views

Machinery Loans

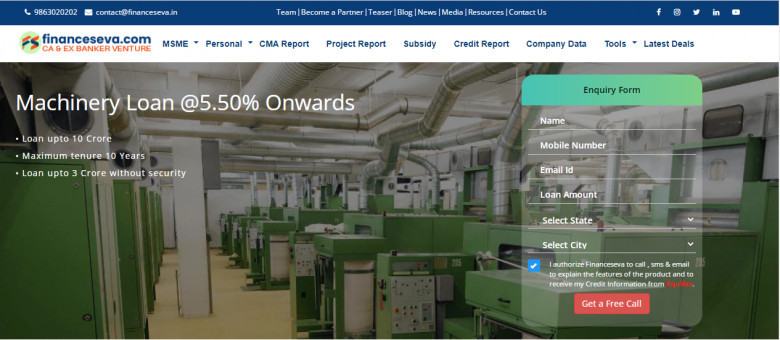

Machinery Loan

Machinery loan is a type of business loan that enables business owners, entrepreneurs and other business entities in acquiring finance to buy machinery/equipment for various business purposes.

Loan for machinery loan purchase helps business entities in gaining more productivity while using new equipment and machinery. Increase in production or output results in higher profits from sales and distribution.

Benefits of Machinery Loan

- With a machinery loan, you can purchase new machinery/equipment

- Used to refurbish, modify or change existing

- To repair faulty machines or equipment or to upgrade

- Buying machinery loan for new business

- Flexible loan repayment options with easy EMIs

- Used as working capital loan or equipment finance

- Machinery loan for startup is an additional benefit for new businesses

- Most lenders also offer collateral-free loans

Eligibility Criteria

- Applicant must be between 21 years to 65 years to apply for machinery loan

- Business vintage to be minimum 2 years

- Last 2 years ITR

- Last 12 months’ bank statement

- Applicant should not have defaulted on any previous loan

Steps to Apply for Machinery Loan

Machinery loan can be applied via online and offline procedures

Online Process

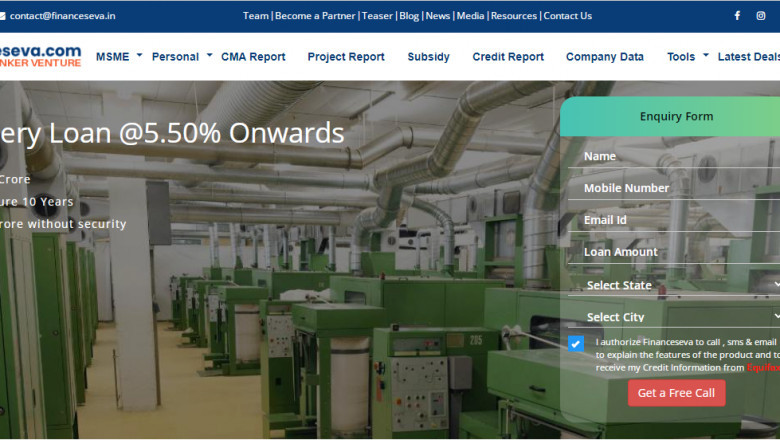

Step 1: Borrower needs to visit the official website of the bank or lender

Step 2: Fill in and submit the loan application form online

Step 3: Submit all the required documents along with proofs and photographs

Step 4: After documents submission, bank’s representative shall contact the applicant to proceed the loan procedure

Step 5: If the application and documents are approved, bank shall approve the loan within defined working days

Step 6: After loan approval, money shall be disbursed in the mentioned bank account of the applicant