views

Professional Loans

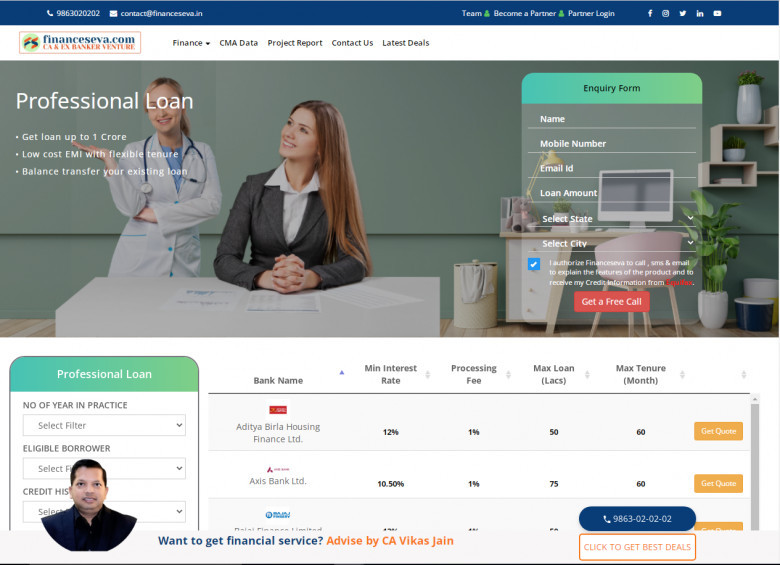

Personal Loans are the loans that provide reorganize loan solutions to the working professionals such as Doctors, Lawyers, Chartered Accountants, Architecture, etc. It is a credit option enlarged to professionals for setting up and growing their organizations. Such loans are mainly for applicants with professional qualifications.

Apply Online Click:- Professional Loan

Features of professional loans

The features of a professional loan vary from bank to bank.

- The loan amount for a professional loan is up to Rs. 1 Crore.

- It has a flexible repayment tenure of up to 5 years.

- It can be used for various purposes such as the purchase of equipment, renovation of offices, working capital requirements, etc.

- The loan amount and interest rates depend on the type of profession such as Doctor, CA, CS, Lawyer, Engineers, Architecture, etc.

Types of professional loans

Professional loan for doctors: - It helps the doctors to purchase medical equipment or any personal purpose.

Professional loan for Engineers: - An engineer can take a professional loan to organize their engineering firm.

Professional loan for Chartered Accountants: - CA can pursue this loan for various purposes like renting an office, hiring employees, and buying furniture for the office, etc.

Professional loan for Lawyers: - A lawyer can opt for this loan to hire employees or rent an office.