor driving the growth of the U.S. Paints and Coatings market.

5. Which are the regional major key players covered for the U.S. Paints and Coatings market report?

Ans. Masco Corporation, Benjamin Moore & Co., PPG Industries, Inc., Nippon Paint Holdings Co., Ltd., Axalta Coating Systems, LLC, The Sherwin-Williams Company, RPM International Inc., Rust Oleum, 3M Company, The Chemours Company, and Others.

For More Information Visit @:https://www.maximizemarketresearch.com/market-report/u-s-paints-and-coatings-market/114483/

This Report Is Submitted By : Maximize Market Research Company

Customization of the report:

Maximize Market Research provides free personalized of reports as per your demand. This report can be personalized to meet your requirements. Get in touch with us and our sales team will guarantee provide you to get a report that suits your necessities.

About Maximize Market Research:

Maximize Market Research provides B2B and B2C research on 20,000 high growth emerging opportunities & technologies as well as threats to the companies across the Healthcare, Pharmaceuticals, Electronics & Communications, Internet of Things, Food and Beverages, Aerospace and Defense and other manufacturing sectors.