733

views

views

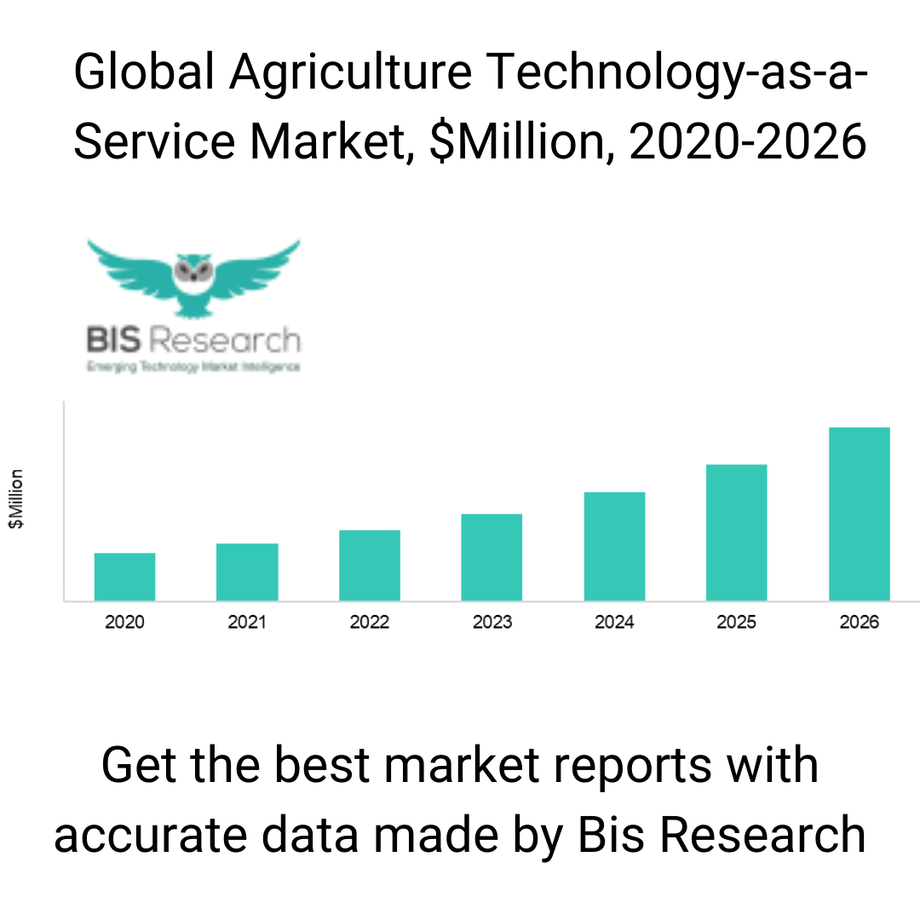

The global agriculture technology-as-a-service market is expected to reach $3,031.1 million by 2026, with a CAGR of 24.42% during the forecast period 2021-2026.

Agriculture technology-as-a-service is a business model that allows the customers to procure their desired agriculture technology (equipment or software) as a service under different affordable pricing models rather than acquiring them as a one-time purchase. Two of the most popular pricing models under agriculture technology-as-a-service include the pay-per-use (PPU) and subscription models. Agriculture technology-as-a-service business models provide the growers with certain features such as easy scalability and upgradation, convenient accessibility, quick deployment, and reliable data backups.

The global agriculture technology-as-a-service market is expected to reach $3,031.1 million by 2026, with a CAGR of 24.42% during the forecast period 2021-2026. The growth rate in the market is because of the increased push by governing bodies toward agricultural automation and digitization.

The introduction of technology in the agriculture industry has opened new opportunity avenues for growers, companies, and governments across the world. The growing demand for higher yield per farm area is the major driver behind the growth in the adoption of agriculture technologies. While the increasing advancements in agriculture technology aides in favorable yield outcomes, it also comes at an increased expenditure for the farmer. With the persisting negative gap in the expenditure and income of farmers across the globe, engagement of growers into agriculture technologies should be determined after assessing the cost strategy of obtaining and operating the agriculture technology. In decision-making, companies and growers should engage themselves in these processes: identify opportunities, assess alternate solutions, collect data, analyze alternatives, implement decisions, monitor results, and accept responsibility. Assessing the cost strategy becomes a part of data collection where economic cost considerations (initial investment cost, service and maintenance costs, operating costs, ownership costs) and economic benefit considerations (input savings, yield increase, the value of better management decisions) are evaluated. In the comprehensive cost strategy assessment, one of the important factors of assessment for the growers should be the calculation of break-even investment price, also known as the break-even point.

The high market share and growth potential associated with data analytics and intelligence as an agriculture technology-as-a-service technology is attributed to the growing requirement of data management in agriculture, especially since the introduction of sensing technology in the industry. Amongst other technologies, guidance technology is one of the most mature agriculture technologies that have a wide adoption rate, specifically across the growers of North America, Europe, and Oceania. Sensing technology plays a pivotal role in enabling the entire agriculture technology ecosystem. The presence of sensing technologies helps other agriculture technologies function as it feeds those technologies with data. Portable equipment also helps the service providers in offering it as a service. While guidance technology has experienced market maturity, the highest investments in product innovation are happening for sensing technologies. Technologies including remote sensing, aerial imagery, and soil sensing are some of the core components of sensing technologies upon which the reported growth for this segment is attributed.

Agriculture Technology to Play Pivotal Role in Soil Management Between 2021-2026:

Agriculture technologies are offered as a service for a host of agriculture applications that covers the entire farming cycle, including data management, soil management, yield mapping, and monitoring, spraying, harvesting, and planting, among others. The adoption of agriculture technologies across the globe has resulted in the rapid accumulation of a large amount of agricultural data on-farm operations and fields. Management of data using software solutions provides increased accuracy, productivity, and reduced manual data feeding. Moreover, several software solutions are integrated with the hardware or equipment, which enable the visualization of data such as yield, moisture, and nutrient, as gathered by a sensor, drone, or satellite. The majority of data management software solutions are offered through a software-as-a-service (SaaS) model.

The supply chain for the majority of the industries across the globe got impacted due to the COVID-19 pandemic, including the agriculture technology-as-a-service industry. During the COVID-19 outbreak, the supply chain of the agriculture industry was disrupted. During the COVID-19 pandemic, agricultural production was hindered for farmers, which led to a decrease in their revenue generation. This has left the farmers in no position to invest in modern agricultural equipment.

365FarmNet GmbH, Accenture plc, AGCO Corporation, Agrellus, Inc., Agrivi, Airbus S.A.S, AT&T Inc., Ceres Imaging Inc., CLAAS Group, CNH Industrial N.V., Cropln Technology Solutions Pvt.Ltd., Deere & Company, DeHaat, Fujitsu Limited, Harvest Automation Inc., Hexagon Agriculture, IBM Corporation, Intertek Group plc, Kubota Corporation, Microsoft Corporation, Naio Technologies, Nutrien AgSolutions, Inc., Parrot SA, Pixhawk, Precision Hawk Inc., Raven Industries Inc., Robert Bosch GmbH, SGS S.A., Small Robot Company, Syngenta AG, SZ DJI Technology Co. Ltd, Taranis, Teejet Technologies, Topcon Corporation, Trimble Inc., Yanmar Co. Ltd. are the some key companies in Agriculture Technology-as-a-Service Industry.

Key Questions Answered by This Report:

What is the expected global agriculture technology-as-a-service market size in terms of value during the period 2021-2026?

What is the expected future scenario and revenue generated by the different types of service, including software-as-a-service (SaaS) and equipment-as-a-service (EaaS)?

What is the expected future scenario and revenue generated by different types of agriculture technologies offered as services, including data analytics and intelligence, guidance technology, sensing technology, and variable rate application technology, among others?

What is the expected future scenario and revenue generated by the application segments for which agriculture technologies are offered as services, including yield mapping and monitoring, soil management, crop health management, and navigation and positioning, among others?

Which region is the largest market for global agriculture technology-as-a-service market?

What are the expected future scenario and the revenue generated by different regions and countries in the global agriculture technology-as-a-service market such as North America, Europe, Asia-Pacific, and Rest-of-the-World?

What is the competitive strength of the key players in the global agriculture technology-as-a-service market on the basis of the analysis of their recent developments, product offerings, and regional presence?

What are the different pricing models available in the global agriculture technology-as-a-service market?

How are the adoption scenario, related opportunities, and challenges associated with agriculture technology-as-a-service?

What are the market dynamics of the global agriculture technology-as-a-service market, including market drivers, restraints, and opportunities?

Download the free sample of the Agriculture Technology-as-a-Service Report: