views

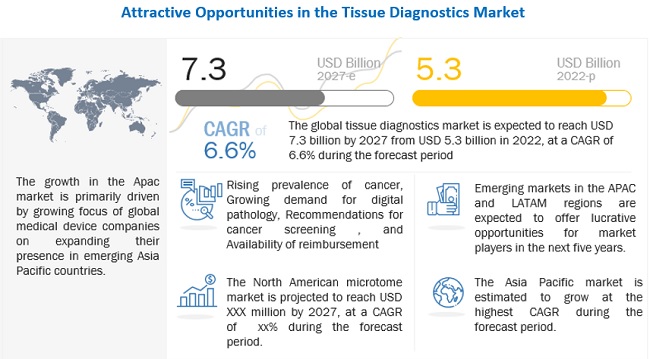

[246 Pages Report] The global Tissue Diagnostics market is growing at a CAGR of 6.6% during and it is expected to reach USD 7.3 billion by 2027 from USD 5.3 billion in 2022, during the forecast period. The expansion of this market is majorly due to rising prevalence of neoplastic cases as well as high demand of oncology screening, However, Lack of skilled professionals is one of the challenge for which may inhibit the growth of this market.

COVID-19 positively impacted the market due to a growing demand for high-throughput and sequencing-based diagnostic tests. For instance, Brooks Automation’s Life Science segment reported USD 199.6 million in revenue in 2021, compared to USD 129.8 million in 2020, with an increase of USD 69.8 million (54%). Likewise, in 2021, the revenue of Roche Diagnostics increased by 28% due to COVID-19.

The number of cancer screening and diagnostic procedures declined precipitously, with countries worldwide being affected by the pandemic. An initial analysis of the US market shows that newly diagnosed metastatic non-small-cell lung cancer patient volumes have declined just over 30% from February 2020 to March 2020—this represents a major decline in just one month. This also impacted KRAS, BRAF, and EGFR testing rates, which are the key biomarkers supporting the appropriate selection of precision medicine therapies that benefit certain patients. Nearly 4,000 EGFR tests were performed in February when most of the country initiated strict “stay-at-home” orders, representing a 13% drop from the previous month.

Histopathology diagnostic services such as autopsy, screening services, teaching, training and quality assurance all these services have been impacted by COVID-19. The pre-analytic phase majorly involves the handling of biological materials, such as fresh tissue for research or frozen sections and formalin-fixed tissue and organs of varying sizes.

For More Info, Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1063949

Additionally, the closure of manufacturing facilities disrupted supply chains and reduced recruitments. For instance, in the UK, universities, sponsors, charities, NHS institutions, and NIHR Clinical Research Network decided to stop all non-COVID-related research in March 2020 and to pause the setup of new trials too. However, in the 2022 recovery phase, restoring clinical trials will be a challenge because of restricted access at trial sites. Hence, further delays in clinical trials might impact the growth of the overall tissue diagnostics market in 2022.

Soon as the FDA implemented regulatory cautions regarding how digital pathology systems could be used during the pandemic, many pathologists started working flexibly in remote locations to minimize the COVID-19 exposure risks and provide timely diagnoses. As a result, the tissue diagnostics market rose to a high extent.

In conclusion, the emergence of new variants of COVID will increase the demand for new clinical trials to identify and evaluate the effectiveness of drugs against COVID-19 during the forecast period.

Some of the major players operating in Tisue Diagnostic Market are F. Hoffmann-La Roche Ltd. (Switzerland), Danaher Corporation (US), Thermo Fisher Scientific, Inc (US), Abbott (US), Agilent Technologies Inc. (US), Merck KGAA (Germany), SAKURA FINETEK JAPAN CO., LTD (Japan), Abcam Plc. (UK), Becton, Dickinson and Company (BD) (US), Bio SB (US), Biogenix (US), Cell Signaling Technology, Inc (US), Histo-Line Laboratories (Italy), SLEE Medical GMBH (Germany), and Hologic Inc. (US)