views

The COVID-19 pandemic has led to a global healthcare crisis, resulting in widespread economic impact since January 2020. In the optimistic scenario, it could be assumed that the COVID-19 pandemic would create a long-term positive impact on the overall market.

The market was initially negatively impacted by the COVID-19 pandemic. Along with the rest of the world, the pharmaceutical companies shut down their laboratories and industry work was stopped in order to mitigate the pandemic effects. Furthermore, the on-site personnel restrictions had biggest impact on pharmaceutical businesses. Most of the large Pharma companies were completely shut down momentarily. Besides this, the safety restrictions required laboratory areas to implement social distancing, increase disinfecting procedures, require self-monitoring for COVID-19 symptoms and heightened PPE requirements.

Additionally, the clinical sites also experienced reduced enrolment and restricted staff. These challenges combined to reduce anticipated trial sizes and created substantial delays in study timelines. Though, recovery can be seen in most regions, particularly North America and Europe, as services regain normality.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=12254971

The expected rise in biosimilar R&D will bring with it a growing demand for the associated bioanalytical testing services—compatibility studies for biosimilars, stability testing, product release testing, and protein analysis of biosimilars—to reduce the risks associated with drug development. Moreover, the introduction of biosimilars and the move toward continuous processing are creating the need for more rapid and sensitive analytical techniques.

Pharmaceutical companies have begun outsourcing several R&D functions that are not core to their internal structure. Companies are trying to be more efficient in the drug development process by focusing on their internal core competencies to bring new products to the market in a more cost-effective manner.

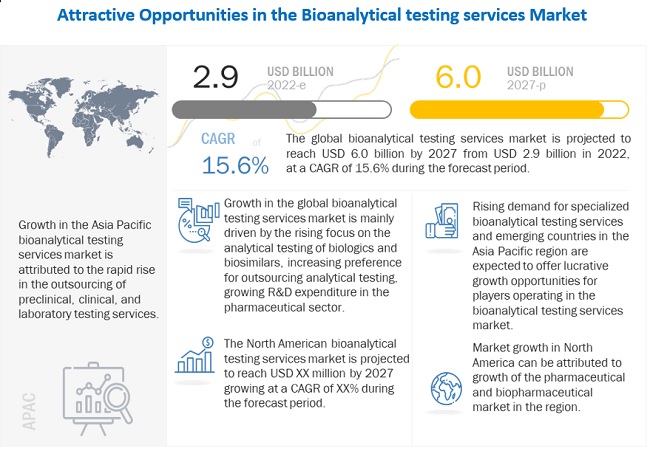

[208 Pages Report] The global bioanalytical testing services market is projected to reach USD 6.0 billion by 2027 from an estimated USD 2.9 billion in 2022, at a CAGR of 15.6% during the forecast period. In 2021, North America accounted for the largest share of the market, followed by Europe. The major factors influencing the growth of the North American market include the well-established pharmaceutical industry, strong presence of major service providers, large number of ongoing clinical trial studies.

According to the ICH Q 10 guidelines, analytical methods are a key part of the pharmaceutical quality system. Implementation of analytical QbD (AQbD) in the manufacturing process ensures product quality and performance. There is a huge difference between the traditional and AQbD approaches of analytical method development.

The bioanalytical testing services market is highly competitive and is expected to grow rapidly in the coming years due to the increasing number of bioanalytical CROs. Additionally, the growing number of contract development and manufacturing organizations (CDMOs) offering bioanalytical services is further expected to intensify the competition in the market. Over the last few years, the number of bioanalytical testing service providers has increased in emerging markets, such as China, India, and Brazil, which is a major challenge for global players.

Key players in the Bioanalytical testing services market: Charles River (US), Medpace (US), WuXi AppTec (China), Eurofins Scientific (Luxembourg), IQVIA (US), SGS SA (Switzerland), Laboratory Corporation of America Holdings (US), Intertek Group (UK), Syneos Health (US), ICON (Ireland), Frontage Labs (US), PPD (US), PAREXEL International Corporation (US), Almac Group (UK), Celerion (US), Altasciences (US), BioAgilytix Labs (US), Lotus Labs (India), LGS Limited (UK), Sartorius AG (Germany), CD BioSciences (US), Absorption Systems LLC (US), Pace Analytical Services (US), Bioneeds India Private Limited (India) and Vipragen Biosciences (India).