views

Best Investment Options

Investment goals, individual preferences, risk appetite, and other factors, one can choose the investment option best suited to their needs Best Investment Options.

1. Direct Equity: For investors looking for a long-term investment with a higher rate of returns, direct equity is the best option. By investing in direct equity, the investor buys the shares of a company and gets a certain percentage of ownership in that company. Here, it becomes important for an investor to know market conditions and how the company is performing.

2. Equity Mutual Funds (EMF): These are also known as stock funds, managed by investment management companies. These companies invest your money in the share market, as a result of which the EMFs carry high risk. These are market-linked securities. If you hold investments for more than a year, the return gets tax exempted.

3. Fixed Deposits (FD): Investing money in fixed deposits is quite common in India. As an investor, one may choose to put his hard-earned money as a fixed deposit for a period, ranging between 7 days to 10 years. These FDs offer a low return but are very safe and flexible. The FD is a very popular investment tool among senior citizens and people with very low-risk appetites. Interest is paid quarterly or monthly, which is very convenient for those seeking regular income.

4. Senior Citizen Saving Scheme (SCSS): It is the most appropriate investment choice for senior citizens of India. SCSS is a simple, safe, and reliable scheme for people above 60 years of age. One can invest up to a maximum of 15 lakhs. It offers a decent rate of returns.

5. Pension Plans: Also called retirement plans, the pension plans offer the dual benefit of returns and insurance cover. These plans provide financial stability and security to an individual during old age. These are ideal for people working in the private sector and around the age of 35 years.

Gold is one of the most preferred investments in India. High liquidity and inflation-beating capacity are its strong selling points, not to mention charm, prestige, and so on. Gold prices shoot up when the markets face turbulence. Though there are phases when markets witness a fall in gold prices, it won’t last for long, and always makes a strong comeback.

Why Should You Invest in Gold

Safety, liquidity, and returns are the three criteria most risk-averse investors look for before investing. While gold meets the first two criteria without any hiccups, it doesn’t perform poorly at the last one either. Here is why you should invest in gold:

a. Investing in gold is worthwhile because it is an inflation-beating investment. Over time, the return on gold investment has been in line with the rate of inflation.

b. Gold has an inverse relation with equity investments. For example, if the equity markets start going down, gold would perform well. Considering gold as an investment option in your investment portfolio will be a buffer to the overall volatility of your portfolio.

How to Invest in Gold

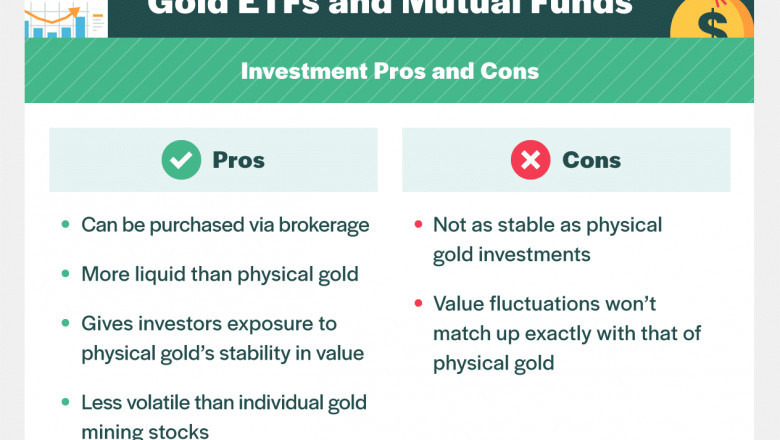

The ‘golden question’ here is – how does one invest in gold? Traditionally, it was by buying physical gold in the form of coins, bullions, artefacts, or jewellery. However, there are newer forms of gold investments nowadays, such as gold ETFs (exchange-traded funds) and gold mutual funds.

Gold ETFs are similar to buying an equivalent sum of physical gold but without the hassles of having to store the physical gold. Hence, there is no risk of theft/burglary as the gold is stored in Demat (paper) form. Gold funds involve investing in gold mining companies.