553

views

views

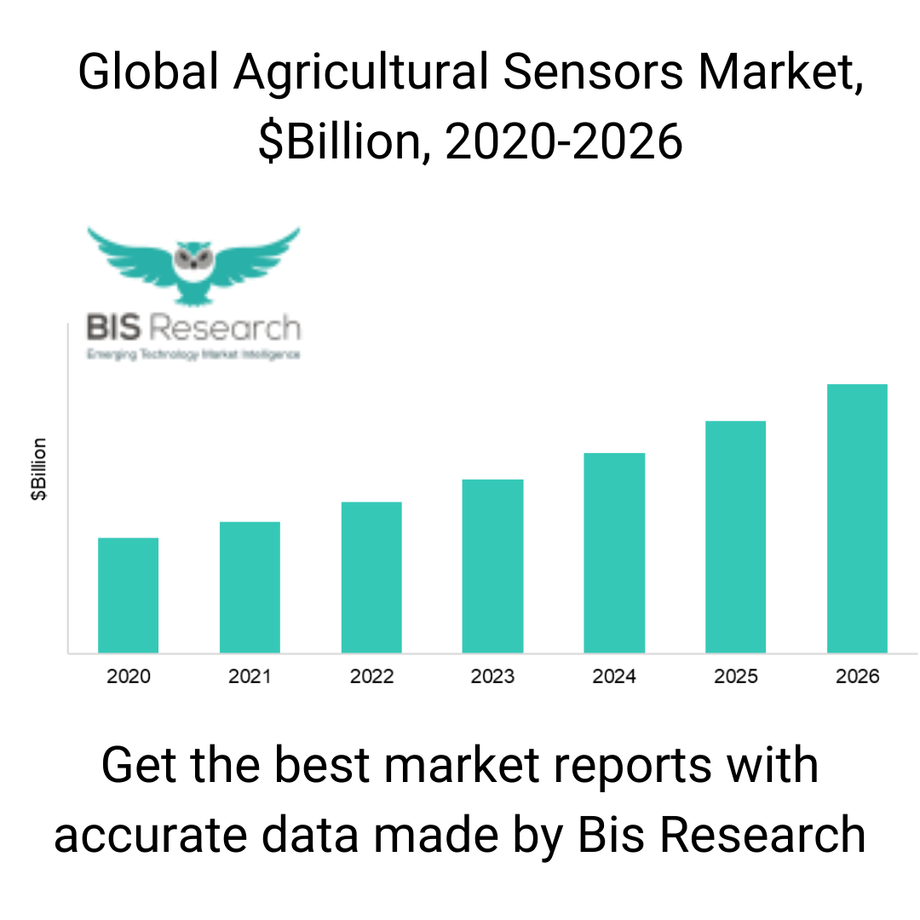

The global agricultural sensors market was valued at $4.18 billion in 2020, which is expected to grow with a CAGR of 15.4% and reach $9.79 billion by 2026.

Sensors used in smart farming are known as agriculture sensors. These sensors provide data that assist farmers in monitoring and optimizing crops by adapting to changes in environmental conditions. By positioning sensors, farmers can examine crop health at a micro-scale, sustain resources, and reduce harsh environmental impact. The smart sensing technology enables farmers to remotely monitor their fields’ pest population on a real-time basis. This helps them take immediate action to protect their crops, utilizing online cloud services and a dashboard.

With a better adoption of alternative farming techniques, countries with low agricultural production due to climatic conditions and low arable land can reinvent their agricultural sector. This would help the countries diversify and limit their vegetable and fruit imports. The global agricultural sensors market is expected to grow more in the coming years with increased emphasis on alternative and vertical farming and increased government initiatives worldwide for uplifting the global agricultural industry.

The global agricultural sensors market is expected to contribute to increased global food production as there is no dependence on arable land and climatic conditions, and year-round crop production can be achieved through these alternative farming techniques. With these techniques, a shift toward indoor growing and vertical farming is achievable, which is a big opportunity for the global agricultural sensors market.

A challenge for the growth of the agricultural sensors market is the high initial investment for achieving a medium and large-scale commercial setup. This is considered a major hindrance in adopting these alternative farming techniques, especially in developing countries. Along with the high initial cost, awareness about alternative farming techniques is somewhat limited in countries where agricultural production is low, such as countries in the Middle East region.

With a better adoption of alternative farming techniques, countries with low agricultural production due to climatic conditions and low arable land can reinvent their agricultural sector. This would help the countries to diversify and limit their vegetable and fruit import. The global agricultural sensors market is expected to grow more in the coming years with increased emphasis on alternative and vertical farming and increased government initiatives throughout the world for uplifting the global agricultural industry.

The global agricultural sensors industry represents a fragmented market in nature and is majorly dominated by the agricultural companies that take the lead by acquiring or collaborating with technology-based firms to diversify, innovate and upgrade their solutions. The companies operating in the industry have developed strong strategies in recent years to survive the competition in the fast-growing IoT integrated agriculture market. For instance, in August 2021, CropX Inc. acquired Dacom Farm Intelligence with an aim to expand into Europe. This corporate strategy represents a major consolidation of agriculture digital twin capabilities, geographic datasets, and acres serviced.

In recent years, developers of agricultural machinery have been investing and using a noticeable amount of advanced sensor technologies in their precision farming and environmental monitoring devices, such as soil salinity monitor, soil carbon flux monitoring, portable photosynthesis system, time domain reflectometry, to name a few. Smart sensors are deployed in precision agriculture to derive data that aids farmers in monitoring and optimizing crops and cope up with changing environmental factors.

The global agricultural sensors market was valued at $4.18 billion in 2020, which is expected to grow with a CAGR of 15.4% and reach $9.79 billion by 2026. The growth is primarily attributed to increased awareness of the benefits of alternative and optimized farming techniques that entail over conventional farming. The key sensor types are humidity sensor, mechanical sensor, water sensor, optical sensor, soil sensor, and others (livestock, electrochemical, pressure) which are being widely used in the agriculture industry for water management, soil management, climate, and dairy management.

The COVID-19 pandemic has had a significant impact on almost all major industries throughout the world, including the agricultural industry. The pandemic has led to economic instability throughout the world, and the GDP for all countries declined in 2020. The pandemic has interrupted normal life, and these changes have proved to act as a catalyst for technology and innovations in every sector, including agriculture. The pandemic’s potential impact on the adoption of the Internet of Things (IoT) has increased the traction of sensing technology in the agricultural sector.

Acclima Inc., Acuity Agriculture, AgriData, AgEagle Aerial Systems Inc., BaySpec, Inc., Caipos GmbH, CropX Inc., Cubert GmbH, Digital Agriculture (Robert Bosch and BASF), FluroSat, Gamaya, HAIP Solution GmbH, Imec, Inno-spec GmbH, INO, Libelium, Precision Hawk, Pycno, The Yield Pty Ltd., are the some key companies of Agricultural Sensors Industry.

Key Questions Answered in the Report

• What is the estimated agricultural sensors market size in terms of revenue for the forecast period 2021-2026, and what is the expected compound annual growth rate (CAGR) during the forecast period 2021-2026?

• What are the key trends, market drivers, and opportunities in the market pertaining to agricultural sensors and equipment?

• What are the major restraints inhibiting the growth of the global agricultural sensors market?

• What kinds of new strategies are being adopted by the existing market players to expand their market position in the industry?

• What is the competitive strength of the key players in the agricultural sensors industry based on an analysis of their recent developments, product offerings, and regional presence?

• How is the competitive benchmarking of the key agricultural sensors and equipment companies in the agriculture market based on the analysis of their market coverage and market potential?

• How much revenue each of the segments is expected to record during the forecast period along with the growth percentage, in the following segments:

o Product including equipment (humidity sensor, water sensor, optical sensor, mechanical sensor, electrochemical sensor, and others)

o Application, including water management, soil management, climate management, and others

o Region, including North America, the U.K., Europe, Asia-Pacific and Japan, China, the Middle East and Africa, and South America

• Which type of players and stakeholders are operating in the market ecosystem of agricultural sensors and equipment, and what is their significance in the global market?

• Which are the leading consortiums and associations in the global agricultural sensors market, and what are their roles in the market?

• How does the regulatory landscape differ in different regions for agricultural sensors and equipment?

Download the free sample of the Agricultural Sensors Report: