views

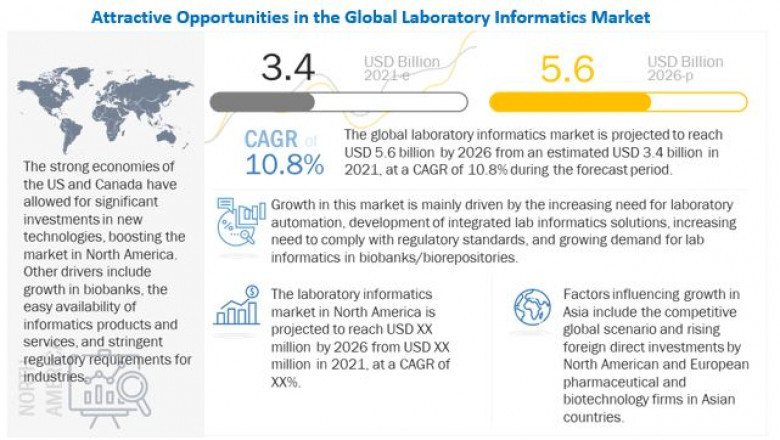

According to the new market research report Lab Informatics Market by Type of Solutions (LIMS, ELN, CDS, EDC, CDMS, LES, ECM, SDMS), Component (Software, Service), Delivery (On premise, Cloud), Industry (CRO, CMO, Pharma, Biotech, Chemical, Agriculture, Oil, Gas) - Global Forecasts to 2026, published by MarketsandMarkets™, the market is projected to reach USD 5.6 billion by 2026 from USD 3.4 billion in 2021, at a CAGR of 10.8% from 2021 to 2026.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=203037633

The increasing need for laboratory automation; the development of integrated lab informatics solutions; the need to comply with regulatory requirements; and the growing demand in biobanks/biorepositories, academic research institutes, and CROs are the major factors driving the growth of the laboratory informatics market. On the other hand, lack of integration standards and high maintenance and services cost are expected to restrain the growth of this market in the coming years. The companies have a large market spread across various countries in North America, Europe, Asia Pacific, and the Rest of the World.

Restraint: High maintenance and service cost

The high maintenance and service costs associated with laboratory informatics solutions are one of the major factors restraining the growth of this market. According to industry experts, the maintenance cost of IT solutions is more than the actual price of the software. Service and maintenance (which includes modification of the software as per changing user requirements) represent a recurring expenditure, amounting to almost 20–30% of the total cost of ownership. Moreover, training and implementation costs together represent around 15% of the actual price. Owing to these factors, many small and medium-sized laboratories find it difficult to invest in these systems, thereby limiting their adoption. However, with the emergence of cloud-based offerings, the effect of this restraint is expected to decrease in the coming years.

Opportunity: Significant growth potential in emerging countries

China, Japan, India, Singapore, Brazil, and Middle Eastern countries are major upcoming markets for LIMS. These markets lack proper standards and government regulations, thus offering huge potential for vendors unable to meet the standards implemented in developed markets such as the US. Several biopharma players are also shifting their manufacturing plants in Asia for low-cost production. This is creating significant demand for informatics solutions in Asian countries. However, the COVID-19 pandemic has compelled stakeholders from developed markets such as the US and Europe to reduce their heavy dependence on Asian countries and shift back to in-house operations.

The cloud-based models segment is expected to grow at the highest CAGR during the forecast period.

On the basis of deployment model, the laboratory informatics market is segmented into on-premise, cloud-based, and remotely hosted models. The cloud-based models segment is expected to grow at the highest CAGR during the forecast period. Factors such as on-demand self-serving analytics, no upfront capital investment for hardware, extreme capacity flexibility, and a pay-as-you-go pricing model will boost the demand for cloud-based laboratory informatics solutions in the coming years. However, data transfer complexities and data security concerns may hinder the growth of this market segment.

The services segment accounted for the largest share of the market in 2020.

Based on components, the laboratory informatics market is segmented into services and software. The services segment dominated this market in 2020. The large share of the services segment can be attributed to the growing technological advancements in solution offerings by various vendors, increasing adoption of cloud-based solutions, growing need for consulting services, and the recurring nature of services. Furthermore, in terms of IT usage and skill, the life science industry relies heavily on service providers.

In 2020, North America dominated the market, followed by Europe. The large share of this market can primarily be attributed to the strong economies in the US and Canada, which have allowed for significant investments in technology in this region. Growth in the North American market is supported by the growing demand for the integration of laboratory systems, rising government funding for research, growth in biobanks, need for early drug discovery, easy availability of laboratory informatics products and services, and stringent regulatory requirements across industries.

Request Sample Free Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=203037633

The prominent players in the Laboratory Informatics Market are Thermo Fisher Scientific Inc. (US), LabVantage Solutions, Inc. (US), LabWare (US), Abbott Informatics (US), LabLynx, Inc. (US), Waters (US), Agilent Technologies, Inc. (US), Autoscribe Informatics (US), Dassault Systèmes (Paris, France), LABWORKS LLC (US), and PerkinElmer Inc. (US).

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: sales@marketsandmarkets.com