views

North America Digital Lending Platform Market Regulatory Framework, Macro-economic Factors and Industry Demand.

North America Digital Lending Platform Market, By Component (Solutions, Services), Deployment Model (On Premises, Cloud), Loan Amount Size (Less than US$ 7,000, US$ 7,001 to US$ 20,000, More than US$ 20,001), Subscription Type (Free, Paid), Loan Type (Automotive Loan, SME Finance Loan, Personal Loan, Home Loan, Consumer Durable, Others), Vertical (Banking, Financial Services, Insurance Companies, P2P (Peer-to-Peer) Lenders, Credit Unions, Saving and Loan Associations) – Industry Trends and Forecast to 2027

Market Analysis and Size

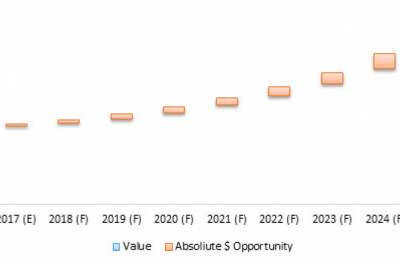

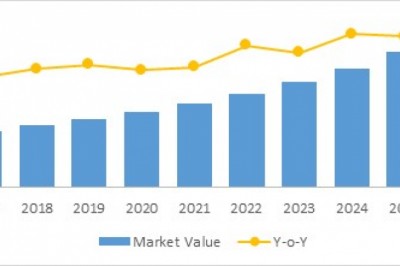

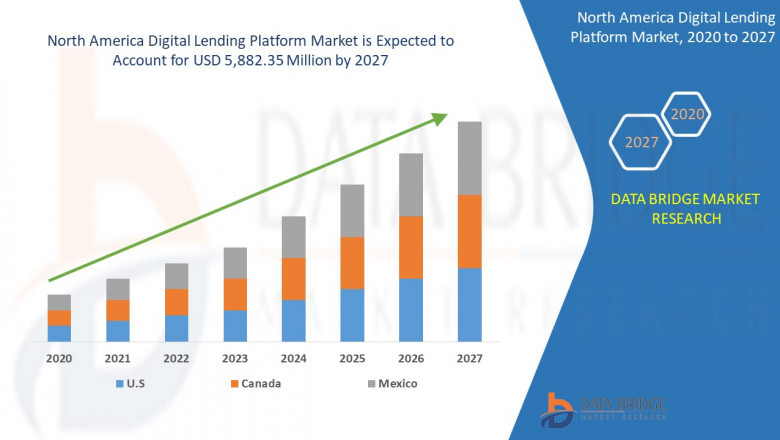

· Data Bridge Market Research analyses that the North America Digital Lending Platform Market was valued at 16930.68 million in 2021 and is expected to reach the value of USD 69937.32 million by 2029, at a CAGR of 19.2 % during the forecast period of 2020 to 2027.

North America Digital Lending Platform Market Scope

· Digital lending platform market is segmented on the basis of component, deployment model, loan amount size, subscription type, loan type and vertical. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

· On the basis of component, the market is segmented into solutions and services. In 2020, solutions holds the largest share in component segment as it requires high initial cost; on the other hand services incur low cost expenditure on occasional basis.

· On the basis of deployment model, the market is segmented into cloud, and on premises. In 2020, on premises segment dominates the deployment model segment considering large enterprises opt for on premises installations; however cloud is growing at higher rate due to specifications based costing.

· On the basis of loan amount size, the market is segmented into less than US$ 7,000, US$ 7,001 to US$ 20,000, more than US$ 20,001. In 2020, less than US$ 7,000 segment is dominating the market due to people preferring low amount of loan through digital lending platforms; however due to increasing assurance of these platforms US$ 7,001 to US$ 20,000 category is growing at higher CAGR.

· On the basis of subscription type, the market is segmented into free, and paid. In 2020, subscription type segment is dominated by free subscription since small enterprises opt for free services for cost cutting; on the other hand with rapidly growing market for digital lending platforms paid subscriptions are being adopted by lenders.

· On the basis of loan type, the market is segmented into automotive loan, SME finance loan, personal loan, home loan, consumer durable and others. In 2020, automotive loan holds largest market share due to growing vehicle sales in the region on instalment basis.

· On the basis of vertical, the market is segmented into banking, financial services, insurance companies, P2P (peer-to-peer) lenders, credit unions, saving and loan associations. In 2020, banking segment dominates vertical segment as solutions such as loan origination and loan managements which are major applications of digital lending platforms are usually completed through banks considering better services offered by banks. Also, other solutions such as portfolio management can also be done by banks using lending platforms.

Get the sample copy of Report here: https://www.databridgemarketresearch.com/request-a-sample/?dbmr=north-america-digital-lending-platform-market

North America Digital Lending Platform Market Regional Analysis/Insights

· The countries covered in digital lending platform market report are U.S., Canada and Mexico.

Competitive Landscape and North America Digital Lending Platform Market Share Analysis

· The North America Digital Lending Platform Market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to North America Digital Lending Platform Market.

The major players covered in the report are

· First American Financial Corporation,

· Mambu GmbH,

· CU Direct,

· Built Technologies, Inc.,

· Jack Henry & Associates, Inc.,

· Turnkey Lender,

· Ellie Mae, Inc.,

To View Detailed Report Analysis, Visit @

https://www.databridgemarketresearch.com/reports/north-america-digital-lending-platform-market

MAJOR TOC OF THE REPORT

· INTRODUCTION

· MARKET SEGMENTATION

· EXECUTIVE SUMMARY

· PREMIUM INSIGHTS

· MARKET OVERVIEW

· QUESTIONNAIRE

To Check the Complete Table of Content Click Here

https://www.databridgemarketresearch.com/toc/?dbmr=north-america-digital-lending-platform-market

Browse More Reports by DBMR:

· Europe Horticulture Lighting Market, By Offering (Hardware, Software & Services), Deployment (Turnkey, Retrofit), Technology (Fluorescent Lamps, HID Lights, LED Lights, Other), Lighting Type (Toplighting, Interlighting), Cultivation (Fruits & Vegetables, Floriculture), Application (Greenhouses, Vertical Farming, Indoor Farming, Others), Country (Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe) – Industry Trends and Forecast to 2027

https://www.databridgemarketresearch.com/reports/europe-horticulture-lighting-market

· Asia-Pacific Horticulture Lighting Market, By Offering (Hardware, Software and Services), Deployment (Turnkey, Retrofit), Technology (Fluorescent Lamps, HID Lights, LED Lights, Other), Lighting Type (Toplighting, Interlighting), Cultivation (Fruits and Vegetables, Floriculture), Application (Greenhouses, Vertical Farming, Indoor Farming, Others) - Industry Trends and Forecast to 2029.

https://www.databridgemarketresearch.com/reports/asia-pacific-horticulture-lighting-market

· Middle East & Africa Europe Horticulture Lighting Market, By Offering (Hardware, Software & Services), Deployment (Turnkey, Retrofit), Technology (Fluorescent Lamps, HID Lights, LED Lights, Other), Lighting Type (Toplighting, Interlighting), Cultivation (Fruits & Vegetables, Floriculture), Application (Greenhouses, Vertical Farming, Indoor Farming, Others), Country (Middle East & Africa, South America, Middle East & Africa, Asia-Pacific, Middle East and Africa)– Industry Trends and Forecast to 2027

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-horticulture-lighting-market

About Us:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market

Contact:

Data Bridge Market Research

Tel: +1-888-387-2818

Email: Sopan.gedam@databridgemarketresearch.com