views

Exactly How to Make Use Of RSI (Relative Strength Index).

The Relative Strength Index, or RSI, is a noticeable indication designed by J. Welles Wilder, a technological analyst, that helps investors examine the strength of the existing market.

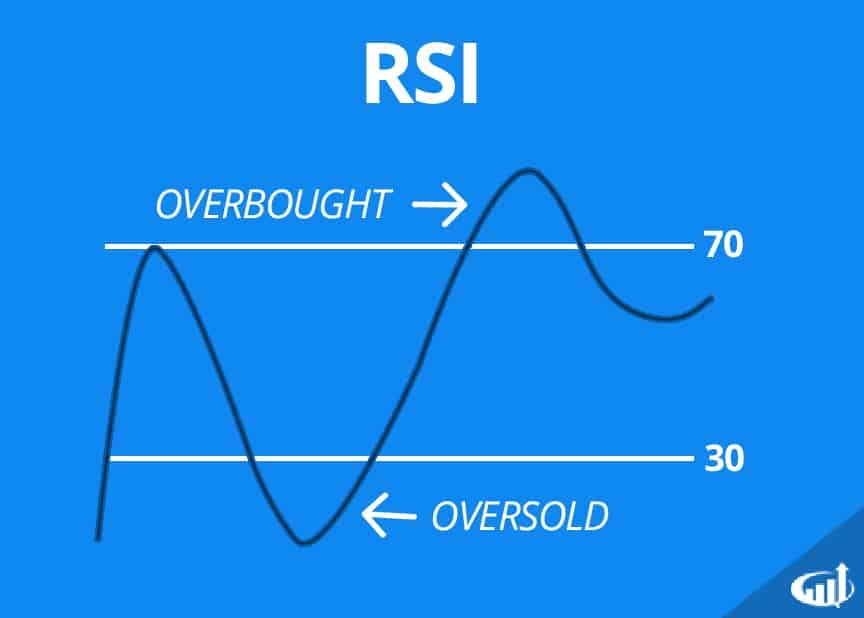

RSI, like Stochastic, indicates overbought as well as oversold scenarios out there.

It is additionally a 0 to 100 range.

Analyses of 30 or much less commonly suggest oversold market conditions and a surge in the probability of price rising (increasing).

Some traders take an oversold money pair as a sign that the declining pattern will reverse, implying that it's a great time to acquire. Readings of 70 or greater suggest overbought conditions and also a raised probability of rate weakness (decreasing).

Some investors perceive an overbought money set as an indication that the higher pattern will reverse, indicating that it's time to offer.

:max_bytes(150000):strip_icc()/dotdash_final_Relative_Strength_Index_RSI_Jul_2020-01-98fcd0c032cb4f0da005c31c44440c90.jpg)

Investors that employ the Relative Strength Index (RSI) sign look for centerline crossovers along with the overbought and also oversold indications gone over over.

A move from below to over the centerline (50) recommends a climbing trend.

When the RSI worth goes across ABOVE the 50 line on the scale, it moves towards the 70 line, showing a climbing centerline crossover. This reveals that the marketplace pattern is strengthening and also is https://forexinvestindo.com/how-to-use-rsi-relative-strength-index/ taken a favorable signal until the RSI comes close to the 70 line.

An action from above to below