views

CAPM Capital Asset Pricing Model) Model

CAPM (Capital Asset Pricing Model) Model

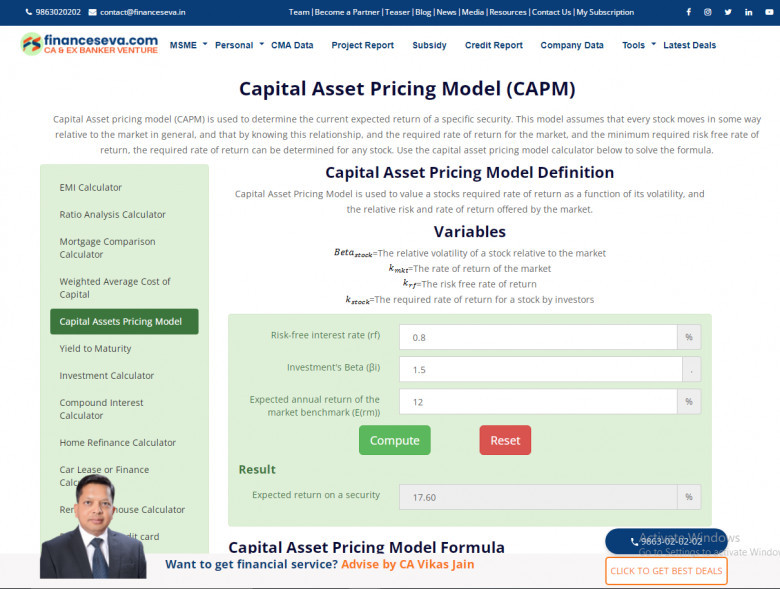

The CAPM (Capital Asset Pricing Model) Model is a model that describes the relationship between the expected return and risk of investing in a security. It shows that the expected return on a security is equal to the risk-free return plus a risk premium, which is based on the beta of that security.

CAPM Formula

ERi =Rf +βi (ERm −Rf )

Here,

ERi =expected return of investment

Rf = risk free rateβi =beta of the investment(ERm −Rf )=market risk premium

The CAPM formula is used to calculate the expected returns of an asset. It is based on the idea of systematic risk (otherwise known as non-diversifiable risk) that investors need to be compensated for in the form of a risk premium.

A risk premium is a rate of return greater than the risk-free rate. When investing, investors desire a higher risk premium when taking on more risky investments. The model considers the asset's sensitivity to non-diversifiable risk or market risk), often represented by the quantity beta (β) in the financial industry, as well as the expected return of the market and the expected return of a theoretical risk-free asset.

Capital Asset Pricing Model assumes a particular form of utility functions or alternatively asset returns whose probability distributions are completely described by the first two moments and zero transaction costs. Under these conditions, CAPM shows that the cost of equity capital is determined only by beta. Despite its failing numerous empirical tests, and the existence of more modern approaches to asset pricing and portfolio selection, the CAPM still remains popular due to its simplicity and utility in a variety of situations.