views

Exactly How to Utilize RSI (Relative Strength Index).

The Relative Strength Index, or RSI, is a prominent indicator created by J. Welles Wilder, a technical expert, that helps traders evaluate the strength of the current market.

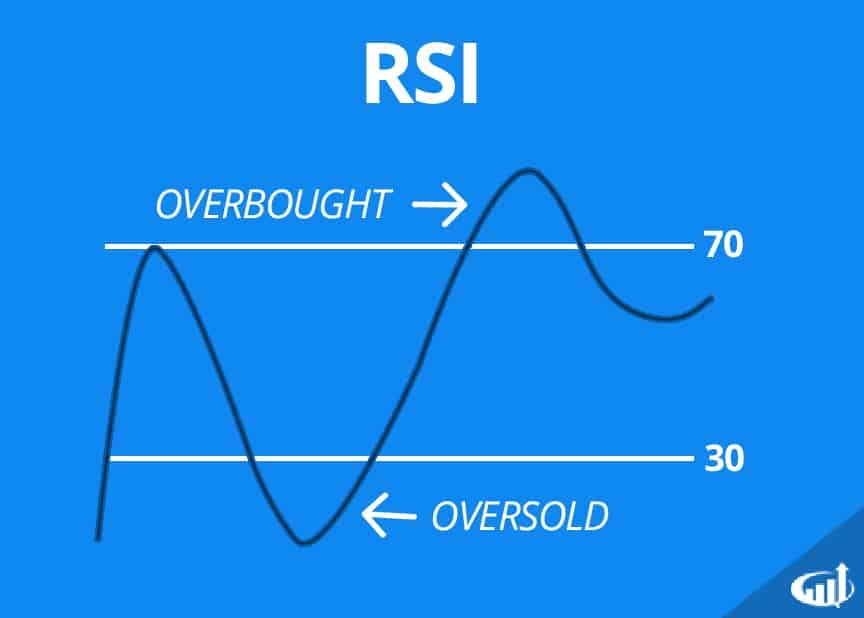

RSI, like Stochastic, suggests overbought and also oversold situations in the marketplace.

:max_bytes(150000):strip_icc()/dotdash_final_Relative_Strength_Index_RSI_Jul_2020-01-98fcd0c032cb4f0da005c31c44440c90.jpg)

It is likewise a 0 to 100 range.

Analyses of 30 Informative post or much less generally recommend oversold market problems as well as a surge in the possibility of price rising (rising).

Some traders take an oversold money pair as an indication that the decreasing pattern will turn around, implying that it's a great time to buy. Readings of 70 or greater recommend overbought problems as well as a raised likelihood of rate weakness (decreasing).

Some investors regard an overbought money set as an indicator that the higher fad will turn around, implying that it's time to sell.

Investors that use the Relative Strength Index (RSI) indicator search for centerline crossovers along with the overbought and also oversold signs gone over above.

A step from listed below to above the centerline (50) recommends a rising fad.

When the RSI worth goes across ABOVE the 50 line on the scale, it moves in the direction of the 70 line, suggesting a climbing centerline crossover. This shows that the marketplace fad is reinforcing as well as is taken a favorable signal till the RSI approaches the 70 line.

A relocation from over to